Requirement: Complete the schedule below by entering an Q to indicate overstatement, a U to indicate understatement, and NE if no effect.

Requirement: Complete the schedule below by entering an Q to indicate overstatement, a U to indicate understatement, and NE if no effect.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 59E: Effects of an Error in Ending Inventory Waymire Company prepared the partial income statements...

Related questions

Question

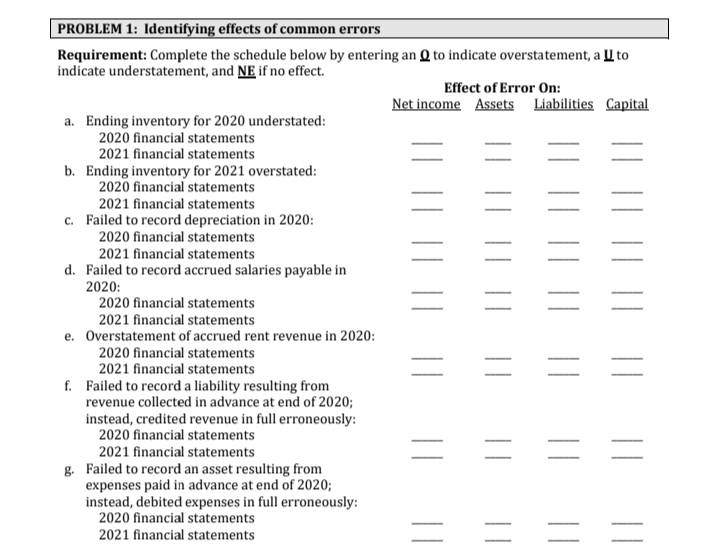

Transcribed Image Text:PROBLEM 1: Identifying effects of common errors

Requirement: Complete the schedule below by entering an Q to indicate overstatement, a I to

indicate understatement, and NE if no effect.

Effect of Error On:

Net income Assets Liabilities Capital

a. Ending inventory for 2020 understated:

2020 financial statements

2021 financial statements

b. Ending inventory for 2021 overstated:

2020 financial statements

2021 financial statements

c. Failed to record depreciation in 2020:

2020 financial statements

2021 financial statements

d. Failed to record accrued salaries payable in

2020:

2020 financial statements

2021 financial statements

e. Overstatement of accrued rent revenue in 2020:

2020 financial statements

2021 financial statements

f. Failed to record a liability resulting from

revenue collected in advance at end of 2020;

instead, credited revenue in full erroneously:

2020 financial statements

2021 financial statements

g. Failed to record an asset resulting from

expenses paid in advance at end of 2020;

instead, debited expenses in full erroneously:

2020 financial statements

2021 financial statements

||

||

||

| |

||

||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,