REQUIRED: Prepare the liabilities section of the Statement of Financial Position for Firah Bhd as at 31 December 2018.

REQUIRED: Prepare the liabilities section of the Statement of Financial Position for Firah Bhd as at 31 December 2018.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 30E

Related questions

Topic Video

Question

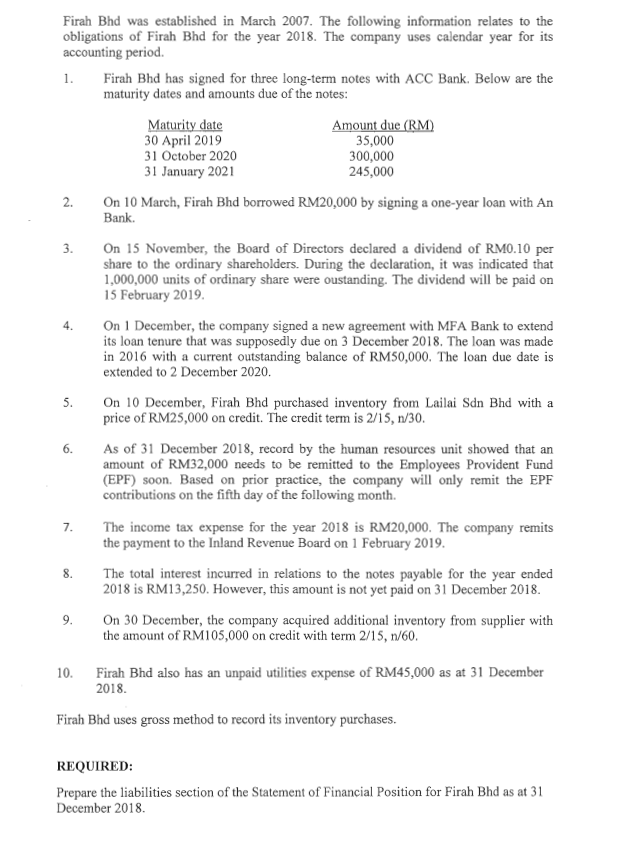

Transcribed Image Text:Firah Bhd was established in March 2007. The following information relates to the

obligations of Firah Bhd for the year 2018. The company uses calendar year for its

accounting period.

Firah Bhd has signed for three long-term notes with ACC Bank. Below are the

maturity dates and amounts due of the notes:

1.

Maturity date

30 April 2019

31 October 2020

Amount due (RM)

35,000

300,000

245,000

31 January 2021

On 10 March, Firah Bhd borrowed RM20,000 by signing a one-year loan with An

Bank.

2.

On 15 November, the Board of Directors declared a dividend of RM0.10 per

share to the ordinary shareholders. During the declaration, it was indicated that

1,000,000 units of ordinary share were oustanding. The dividend will be paid on

15 February 2019.

3.

On 1 December, the company signed a new agreement with MFA Bank to extend

its loan tenure that was supposedly due on 3 December 2018. The loan was made

in 2016 with a current outstanding balance of RM50,000. The loan due date is

extended to 2 December 2020.

On 10 December, Firah Bhd purchased inventory from Lailai Sdn Bhd with a

price of RM25,000 on credit. The credit term is 2/15, n/30.

5.

As of 31 December 2018, record by the human resources unit showed that an

amount of RM32,000 needs to be remitted to the Employees Provident Fund

(EPF) soon. Based on prior practice, the company will only remit the EPF

contributions on the fifth day of the following month.

The income tax expense for the year 2018 is RM20,000. The company remits

the payment to the Inland Revenue Board on 1 February 2019.

7.

8.

The total interest incurred in relations to the notes payable for the year ended

2018 is RM13,250. However, this amount is not yet paid on 31 December 2018.

On 30 December, the company acquired additional inventory from supplier with

the amount of RM105,000 on credit with term 2/15, n/60.

9.

10. Firah Bhd also has an unpaid utilities expense of RM45,000 as at 31 December

2018.

Firah Bhd uses gross method to record its inventory purchases.

REQUIRED:

Prepare the liabilities section of the Statement of Financial Position for Firah Bhd as at 31

December 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub