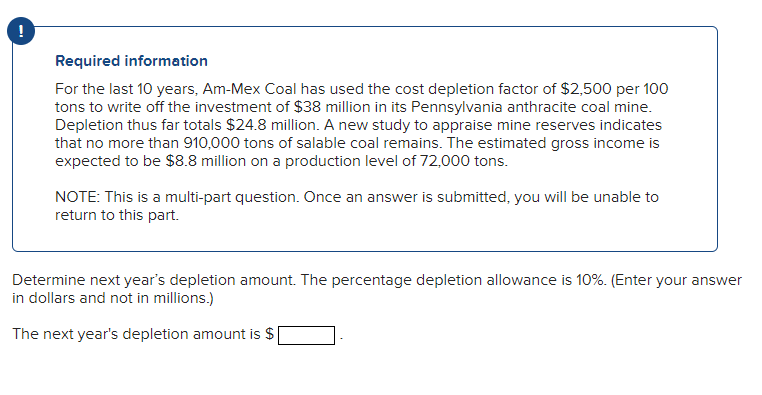

Required information For the last 10 years, Am-Mex Coal has used the cost depletion factor of $2,500 per 100 tons to write off the investment of $38 million in its Pennsylvania anthracite coal mine. Depletion thus far totals $24.8 million. A new study to appraise mine reserves indicates that no more than 910,000 tons of salable coal remains. The estimated gross income is expected to be $8.8 million on a production level of 72,000 tons. NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. Determine next year's depletion amount. The percentage depletion allowance is 10%. (Enter your answer in dollars and not in millions.)

Required information For the last 10 years, Am-Mex Coal has used the cost depletion factor of $2,500 per 100 tons to write off the investment of $38 million in its Pennsylvania anthracite coal mine. Depletion thus far totals $24.8 million. A new study to appraise mine reserves indicates that no more than 910,000 tons of salable coal remains. The estimated gross income is expected to be $8.8 million on a production level of 72,000 tons. NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. Determine next year's depletion amount. The percentage depletion allowance is 10%. (Enter your answer in dollars and not in millions.)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 6PA: Gimli Miners recently purchased the rights to a diamond mine. It is estimated that there are one...

Related questions

Question

Transcribed Image Text:!

Required information

For the last 10 years, Am-Mex Coal has used the cost depletion factor of $2,500 per 100

tons to write off the investment of $38 million in its Pennsylvania anthracite coal mine.

Depletion thus far totals $24.8 million. A new study to appraise mine reserves indicates

that no more than 910,000 tons of salable coal remains. The estimated gross income is

expected to be $8.8 million on a production level of 72,000 tons.

NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to

return to this part.

Determine next year's depletion amount. The percentage depletion allowance is 10%. (Enter your answer

in dollars and not in millions.)

The next year's depletion amount is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning