Requirement 2. Describe each adjusting entry. For example, a. Prepaid rent expires, $1,150. Select the description that best describes each adjusting entry. The first entry has been completed for you. a. Prepaid rent expired, $1,150. b. C. d. e. f. 9.

Requirement 2. Describe each adjusting entry. For example, a. Prepaid rent expires, $1,150. Select the description that best describes each adjusting entry. The first entry has been completed for you. a. Prepaid rent expired, $1,150. b. C. d. e. f. 9.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter4: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 7QY: Accumulated Depreciation, Equipment is reported a. on the income statement as an expense. b. on the...

Related questions

Topic Video

Question

Question found in second image, use adjustment table to fill out

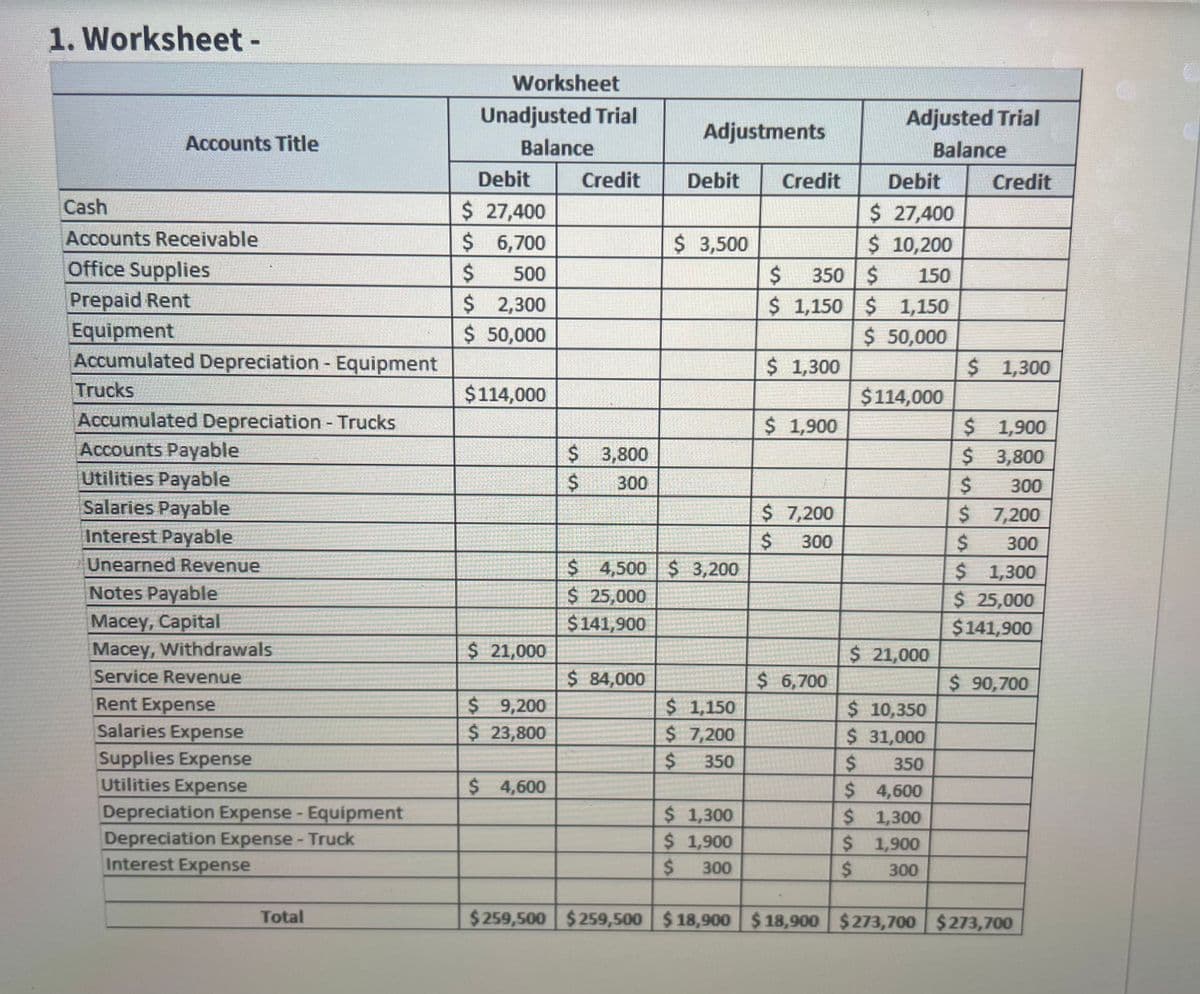

Transcribed Image Text:1. Worksheet -

Accounts Title

Cash

Accounts Receivable

Office Supplies

Prepaid Rent

Equipment

Accumulated Depreciation - Equipment

Trucks

Accumulated Depreciation - Trucks

Accounts Payable

Utilities Payable

Salaries Payable

Interest Payable

Unearned Revenue

Notes Payable

Macey, Capital

Macey, Withdrawals

Service Revenue

Rent Expense

Salaries Expense

Supplies Expense

Utilities Expense

Depreciation Expense - Equipment

Depreciation Expense - Truck

Interest Expense

Total

Worksheet

Unadjusted Trial

Balance

Debit

$ 27,400

$

6,700

$

500

$

2,300

$ 50,000

$114,000

$ 21,000

$ 9,200

$ 23,800

$4,600

$

$

Credit

3,800

300

Adjustments

$ 84,000

Debit

$ 3,500

$ 4,500 $3,200

$ 25,000

$141,900

$ 1,150

$ 7,200

$ 350

$ 1,300

$ 1,900

$ 300

Debit

$ 27,400

$ 10,200

$ 350 $ 150

$ 1,150 $ 1,150

$ 50,000

$ 1,300

Credit

$ 1,900

$ 7,200

300

SS

$

$ 6,700

SENIL

SSS is es SS

Adjusted Trial

Balance

$ 21,000

$

$114,000

$ 10,350

$ 31,000

350

$ 4,600

1,300

$ 1,900

$

$ 300

Credit

$ 1,300

$ 1,900

$

3,800

300

$

$

7,200

$

300

$ 1,300

$ 25,000

$141,900

$ 90,700

$259,500 $259,500 $ 18,900 $ 18,900 $273,700 $273,700

Transcribed Image Text:Requirement 2. Describe each adjusting entry. For example, a. Prepaid rent expires, $1,150.

Select the description that best describes each adjusting entry. The first entry has been completed for you.

a. Prepaid rent expired, $1,150.

b.

ο

C.

d.

e.

f.

g.

h.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,