Required: 1. Compute payback period of the truck. Is the investment in new truck desirable if maximum desired payback period of the Euro Transport company is 5 years? 2. Compute the accounting rate of return promised by the truck. Would the Euro Transport company be interested in new truck if minimum required accounting rate of return is 12%?

Required: 1. Compute payback period of the truck. Is the investment in new truck desirable if maximum desired payback period of the Euro Transport company is 5 years? 2. Compute the accounting rate of return promised by the truck. Would the Euro Transport company be interested in new truck if minimum required accounting rate of return is 12%?

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter21: Cost Behavior And Cost-volume-profit Analysis

Section: Chapter Questions

Problem 21.26EX: Items on variable costing income statement In the following equations, based on the variable costing...

Related questions

Question

Q2

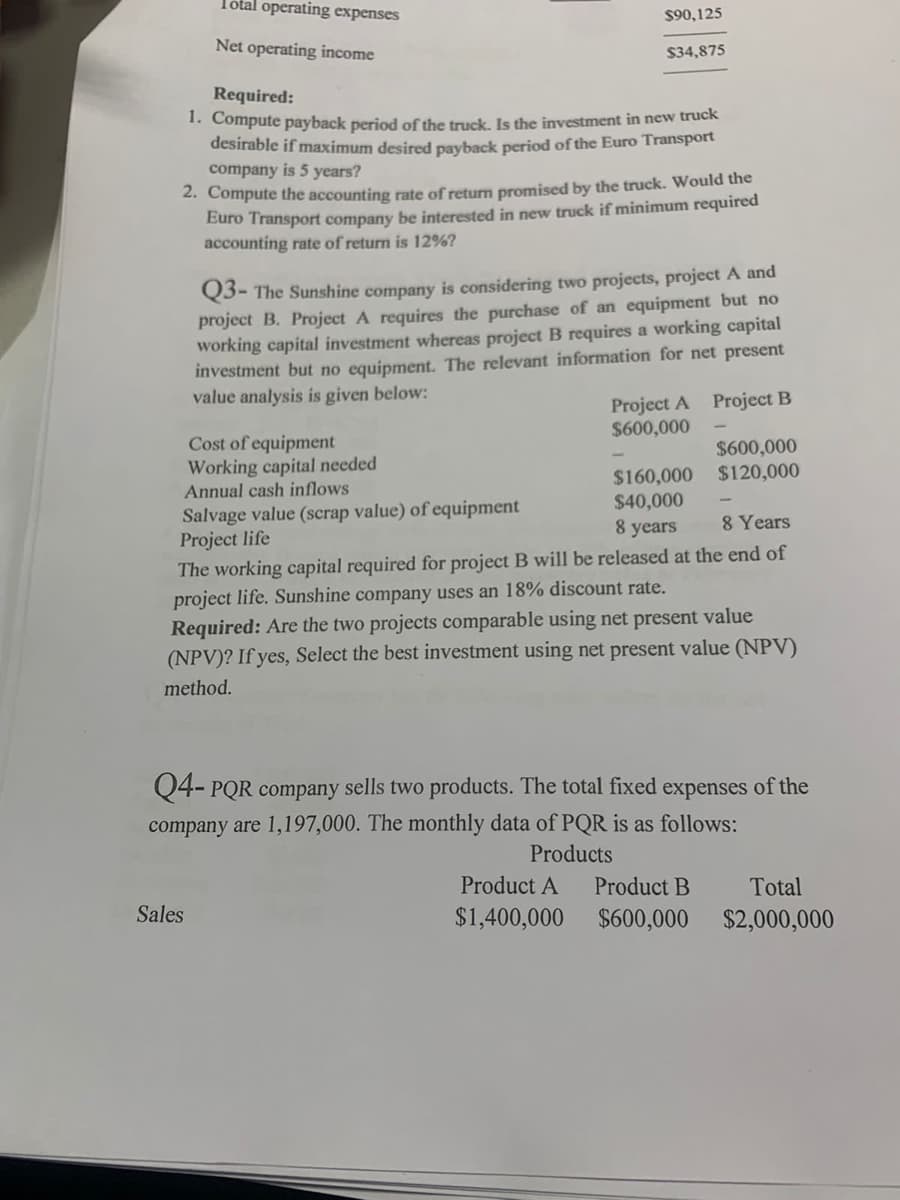

Transcribed Image Text:Total operating expenses

$90,125

Net operating income

$34,875

Required:

1. Compute payback period off the truck. Is the investment in new truck

desirable if maximum desired payback period of the Euro Transport

company is 5 years?

2. Compute the accounting rate of return promised by the truck. Would the

Euro Transport company be interested in new truck if minimum required

accounting rate of return is 12%?

Q3- The Sunshine company is considering two projects, project A and

project B. Project A requires the purchase of an equipment but no

working capital investment whereas project B requires a working capital

investment but no equipment. The relevant information for net present

value analysis is given below:

Project A Project B

$600,000

Cost of equipment

Working capital needed

Annual cash inflows

$600,000

$160,000 $120,000

$40,000

Salvage value (scrap value) of equipment

Project life

The working capital required for project B will be released at the end of

project life. Sunshine company uses an 18% discount rate.

Required: Are the two projects comparable using net present value

(NPV)? If yes, Select the best investment using net present value (NPV)

8 years

8 Years

method.

Q4- PQR company sells two products. The total fixed expenses of the

company are 1,197,000. The monthly data of PQR is as follows:

Products

Product A

Product B

Total

$1,400,000 $600,000 $2,000,000

Sales

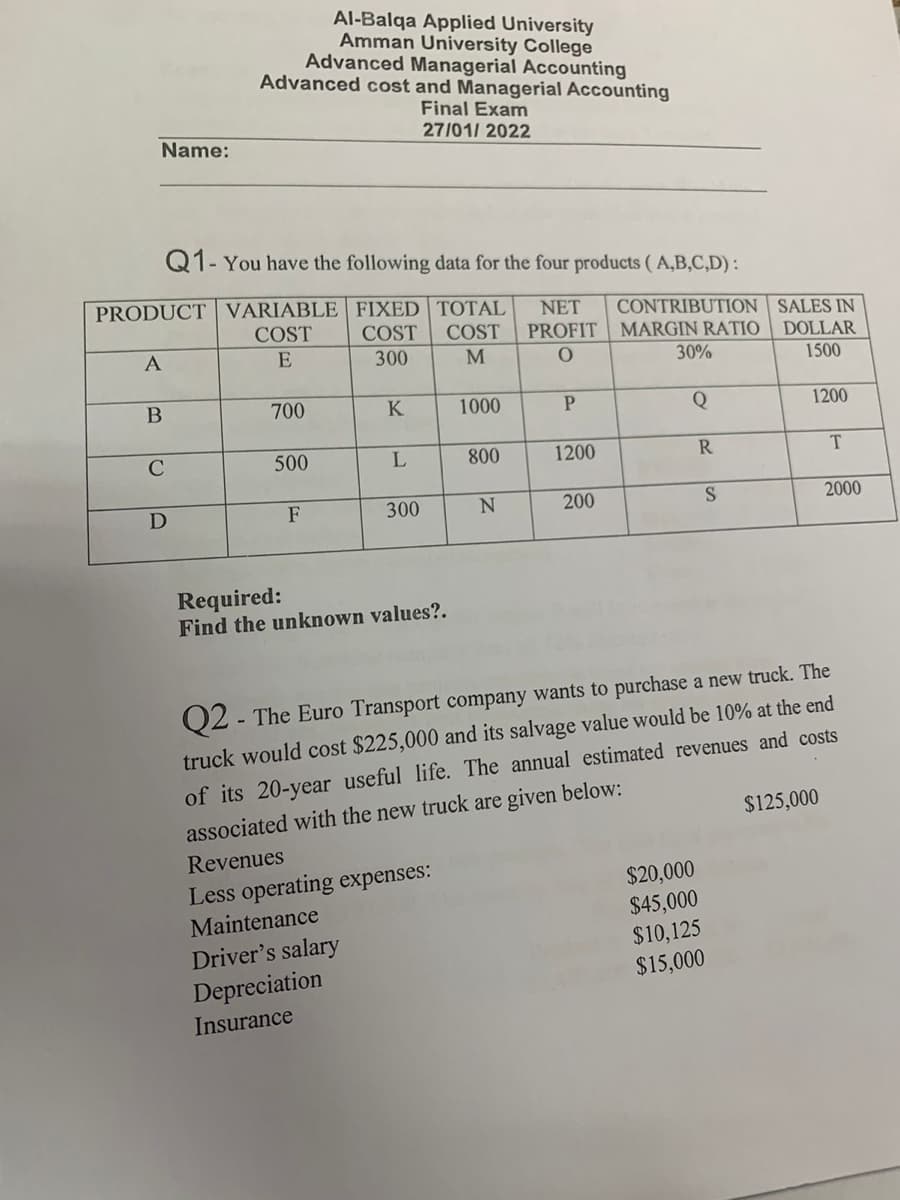

Transcribed Image Text:Al-Balqa Applied University

Amman University College

Advanced Managerial Accounting

Advanced cost and Managerial Accounting

Final Exam

27/01/ 2022

Name:

Q1- You have the following data for the four products ( A,B,C,D):

PRODUCT VARIABLE FIXED TOTAL

NET

CONTRIBUTION SALES IN

COST

COST

COST

PROFIT MARGIN RATIO

DOLLAR

300

M

30%

1500

700

K

1000

1200

500

800

1200

R.

F

300

200

2000

Required:

Find the unknown values?.

Q2 - The Euro Transport company wants to purchase a new truck. The

of its 20-year useful life. The annual estimated revenues and costs

$125,000

truck would cost $225,000 and its salvage value would be 10% at the end

associated with the new truck are given below:

Revenues

Less operating expenses:

$20,000

$45,000

$10,125

$15,000

Maintenance

Driver's salary

Depreciation

Insurance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning