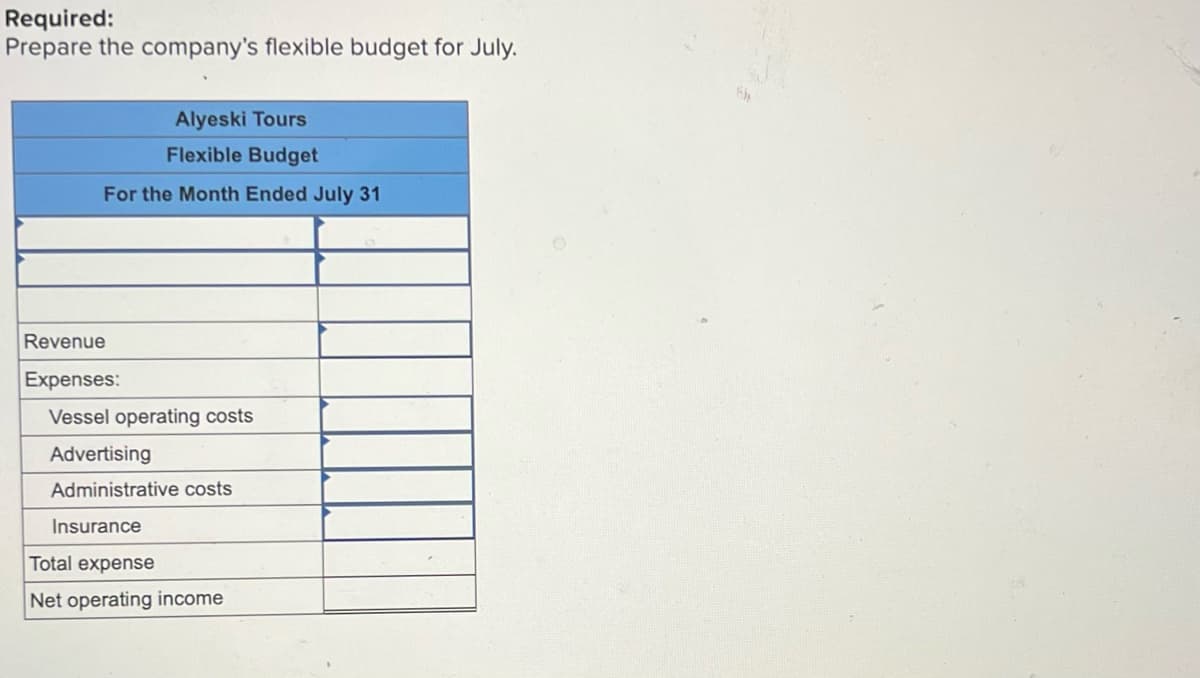

Required: Prepare the company's flexible budget for July. Alyeski Tours Flexible Budget For the Month Ended July 31 Revenue Expenses: Vessel operating costs Advertising Administrative costs Insurance Total expense Net operating income

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

![Exercise 9-3 Prepare a Flexible Budget with More Than One Cost Driver [LO9-3]

Alyeski Tours operates day tours of coastal glaciers in Alaska on its tour boat the Blue Glacier. Management has identified two cost

drivers the number of cruises and the number of passengers-that it uses in its budgeting and performance reports. The company

publishes a schedule of day cruises that it may supplement with special sailings if there is sufficient demand. Up to 80 passengers can

be accommodated on the tour boat. Data concerning the company's cost formulas appear below:

Fixed Cost per Month Cost per Cruise Cost per Passenger

$475.00

Vessel operating costs

Advertising

$ 6,700

$ 2,800

$3.00

$1.50

Administrative costs

$39.00

$5,200

$3,900

Insurance

For example, vessel operating costs should be $6,700 per month plus $475.00 per cruise plus $3.00 per passenger. The company's

sales should average $33.00 per passenger. In July, the company provided 59 cruises for a total of 3,000 passengers.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F897d79a8-0004-4a50-90da-1b33c73eda01%2F265760ed-0d75-472b-887d-6c9e852e5d1c%2F9xv4ve6_processed.jpeg&w=3840&q=75)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images