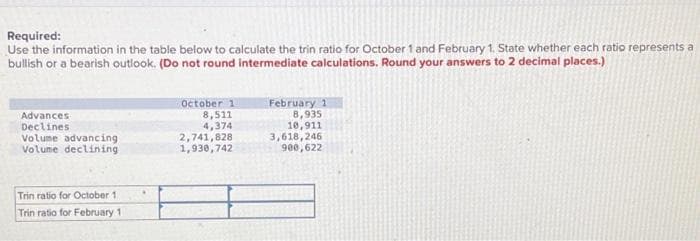

Required: Use the information in the table below to calculate the trin ratio for October 1 and February 1. State whether each ratio represents a bullish or a bearish outlook. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Advances Declines Volume advancing Volume declining October 1 8,511 4,374 2,741,828 1,930,742 February 1 8,935 10,911 3,618,246 900,622

Required: Use the information in the table below to calculate the trin ratio for October 1 and February 1. State whether each ratio represents a bullish or a bearish outlook. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Advances Declines Volume advancing Volume declining October 1 8,511 4,374 2,741,828 1,930,742 February 1 8,935 10,911 3,618,246 900,622

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 77E: Ratio Analysis The following information was taken from Logsden Manufacturings trial balances as of...

Related questions

Question

Required: Use the information in the table below to calculate the trin ratio for October 1 and February 1. State whether each ratio represents a bullish or a bearish outlook. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Advances Declines Volume advancing Volume declining Trin ratio for October 1 Trin ratio for February 1 2 October 1 8,511 4,374 2,741,828 1,930,742 February 1 8,935 10,911 3,618,246 900,622

Transcribed Image Text:Required:

Use the information in the table below to calculate the trin ratio for October 1 and February 1. State whether each ratio represents a

bullish or a bearish outlook. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Advances

Declines

Volume advancing.

Volume declining

Trin ratio for October 1

Trin ratio for February 11

October 1

8,511

4,374

2,741,828

1,930,742

February 1

8,935

10,911

3,618,246

900,622

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage