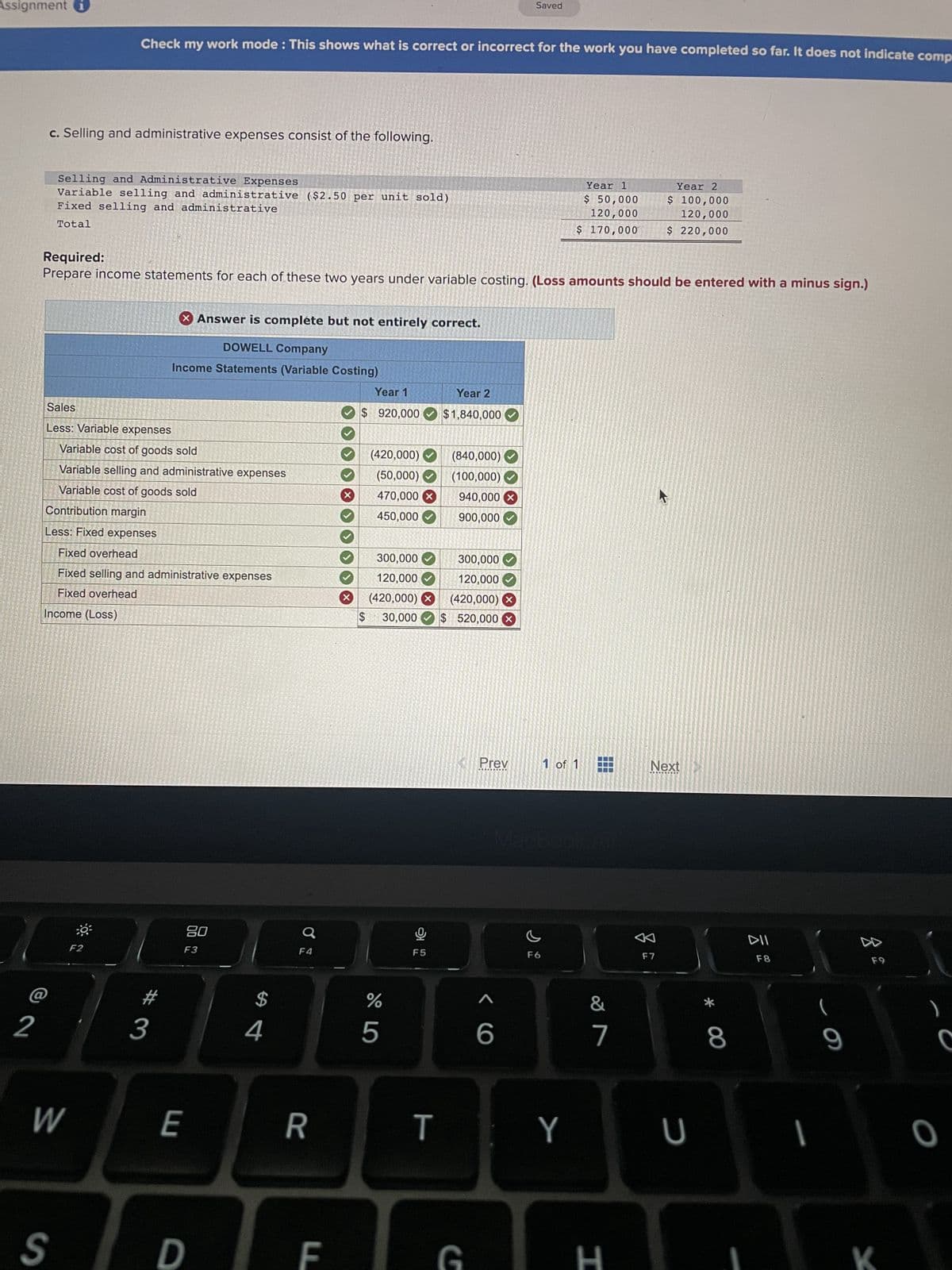

Required: Prepare income statements for each of these two years under variable costing. (Loss amounts should be entered with a minus sign.) Sales Less: Variable expenses X Answer is complete but not entirely correct. DOWELL Company Income Statements (Variable Costing) Variable cost of goods sold Variable selling and administrative expenses Variable cost of goods sold Contribution margin Less: Fixed expenses Fixed overhead Fixed selling and administrative expenses Fixed overhead Income (Loss) ✓ → (420,000) x ✓ ✓ Year 1 $920,000 ✓ X $ (50,000)✓ 470,000 X 450,000✔ 300,000✔ 120,000 ✓ (420,000) X Year 2 $1,840,000✔ (840,000) (100,000) 940,000 x 900,000✔ 300,000 120,000✔ (420,000) X 30,000 $ 520,000

Required: Prepare income statements for each of these two years under variable costing. (Loss amounts should be entered with a minus sign.) Sales Less: Variable expenses X Answer is complete but not entirely correct. DOWELL Company Income Statements (Variable Costing) Variable cost of goods sold Variable selling and administrative expenses Variable cost of goods sold Contribution margin Less: Fixed expenses Fixed overhead Fixed selling and administrative expenses Fixed overhead Income (Loss) ✓ → (420,000) x ✓ ✓ Year 1 $920,000 ✓ X $ (50,000)✓ 470,000 X 450,000✔ 300,000✔ 120,000 ✓ (420,000) X Year 2 $1,840,000✔ (840,000) (100,000) 940,000 x 900,000✔ 300,000 120,000✔ (420,000) X 30,000 $ 520,000

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter21: Cost Behavior And Cost-volume-profit Analysis

Section: Chapter Questions

Problem 21.28EX: Appendix Absorption costing income statement On June 30, the end of the first month of operations,...

Related questions

Question

How do I complete the chart?

Transcribed Image Text:Assignment

2

c. Selling and administrative expenses consist of the following.

Selling and Administrative Expenses

Variable selling and administrative ($2.50 per unit sold)

Fixed selling and administrative

Total

Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate comp

Sales

Less: Variable expenses

Variable cost of goods sold

Variable selling and administrative expenses

Variable cost of goods sold

Contribution margin

Less: Fixed expenses

Income (Loss)

Required:

Prepare income statements for each of these two years under variable costing. (Loss amounts should be entered with a minus sign.)

Fixed overhead

Fixed selling and administrative expenses

Fixed overhead

W

F2

X Answer is complete but not entirely correct.

DOWELL Company

Income Statements (Variable Costing)

#

3

20

F3

E

S D

S4

Q

F4

R

LL

X

✓

X

Year 1

$920,000

(420,000)

(840,000)

(100,000)✓

(50,000)✓

470,000 X 940,000 X

450,000

900,000

300,000

120,000

(420,000) X

%

5

300,000

120,000

(420,000) X

30,000 $ 520,000 X

Year 2

$1,840,000

C

F5

T

G

Prev

Saved

< C

6

F6

Year 1

$ 50,000

120,000

$ 170,000

1 of 1

Y

&

7

H

Year 2

$ 100,000

120,000

$ 220,000

Next

F7

U

* 0

8

DII

F8

I

(

9

F9

K

0

Transcribed Image Text:O

19 Assignment

1

ints

Mc

Graw

Hill

Q

N

F1

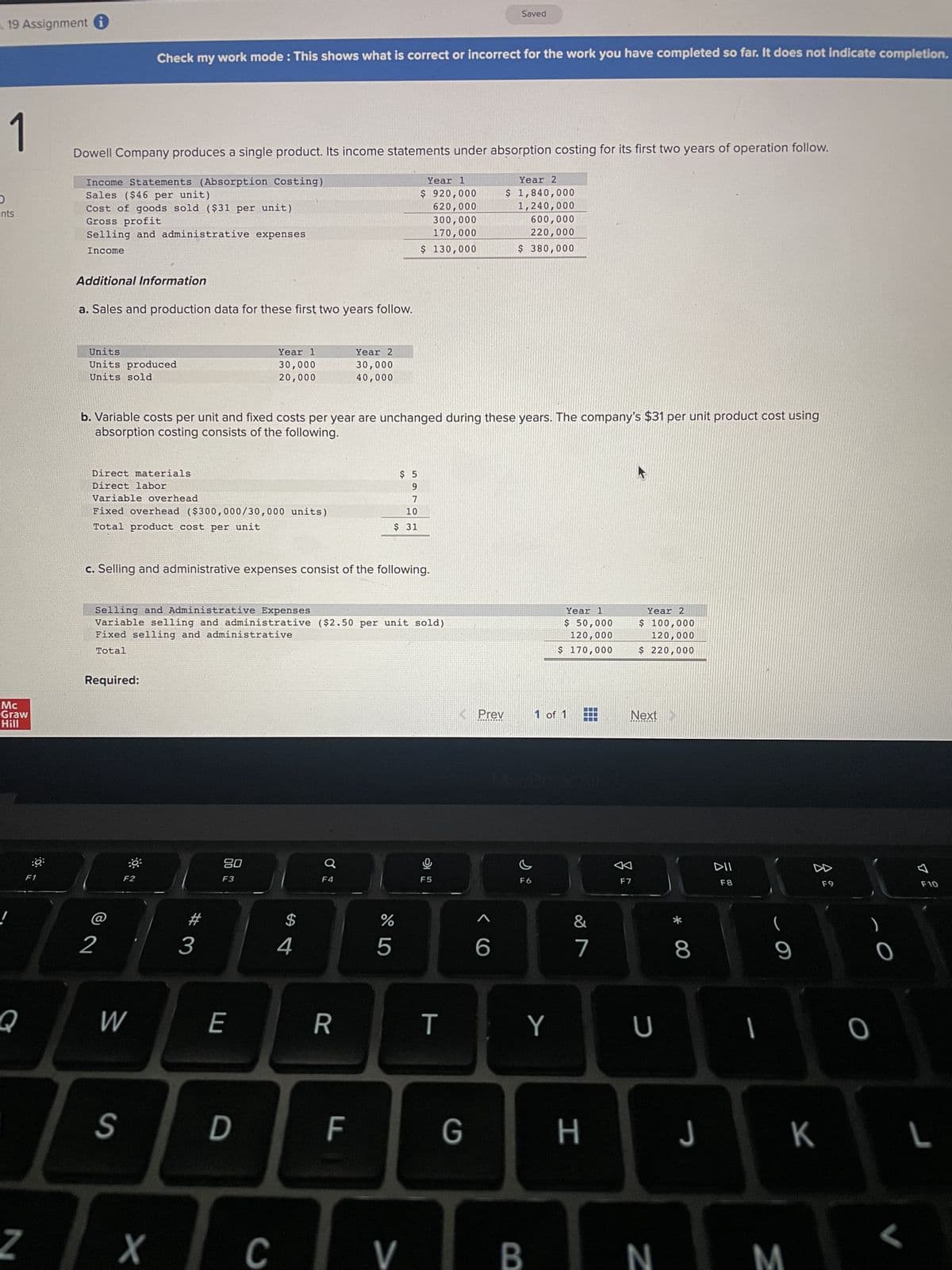

Dowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow.

Income Statements (Absorption Costing)

Sales ($46 per unit)

Cost of goods sold ($31 per unit)

Gross profit

Selling and administrative expenses

Income

Additional Information

a. Sales and production data for these first two years follow.

Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

Units

Units produced

Units sold

Direct materials

Direct labor

Variable overhead

Fixed overhead ($300,000/30,000 units)

Total product cost per unit

2

F2

b. Variable costs per unit and fixed costs per year are unchanged during these years. The company's $31 per unit product cost using

absorption costing consists of the following.

W

c. Selling and administrative expenses consist of the following.

Selling and Administrative Expenses

Variable selling and administrative ($2.50 per unit sold)

Fixed selling and administrative

Total

Required:

#

Year 1

30,000

20,000

3

80

F3

E

S D

$

4

Ơ

Year 2

30,000

40,000

F4

R

LL

$5

9

7

10

$ 31

Year 1

$ 920,000

620,000

300,000

170,000

$ 130,000

%

5

X CV

F5

T

< Prev

Saved

G

1

6

Year 2

$ 1,840,000

1,240,000

600,000

220,000

$ 380,000

c

F6

Y

B

Year 1

$ 50,000

120,000

$ 170,000

1 of 1

&

7

7

H

E

Year 2

$ 100,000

120,000

$ 220,000

Next

F7

U

N

* 00

8

DII

F8

1

(

9

J K

M

F9

O

0

7

F10

L

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning