Required information Exercise 12-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 [The following information applies to the questions displayed below.] The following financial statements and additional information are reported. At June 30 Assets Cash IKIBAN INCORPORATED Comparative Balance Sheets Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity Sales Cost of goods sold Gross profit 2020 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income $ 100,900 81,500 74,800 5,500 Additional Information 262,700 135,000 (32,500) $365,200 $ 36,000 7,100 4,500 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2020 47,600 41,000 88,600 242,000 34,600 $365,200 Operating expenses (excluding depreciation) Depreciation expense 2019 $ 55,000 62,000 103,000 7,600 227,600 126,000 (14,500) $ 339,100 $ 46,500 17,200 6,000 69,700 71,000 140, 700 171,000 27,400 $ 339,100 $ 733,000 422,000 311,000 78,000 69,600 163,400 3,100 166,500 44,990 $ 121,510 a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $68,600 cash. d. Received cash for the sale of equipment that had cost $59,600, yielding a $3,100 gain. e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income statement. f. All purchases and sales of inventory are on credit.

Required information Exercise 12-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 [The following information applies to the questions displayed below.] The following financial statements and additional information are reported. At June 30 Assets Cash IKIBAN INCORPORATED Comparative Balance Sheets Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity Sales Cost of goods sold Gross profit 2020 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income $ 100,900 81,500 74,800 5,500 Additional Information 262,700 135,000 (32,500) $365,200 $ 36,000 7,100 4,500 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2020 47,600 41,000 88,600 242,000 34,600 $365,200 Operating expenses (excluding depreciation) Depreciation expense 2019 $ 55,000 62,000 103,000 7,600 227,600 126,000 (14,500) $ 339,100 $ 46,500 17,200 6,000 69,700 71,000 140, 700 171,000 27,400 $ 339,100 $ 733,000 422,000 311,000 78,000 69,600 163,400 3,100 166,500 44,990 $ 121,510 a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $68,600 cash. d. Received cash for the sale of equipment that had cost $59,600, yielding a $3,100 gain. e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income statement. f. All purchases and sales of inventory are on credit.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter23: Statement Of Cash Flows

Section: Chapter Questions

Problem 10SPB

Related questions

Question

The table is not done, that'd be great if you could help me finish it. Thank you.

Do not give answer in image

![Required information

Exercise 12-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1

[The following information applies to the questions displayed below.]

The following financial statements and additional information are reported.

At June 30

Assets

Cash

IKIBAN INCORPORATED

Comparative Balance Sheets

Accounts receivable, net

Inventory

Prepaid expenses

Total current assets

Equipment

Accumulated depreciation-Equipment

Total assets

Liabilities and Equity

Accounts payable

Wages payable

Income taxes payable

Total current liabilities

Notes payable (long term)

Total liabilities

Equity

Common stock, $5 par value

Retained earnings

Total liabilities and equity

Sales

Cost of goods sold

Gross profit

2020

Other gains (losses)

Gain on sale of equipment

Income before taxes

Income taxes expense

Net income

$ 100,900

81,500

74,800

5,500

Additional Information

262,700

135,000

(32,500)

$365,200

$ 36,000

7,100

4,500

IKIBAN INCORPORATED

Income Statement

For Year Ended June 30, 2020

47,600

41,000

88,600

242,000

34,600

$365,200

Operating expenses (excluding depreciation)

Depreciation expense

2019

$ 55,000

62,000

103,000

7,600

227,600

126,000

(14,500)

$ 339,100

$ 46,500

17,200

6,000

69,700

71,000

140, 700

171,000

27,400

$ 339,100

$ 733,000

422,000

311,000

78,000

69,600

163,400

3,100

166,500

44,990

$ 121,510

a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid.

c. New equipment is acquired for $68,600 cash.

d. Received cash for the sale of equipment that had cost $59,600, yielding a $3,100 gain.

e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income statement.

f. All purchases and sales of inventory are on credit.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F756650b3-18d1-4b86-ac9b-c71ad5c7bd76%2Fce3dc8a5-72c6-4701-9a2c-8c7f62883779%2F3muoj23_processed.png&w=3840&q=75)

Transcribed Image Text:Required information

Exercise 12-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1

[The following information applies to the questions displayed below.]

The following financial statements and additional information are reported.

At June 30

Assets

Cash

IKIBAN INCORPORATED

Comparative Balance Sheets

Accounts receivable, net

Inventory

Prepaid expenses

Total current assets

Equipment

Accumulated depreciation-Equipment

Total assets

Liabilities and Equity

Accounts payable

Wages payable

Income taxes payable

Total current liabilities

Notes payable (long term)

Total liabilities

Equity

Common stock, $5 par value

Retained earnings

Total liabilities and equity

Sales

Cost of goods sold

Gross profit

2020

Other gains (losses)

Gain on sale of equipment

Income before taxes

Income taxes expense

Net income

$ 100,900

81,500

74,800

5,500

Additional Information

262,700

135,000

(32,500)

$365,200

$ 36,000

7,100

4,500

IKIBAN INCORPORATED

Income Statement

For Year Ended June 30, 2020

47,600

41,000

88,600

242,000

34,600

$365,200

Operating expenses (excluding depreciation)

Depreciation expense

2019

$ 55,000

62,000

103,000

7,600

227,600

126,000

(14,500)

$ 339,100

$ 46,500

17,200

6,000

69,700

71,000

140, 700

171,000

27,400

$ 339,100

$ 733,000

422,000

311,000

78,000

69,600

163,400

3,100

166,500

44,990

$ 121,510

a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid.

c. New equipment is acquired for $68,600 cash.

d. Received cash for the sale of equipment that had cost $59,600, yielding a $3,100 gain.

e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income statement.

f. All purchases and sales of inventory are on credit.

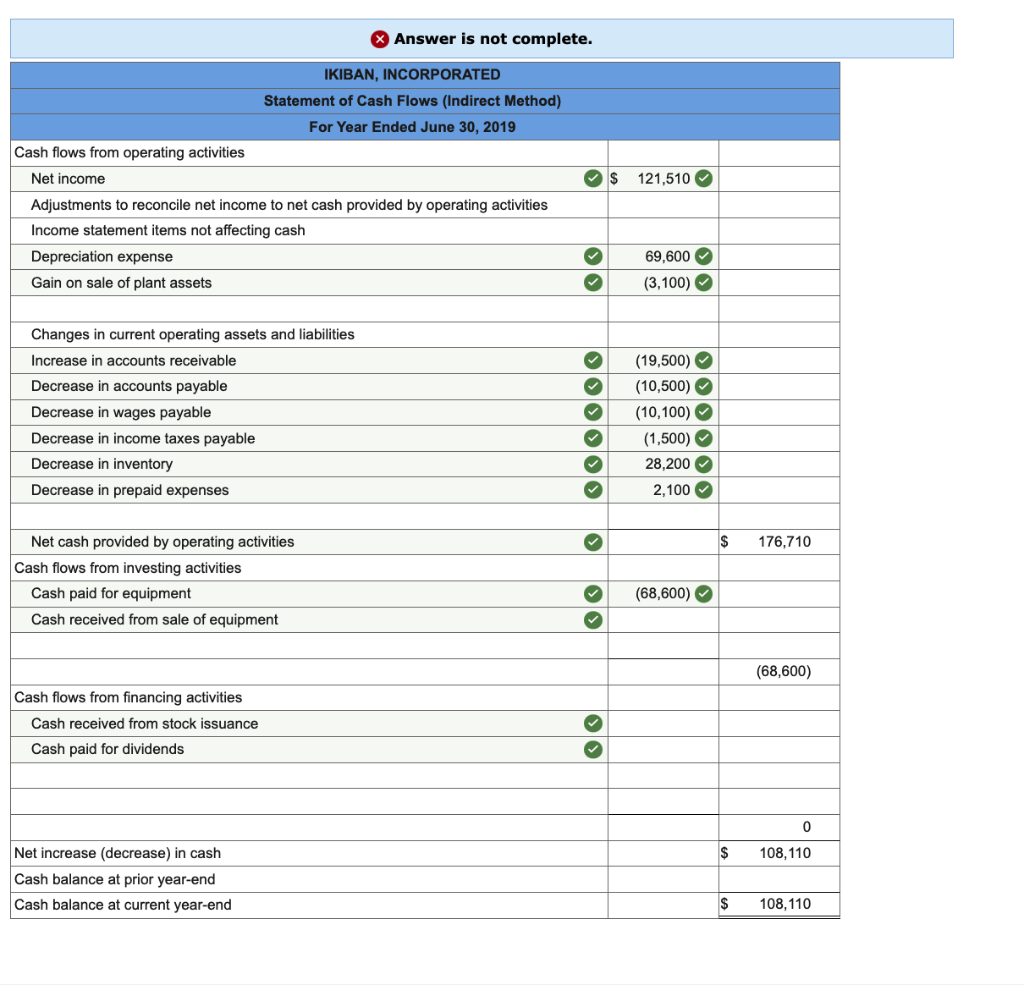

Transcribed Image Text:Depreciation expense

Gain on sale of plant assets

Cash flows from operating activities

Net income

Adjustments to reconcile net income to net cash provided by operating activities

Income statement items not affecting cash

Changes in current operating assets and liabilities

Increase in accounts receivable

Decrease in accounts payable

Decrease in wages payable

Decrease in income taxes payable

Decrease in inventory

Decrease in prepaid expenses

IKIBAN, INCORPORATED

Statement of Cash Flows (Indirect Method)

For Year Ended June 30, 2019

Net cash provided by operating activities

Cash flows from investing activities

Cash paid for equipment

Cash received from sale of equipment

Cash flows from financing activities

Cash received from stock issuance

Cash paid for dividends

X Answer is not complete.

Net increase (decrease) in cash

Cash balance at prior year-end

Cash balance at current year-end

✓

✓

✓

✓

✓

✓

✓

>>

33

$ 121,510✔

69,600✔

(3,100)✔

(19,500)✔

(10,500) ✔

(10,100)✔

(1,500) ✔

28,200✔

2,100✔

(68,600) ✔

$ 176,710

(68,600)

0

S 108,110

$

108,110

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning