Required: 1. Prepare the journal entries for the following: a. To close the books of Amos' proprietorship. b. To record the investments of Amos in the partnership books. c. To close the books of Anah's sole proprietorship. d. To record the investments of Amos in the partnership books. 2. Prepare the balance sheet of Amos and Anah partnership upon formation.

Required: 1. Prepare the journal entries for the following: a. To close the books of Amos' proprietorship. b. To record the investments of Amos in the partnership books. c. To close the books of Anah's sole proprietorship. d. To record the investments of Amos in the partnership books. 2. Prepare the balance sheet of Amos and Anah partnership upon formation.

Chapter21: Partnerships

Section: Chapter Questions

Problem 65P

Related questions

Question

100%

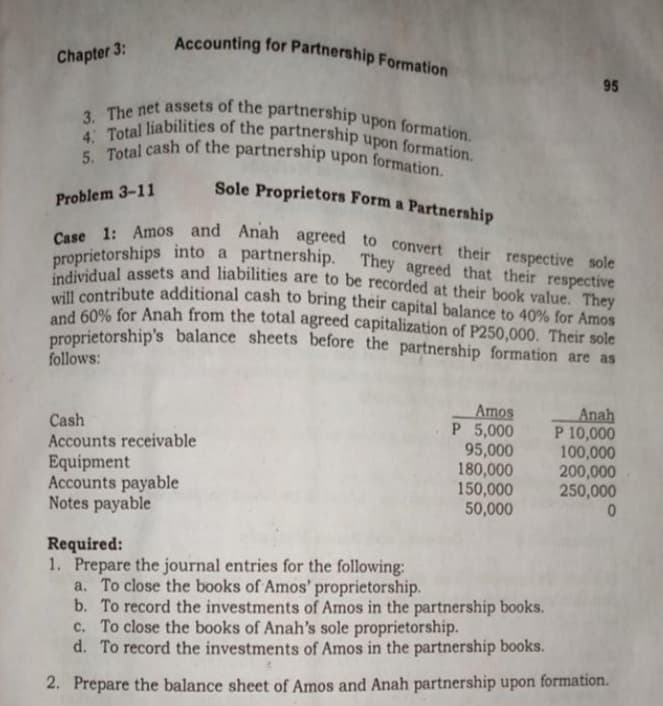

Transcribed Image Text:proprietorships into a partnership. They agreed that their respective

Accounting for Partnership Formation

4 Total liabilities of the partnership upon formation.

3. The net assets of the partnership upon formation.

5. Total cash of the partnership upon formation.

Case 1: Amos and Anah agreed to convert their respective sole

individual assets and liabilities are to be recorded at their book value. They

Chapter 3:

95

Sole Proprietors Form a Partnership

Problem 3-11

ll contribute additional cash to bring their capital balance to 40% for Amos

nd % for Anah from the total agreed capitalization of P250,000. Their sole

proprietorship's balance sheets before the partnership formation are as

follows:

Amos

P 5,000

95,000

180,000

150,000

50,000

Anah

P 10,000

100,000

200,000

250,000

Cash

Accounts receivable

Equipment

Accounts payable

Notes payable

Required:

1. Prepare the journal entries for the following:

a. To close the books of Amos' proprietorship.

b. To record the investments of Amos in the partnership books.

c. To close the books of Anah's sole proprietorship.

d. To record the investments of Amos in the partnership books.

2. Prepare the balance sheet of Amos and Anah partnership upon formation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College