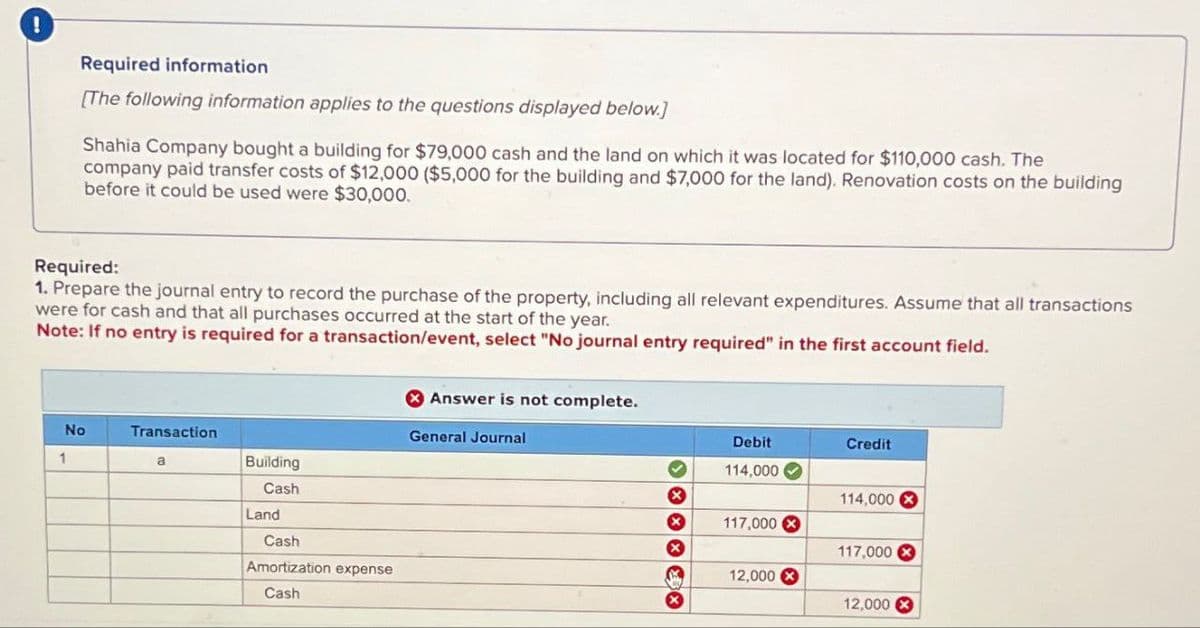

Required information [The following information applies to the questions displayed below.] Shahia Company bought a building for $79,000 cash and the land on which it was located for $110,000 cash. The company paid transfer costs of $12,000 ($5,000 for the building and $7,000 for the land). Renovation costs on the building before it could be used were $30,000. Required: 1. Prepare the journal entry to record the purchase of the property, including all relevant expenditures. Assume that all transactions were for cash and that all purchases occurred at the start of the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Required information [The following information applies to the questions displayed below.] Shahia Company bought a building for $79,000 cash and the land on which it was located for $110,000 cash. The company paid transfer costs of $12,000 ($5,000 for the building and $7,000 for the land). Renovation costs on the building before it could be used were $30,000. Required: 1. Prepare the journal entry to record the purchase of the property, including all relevant expenditures. Assume that all transactions were for cash and that all purchases occurred at the start of the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 2EA: Jada Company had the following transactions during the year: Purchased a machine for $500,000 using...

Related questions

Question

Transcribed Image Text:!

Required information

[The following information applies to the questions displayed below.)

Shahia Company bought a building for $79,000 cash and the land on which it was located for $110,000 cash. The

company paid transfer costs of $12,000 ($5,000 for the building and $7,000 for the land). Renovation costs on the building

before it could be used were $30,000.

Required:

1. Prepare the journal entry to record the purchase of the property, including all relevant expenditures. Assume that all transactions

were for cash and that all purchases occurred at the start of the year.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

No

Transaction

1

a

Building

Cash

Land

Cash

Amortization expense

Cash

Answer is not complete.

General Journal

1*****

Debit

114,000

Credit

114,000

117,000 ×

117,000

12,000 ×

12,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning