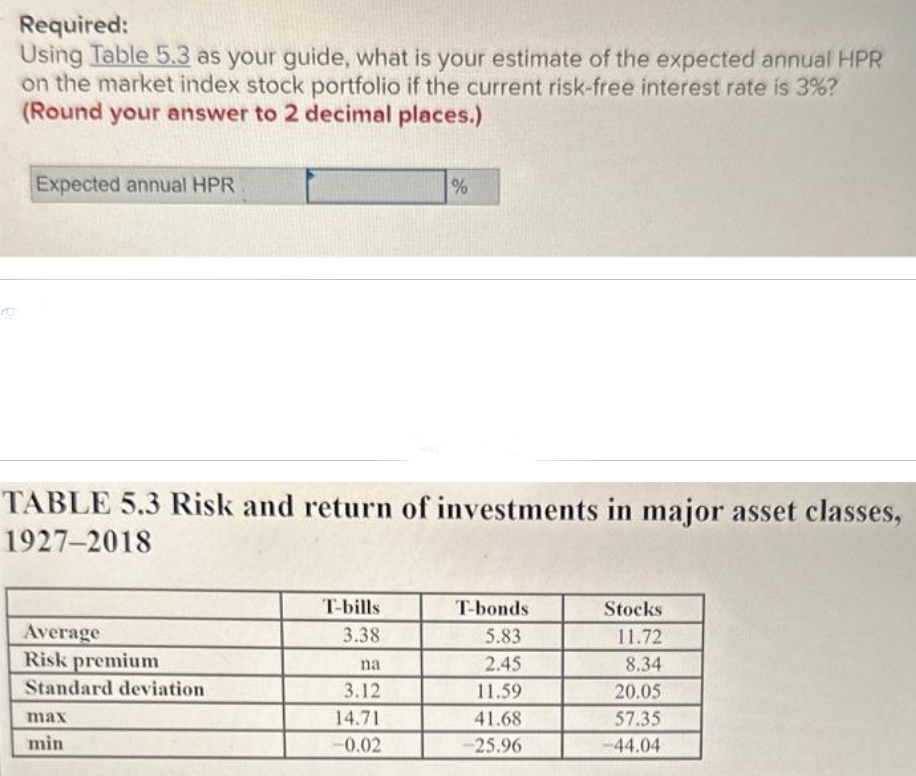

Using Table 5.3 as your guide, what is your estimate of the expected annual HPR on the market index stock portfolio if the current risk-free interest rate is 3%? (Round your answer to 2 decimal places.) Expected annual HPR %

Q: For a standard U.S. Treasury bond, when are the following characteristics of the bond determined?…

A: The question is asking about the timing of when various characteristics of a standard corporate bond…

Q: Both Bond Bill and Bond Ted have 12.4 percent coupons, make semiannual payments, and are priced at…

A: Bond valuation is the process of determining the fair value of a bond, which is a debt instrument…

Q: Money is a claim against both real and financial assets. True/false.

A: Financial assets are intangible assets that represent a claim to an economic resource. They are…

Q: A $27,000, 6% bond redeemable at par with interest payable annually is bought 12.5 years before…

A: Data given: FV=$27000 Coupon rate=6% (payable annually) n=12.5 years Working Note#1 Calculation of…

Q: an adjustable rate mortgage (ARM) of $190,000 with a maturity of 30 years and monthly payments. At…

A: In this question Adjustable Rate Mortgage ( ARM) $190,000 with 30 Years maturity and monthly…

Q: What are the functions of a controller? What are the functions of a treasurer?

A: A controller is a financial professional who is responsible for managing a company's accounting…

Q: Why is liquidity risk inherent to the business of banking? How can a bank seek to minimize its…

A: In banking sector it is important to manage the liquidity because there is use of gas deposit of…

Q: a. Calculate the amount of interest and, separately, principal paid on each mortgage. What is the…

A:

Q: EAR What is the effective annual rate (EAR) of a mortgage that is advertised at 12% (APR) over the…

A: To calculate the effective annual rate we will use the below formula Effective annual rate =…

Q: Your banker has analyzed your company account and has suggested that her bank has a cash management…

A: Step 1 We will first find the cost of funds saved by reducing the float days as per the question.…

Q: Calculate the APV of the project. (Do not round intermediate calculations. Round the final answer to…

A: First, we have to calculate the unlevered cost of capital to discount the given cash flows and…

Q: Vigour Pharmaceuticals Ltd. is considering investing in a new production line for its pain-reliever…

A: Initial cost includes the cost of equipment, installation cost and increase in net working capital.…

Q: The dividend policy of Berkshire Gardens Inc. can be represented by a gradual adjustment to a target…

A: Adjustment factor = 1/Adjustment period in years = 1/5 = 0.20

Q: FIRM DIVIDEND EXPECTED NEXT YEAR DIVIDEND GROWTH RATE REQUIRED RETURN VALUE WITH PREVIOUS…

A: The dividend discount model (DDM) is a stock valuation method that calculates the intrinsic value of…

Q: FUTURE VALUE OF AN ANNUITY Your client is 26 years old. She wants to begin saving for retirement,…

A:

Q: n insurance company is offering a new policy to its customers. Typically, the policy is bought by a…

A: The concept of time value of money will be used here. Since future value has to be computed we will…

Q: Robert has struck an agreement to buy his dad's car. The sale takes place when Robert can pay the…

A: Depreciation is an accounting method used to allocate the cost of a tangible asset over its useful…

Q: Suppose that the yield on a two-year Treasury security is 5.84%, and the yield on a five-year…

A: Under expectation theory, we can determine the future rates using the spot rates as the term…

Q: Theodora received an 8-year PLUS Loan of $17,000 to attend law school for her last 2 years. If the…

A: Step 1 The amount paid each month to repay the loan over the course of the loan is known as the…

Q: As a stockholder of Bozo Oil Company, you receive its annual report. In the financial statements,…

A: To calculate the earnings per share (EPS) of Bozo Oil's common stock, we need to divide the…

Q: Revenues = $18,277. Cost of Goods Sold = $5,112. Depreciation Expense = $2,914, Interest = $532 and…

A: Operating cash flow (OCF) is a financial metric that represents the amount of cash a company…

Q: Ken spent 1/4 of his money and an additional $6 on a number of CDs. He then spent 3/5 of the…

A: Let the amount now be “X’, Amount spent on CD is x/4+$6. Amount spent on magazine is “(X-X/4)*3/5 +…

Q: At any point in time forward rates computed by the yield curve represent the market's best estimates…

A: Forward rates are implied future interest rates derived from the yield curve, which is a graphical…

Q: The proposed expansion of CIV Electronics' plant facilities requires the immediate outlay of…

A: Step 1 IRR A financial analysis tool used to determine the profitability of possible investments is…

Q: Suppose you know that a company's stock currently sells for $65.90 per share and required return on…

A: Stock price (P0) = $65.90 Required return (r) = 0.12 Dividend yield = 0.06 (i.e. 0.12 / 2) Capital…

Q: A local finance company quotes a 17 percent interest rate on one-year loans. So, if you borrow…

A: A loan is a financial arrangement in which one or more people, companies, or other entities lend…

Q: Use Table 12-2 to calculate the present value (in $) of the annuity due. (Round your answer to the…

A: Present value is the estimation of the current value of future cash value which is likely to be…

Q: What are the essential components of financial plan.

A: A financial plan is a comprehensive strategy that outlines an individual's or organization's current…

Q: Mikas Hospital Ltd. is considering investing in a new production line for its pain-reliever…

A:

Q: Calculate the missing information for the installment loan that is being paid off early. Number of…

A: An installment loan refers to a contract between the lender and the borrower for raising funds in…

Q: Ken spent 1/4 of his money and an additional $6 on a number of CDs. He then spent 3/5 of the…

A: Working Note#1 Let "x" be the remaining money after buying a number of CDs. x-(35 x+$12)= $18 x-…

Q: A 20-year, $1,000 par value bond has a 7% annual payment coupon. The bond currently sells for $900.…

A: Annual coupon payment of the bond = Coupon rate×Par value = 0.07×$1000 = $70

Q: 8. Paul and Mary, both age 45, files taxes as married filing jointly, and have a MAGI of $130,000…

A: For Roth IRA eligibility, the income limit for married filing jointly in 2020 is $196,000, and if…

Q: Ken spent 1/4 of his money and an additional $6 on a number of CDs. He then spent 3/5 of the…

A: Let the amount now be “X’, Amount spent on CD is X/4+$6. Amount spent on magazine is “(X-X/4)*3/5 +…

Q: Rabbit Town Corp. Is experiencing rapid growth. Dividends are expected to grow at 30% per year…

A: The concept of dividend discount model will be used here. As per the dividend discount model the…

Q: Sheet ($ in Millions) ASSETS Cash & Marketable Securities Accounts Receivable Inventories Other…

A: A quantitative metric employed to assess any firm's financial stability, solvency liquidity,…

Q: You have a mortgage of $120000 at j2 = 5%. You wish to make payments once every two weeks for 25…

A: The mortgage is a loan taken out for purchasing a property with the property itself acting as…

Q: If the yield curve is downward sloping, what would the expectations theory suggest about expected…

A: Yield Curve: It represents a plotting of interest rates of bonds with equal credit & different…

Q: An individual invests a series of level payments at the end of each quarter into a sinking fund,…

A: £1511 is the annual payment. Quarterly payment for first 8 years or 8*4 quarters is £1511/4 =…

Q: Peyton received a 10 year subsidized student loan of $33,000 I didn’t and your interest rate of…

A: Subsidized student loan- In case of subsidized student loan, the federal government pays the…

Q: a firm will pay dividend of $2.40 next year. the dividend is expected to grow at constant rate of 2%…

A: The Dividend Discount Model (DDM) is a method used to value the stock of a company based on the…

Q: At the end of every year an investor pays £2,000 towards additional voluntary contributions to build…

A: A pension fund is a type of investment fund that is set up to provide retirement income to employees…

Q: For a standard corporate bond, when are the following characteristics of the bond determined?

A: The question is asking about the timing of when various characteristics of a standard corporate bond…

Q: A firm has net working capital of $580, net fixed assets of $2,326, sales of $6,900, and current…

A: Sales are the total revenue generated by a firm. There are several costs that are deducted from the…

Q: Carlos earns a gross income of $5,580 per month and applies for a mortgage with a monthly PITI of…

A: We have to first calculate the ratios of his housing expense to gross income and his total…

Q: Most products have at least some element of service, such as a warranty, documentation and…

A: Product service refers to the support and assistance provided by a company to customers before,…

Q: Vigour Pharmaceuticals Ltd. is considering investing in a new production line for its pain-reliever…

A: Initial Cash Flow: It represents the cash outflow required to purchase an asset like equipment.…

Q: Amortization schedule. Chuck Ponzi has talked an elderly woman into loaning him $45,000 for a new…

A: The amortization schedule refers to the format representing the loan balance, the interest charged,…

Q: Assume you are now 21 years old and will start working as soon as you graduate from college. You…

A: The PV of an investment refers to the value of the cash flows after they have been discounted at an…

Q: A credit card bill of $660 was due on July 1. Purchase of $375 were made on July 7, and $310 was…

A: Credit card issuing companies charges monthly interest on any unpaid balance. For computing the…

Ef 355.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- A stock is trading at $80 per share. The stock is expected to have a yearend dividend of $4 per share (D1 = $4), and it is expected to grow at some constant rate, g, throughout time. The stock’s required rate of return is 14% (assume the market is in equilibrium with the required return equal to the expected return). What is your forecast of gL?Two-Asset Portfolio Stock A has an expected return of 12% and a standard deviation of 40%. Stock B has an expected return of 18% and a standard deviation of 60%. The correlation coefficient between Stocks A and B is 0.2. What are the expected return and standard deviation of a portfolio invested 30% in Stock A and 70% in Stock B?What is the expected return for the following portfolio? (State your answer in percent with two decimal places.) Stock Expected returns Investment AAA 35% $500,000 BBB 29% $1,300,000 CCC 18% $1,200,000 DDD 7% $1,500,000 O.17.13% O.19.40% O.21.01% O.22.21% O.23.88%

- Roundall dollar answers to 2 decimal places and record all interest rate, coupon rate and growth rate answers as a percentrounded to one decimal place 40. If the expected return on the market portfolio (i.e., Rm) is 18%, if the risk-free rate (i.e., Rf) is 8% and if thebeta of Homton, Inc. stock is 1.75, what is the equilibrium expected rate of return on Homton’s stockaccording to the Capital Asset Pricing Model (CAPM)? (Record your answer rounded to 1 decimal place; forexample, record 18.29654% as 18.3).41. If the beta of Braxton, Inc. stock is 1.51, the risk-free rate (Rf) is 3.5%, and the market risk premium is 4.8%,what is the equilibrium expected rate of return on Braxton’s stock according to the Capital Asset PricingModel (CAPM)? (Record your answer rounded to 1 decimal place; for example, record 18.29654% as 18.3)An analyst wants to evaluate Portfolio X, consisting entirely of U.S. common stocks, using both the Treynor and Sharpe measures of portfolio performance. The following table provides the average annual rate of return for Portfolio X, the market portfolio (as measured by the Standard and Poor’s 500 Index), and U.S. Treasury bills (T-bills) during the past eight years. Rate Annual Averageof Return STANDARD DEVIATION OF RETURN BETA Portfolio X 10 13 0.40 S&P 500 12 10 1.00 T-bills 7 n/a n/a n/a = not applicable Calculate both the Treynor measure and the Sharpe measure for both Portfolio X and the S&P 500. Round your answers for the Treynor measure to one decimal place and for the Sharpe measure to three decimal places. Treynor measure Sharpe measure Portfolio X 7.5 S&P 500 5Currently, the risk-free return is 2 percent, and the expected market rate of return is 11 percent. What is the expected return of the following three-stock portfolio? Do not round intermediate calculations. Round your answer to two decimal places. Investment Beta $ 200,000 1.0 100,000 0.1 700,000 2.9 %

- Consider historical data showing that the average annual rate of return on the S&P 500 portfolio over the past 85 years has averaged roughly 8% more than the Treasury bill return and that the S&P 500 standard deviation has been about 38% per year. Assume these values are representative of investors' expectations for future performance and that the current T-bill rate is 5%. Calculate the expected return and variance of portfolios invested in T-bills and the S&P 500 index with weights as shown below. (Enter your answers as decimals rounded to 4 places. Leave no cells blank - be certain to enter "0" wherever required.) WBills: WIndex: Expected Return: Variance: 0.0 1.0 0.1300 0.1444 Example 0.2 0.8 0.4 0.6 0.6 0.4 0.8 0.2 1.0 0.02-11 We have the following information on a portfolio consisting of Stocks A, B, and C: A B C Expectd annual return 25% 20% 15% Standard Deviation of Return 35% 30% 25% Price per share 100 85 75 # shares 100,000 150,000 200,000 correlation coefficient (A,B) 0.5 correlation coefficient (A,C) 0.2 correlation coefficient (B,C) .8 number of days per year 365…2-9 We have the following information on a portfolio consisting of Stocks A, B, and C: A B C Expectd annual return 25% 20% 15% Standard Deviation of Return 35% 30% 25% Price per share 100 85 75 # shares 100,000 150,000 200,000 correlation coefficient (A,B) 0.5 correlation coefficient (A,C) 0.2 correlation coefficient (B,C) .8 number of days per year 365 What…