Required information P9-2 (Algo) Recording and Reporting Current Liabilities with Discussion of Cash Flow Effects LO9-1, 9-5 [The following information applies to the questions displayed below.] Roger Company completed the following transactions during Year 1. Roger's fiscal year ends on December 31. Jan. 8 Purchased merchandise for resale on account. The invoice amount was $14,850; assume a perpetual inventory system. 17 Paid January 8 invoice. Apr. 1 Borrowed $48,000 from National Bank for general use; signed a 12-month, 12% annual interest-bearing note for the money. June 3 Purchased merchandise for resale on account. The invoice

Required information P9-2 (Algo) Recording and Reporting Current Liabilities with Discussion of Cash Flow Effects LO9-1, 9-5 [The following information applies to the questions displayed below.] Roger Company completed the following transactions during Year 1. Roger's fiscal year ends on December 31. Jan. 8 Purchased merchandise for resale on account. The invoice amount was $14,850; assume a perpetual inventory system. 17 Paid January 8 invoice. Apr. 1 Borrowed $48,000 from National Bank for general use; signed a 12-month, 12% annual interest-bearing note for the money. June 3 Purchased merchandise for resale on account. The invoice

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

![Required information

P9-2 (Algo) Recording and Reporting Current Liabilities with Discussion of Cash Flow Effects LO9-1, 9-5

[The following information applies to the questions displayed below.]

Roger Company completed the following transactions during Year 1. Roger's fiscal

year ends on December 31.

Jan. 8 Purchased merchandise for resale on account. The invoice

amount was $14,850; assume a perpetual inventory system.

17 Paid January 8 invoice.

Apr. 1 Borrowed $48,000 from National Bank for general use; signed

a 12-month, 12% annual interest-bearing note for the money.

June 3 Purchased merchandise for resale on account. The invoice

amount was $17,320.

July 5 Paid June 3 invoice.

Aug. 1 Rented office space in one of Roger's buildings to another

company and collected six months' rent in advance amounting

to $27,000.

Dec.20 Received a $280 deposit from a customer as

a guarantee to

return a trailer borrowed for 30 days.

31 Determined wages of $9,900 were earned but not yet paid on

December 31 (disregard payroll taxes).](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F73af3eac-b7de-47eb-afa9-f05519ef89c1%2F2c8efc87-98d3-4ebd-835e-440d7acb0efe%2F2ef6gvf_processed.png&w=3840&q=75)

Transcribed Image Text:Required information

P9-2 (Algo) Recording and Reporting Current Liabilities with Discussion of Cash Flow Effects LO9-1, 9-5

[The following information applies to the questions displayed below.]

Roger Company completed the following transactions during Year 1. Roger's fiscal

year ends on December 31.

Jan. 8 Purchased merchandise for resale on account. The invoice

amount was $14,850; assume a perpetual inventory system.

17 Paid January 8 invoice.

Apr. 1 Borrowed $48,000 from National Bank for general use; signed

a 12-month, 12% annual interest-bearing note for the money.

June 3 Purchased merchandise for resale on account. The invoice

amount was $17,320.

July 5 Paid June 3 invoice.

Aug. 1 Rented office space in one of Roger's buildings to another

company and collected six months' rent in advance amounting

to $27,000.

Dec.20 Received a $280 deposit from a customer as

a guarantee to

return a trailer borrowed for 30 days.

31 Determined wages of $9,900 were earned but not yet paid on

December 31 (disregard payroll taxes).

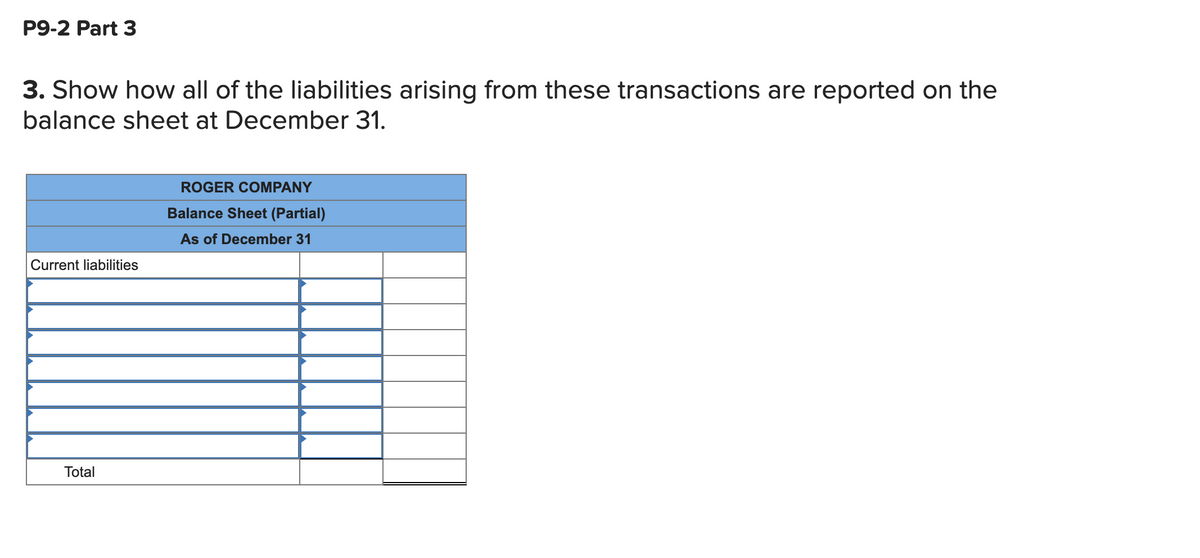

Transcribed Image Text:P9-2 Part 3

3. Show how all of the liabilities arising from these transactions are reported on the

balance sheet at December 31.

ROGER COMPANY

Balance Sheet (Partial)

As of December 31

Current liabilities

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning