Required: 49.c00 1. Prepare the cash priority program. 2. Prepare the journal entries to record the realization of assets and distribution of cash to creditors and partners.

Required: 49.c00 1. Prepare the cash priority program. 2. Prepare the journal entries to record the realization of assets and distribution of cash to creditors and partners.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 9SPB

Related questions

Question

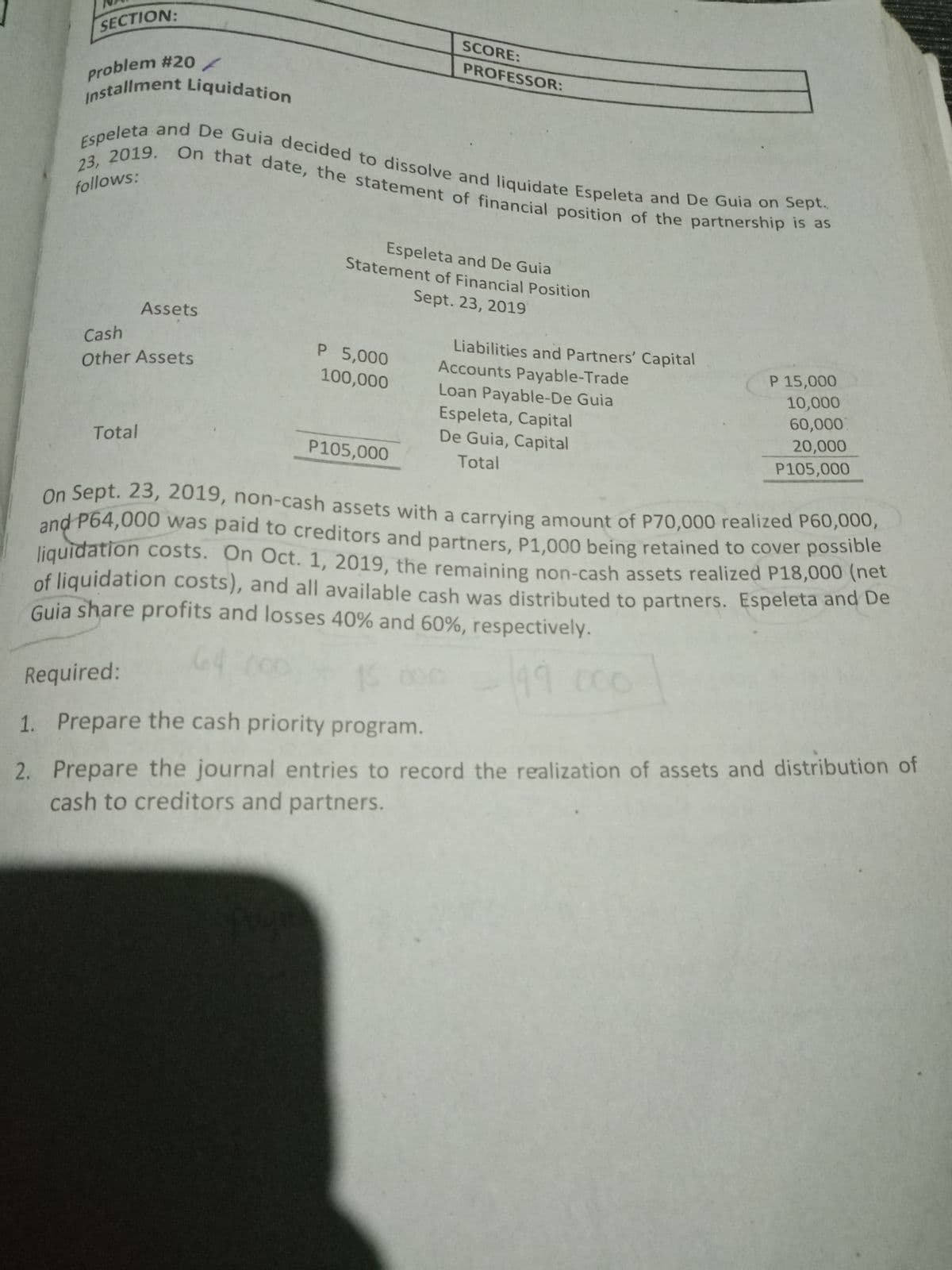

Transcribed Image Text:problem #20/

and P64,000 was paid to creditors and partners, P1,000 being retained to cover possible

23, 2019. On that date, the statement of financial position of the partnership is as

Espeleta and De Guia decided to dissolve and liquidate Espeleta and De Guia on Sept.

Installment Liquidation

On Sept. 23, 2019, non-cash assets with a carrying amount of P70,000 realized P60,000,

SECTION:

SCORE:

PROFESSOR:

23, 2019.

follows:

Espeleta and De Guia

Statement of Financial Position

Sept. 23, 2019

Assets

Liabilities and Partners' Capital

Accounts Payable-Trade

Loan Payable-De Guia

Espeleta, Capital

De Guia, Capital

Cash

P 5,000

P 15,000

10,000

60,000

20,000

Other Assets

100,000

Total

P105,000

Total

P105,000

On Sept. 23, 2019, non-cash assets with a carrving amount of P70,000 realized P60,000,

and P64,000 was paid to creditors and partners, P1.000 being retained to cover possIble

liquidation costs. On Oct. 1, 2019, the remaining non-cash assets realized P18,000 (net

of liquidation costs), and all available cash was distributed to partners. Espeleta and De

Guia share profits and losses 40% and 60%, respectively.

64.00

149.000

Required:

1. Prepare the cash priority program.

2. Prepare the journal entries to record the realization of assets and distribution of

cash to creditors and partners.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning