Required information (The following information applies to the questions displayed below.] Gerald Utsey earned $47,600 in 2021 for a company in Kentucky. He is single with one dependent under 17 and is paid weekly. The FUTA rate in Kentucky for 2021 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in ARRendix D. Manual payroll system is used and Box 2 is not checked. Required: Compute the following employee share of the taxes. (Do not round intermediate calculation. Round your final answers to 2 dee places.) Federal income tax withholding Social Security tax 56.75 13.27 Medicare tax 2. State income tax withholding

Required information (The following information applies to the questions displayed below.] Gerald Utsey earned $47,600 in 2021 for a company in Kentucky. He is single with one dependent under 17 and is paid weekly. The FUTA rate in Kentucky for 2021 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in ARRendix D. Manual payroll system is used and Box 2 is not checked. Required: Compute the following employee share of the taxes. (Do not round intermediate calculation. Round your final answers to 2 dee places.) Federal income tax withholding Social Security tax 56.75 13.27 Medicare tax 2. State income tax withholding

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 7E

Related questions

Question

100%

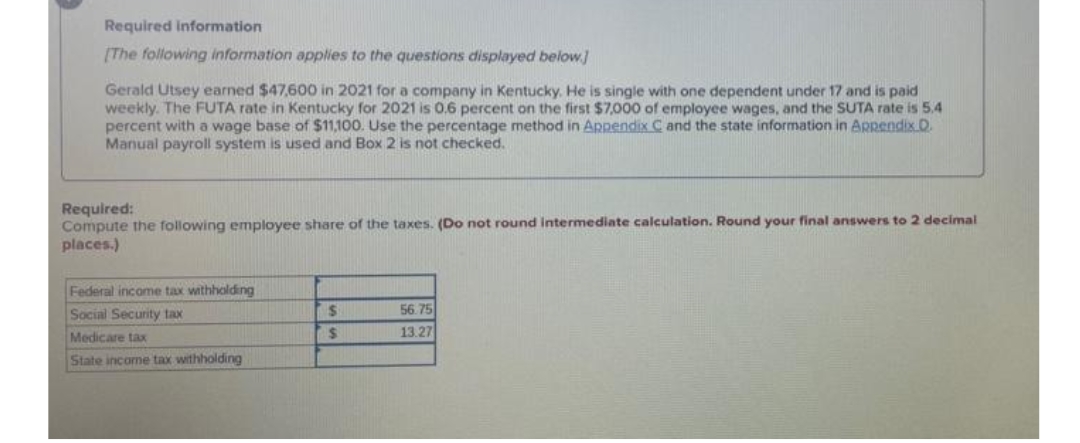

Transcribed Image Text:Required information

(The following information applies to the questions displayed below.

Gerald Utsey earned $47,600 in 2021 for a company in Kentucky. He is single with one dependent under 17 and is paid

weekly. The FUTA rate in Kentucky for 2021 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5,4

percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in ARRendix D.

Manual payroll system is used and Box 2 is not checked.

Required:

Compute the following employee share of the taxes. (Do not round Intermediate calculation. Round your final answers to 2 decimal

places.)

Federal income tax withholding

Social Security tax

56.75

13.27

Medicare tax

State income tax withholding

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT