Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Hint: Should you use net income or net operating income in your calculations?) 3. What was the company's residual income last year?

Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Hint: Should you use net income or net operating income in your calculations?) 3. What was the company's residual income last year?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.3.2MBA: Margin of safety Use the data from E11-12 and assume that break-even sales are $2,798 million....

Related questions

Question

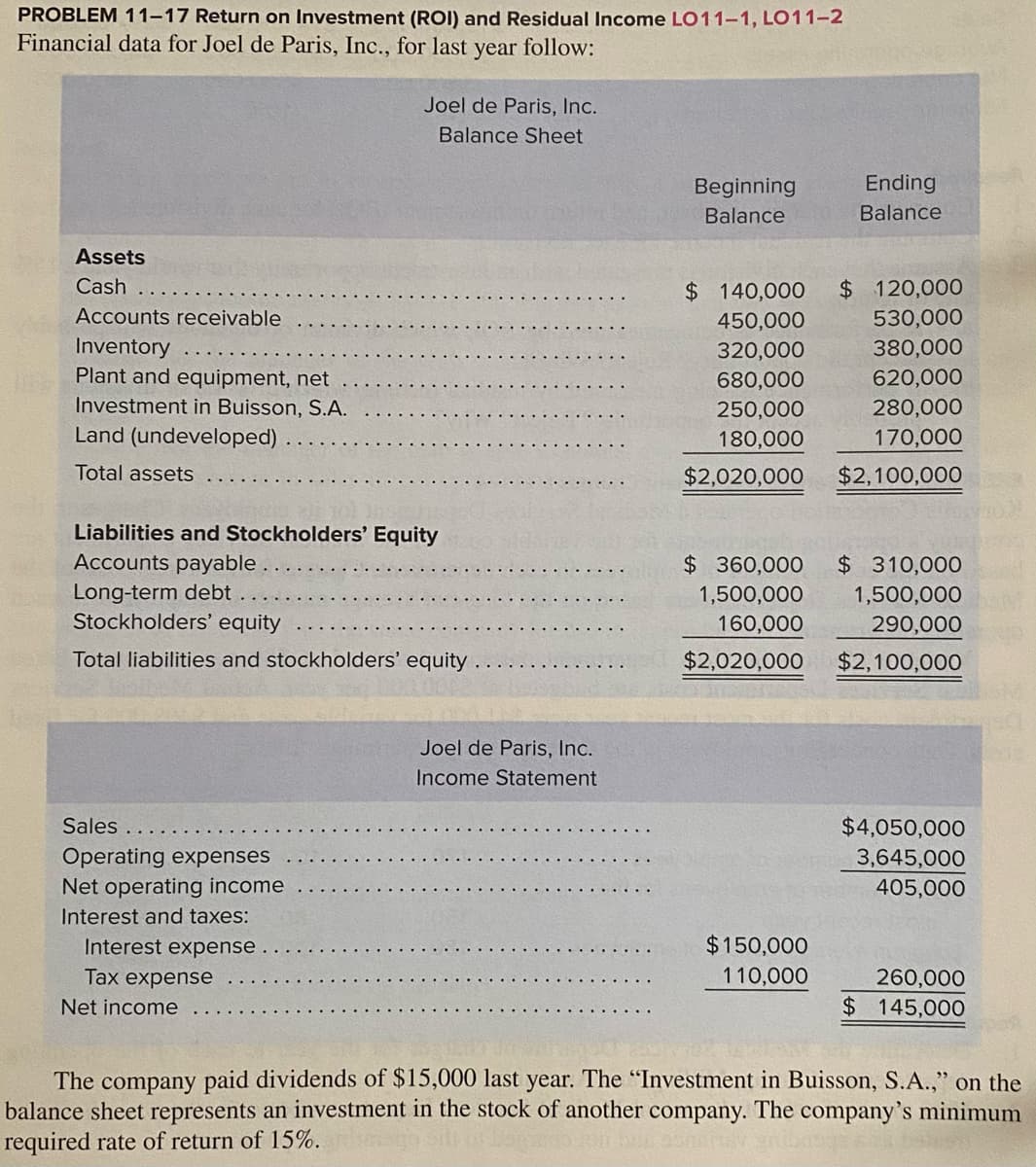

Transcribed Image Text:PROBLEM 11-17 Return on Investment (ROI) and Residual Income LO11-1, LO11-2

Financial data for Joel de Paris, Inc., for last year follow:

Joel de Paris, Inc.

Balance Sheet

Beginning

Ending

Balance

Balance

Assets

Cash

$ 140,000

$ 120,000

Accounts receivable

450,000

530,000

Inventory

320,000

380,000

Plant and equipment, net

680,000

620,000

Investment in Buisson, S.A.

280,000

170,000

250,000

Land (undeveloped)

180,000

Total assets

$2,020,000

$2,100,000

Liabilities and Stockholders' Equity

Accounts payable.

$ 360,000

$ 310,000

Long-term debt

Stockholders' equity

1,500,000

1,500,000

160,000

290,000

Total liabilities and stockholders' equity

$2,020,000

$2,100,000

Joel de Paris, Inc.

Income Statement

Sales

$4,050,000

Operating expenses

Net operating income

3,645,000

405,000

Interest and taxes:

Interest expense

$150,000

Таx expense

110,000

260,000

Net income

$ 145,000

The

company paid dividends of $15,000 last year. The "Investment in Buisson, S.A.," on the

balance sheet represents an investment in the stock of another company. The company's minimum

required rate of return of 15%.

Transcribed Image Text:Required:

1. Compute the company's average operating assets for last year.

2. Compute the company's margin, turnover, and return on investment (ROI) for last year.

(Hint: Should you use net income or net operating income in your calculations?)

3.

What was the company's residual income last year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning