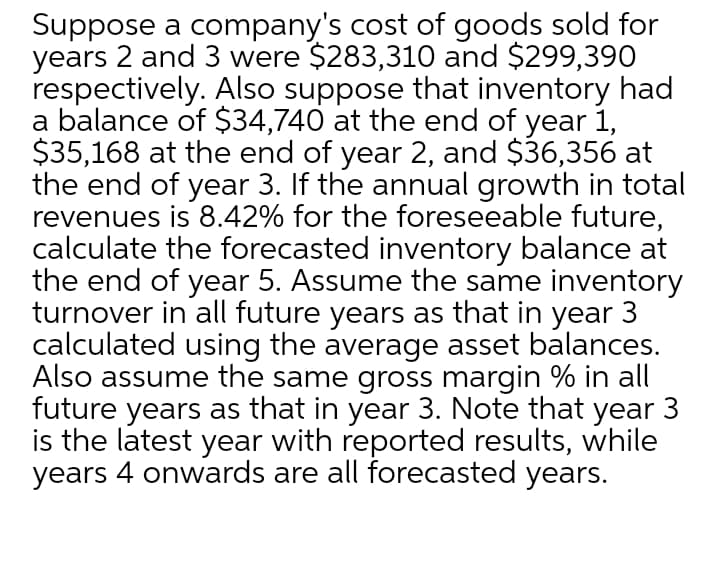

Suppose a company's cost of goods sold for years 2 and 3 were $283,310 and $299,390 respectively. Also suppose that inventory had a balance of $34,740 at the end of year 1, $35,168 at the end of year 2, and $36,356 at the end of year 3. If the annual growth in total revenues is 8.42% for the foreseeable future, calculate the forecasted inventory balance at the end of year 5. Assume the same inventory turnover in all future years as that in year 3 calculated using the average asset balances. Also assume the same gross margin % in all future years as that in year 3. Note that year 3 is the latest year with reported results, while years 4 onwards are all forecasted years.

Suppose a company's cost of goods sold for years 2 and 3 were $283,310 and $299,390 respectively. Also suppose that inventory had a balance of $34,740 at the end of year 1, $35,168 at the end of year 2, and $36,356 at the end of year 3. If the annual growth in total revenues is 8.42% for the foreseeable future, calculate the forecasted inventory balance at the end of year 5. Assume the same inventory turnover in all future years as that in year 3 calculated using the average asset balances. Also assume the same gross margin % in all future years as that in year 3. Note that year 3 is the latest year with reported results, while years 4 onwards are all forecasted years.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 46E

Related questions

Question

Transcribed Image Text:Suppose a company's cost of goods sold for

years 2 and 3 were $283,310 and $299,390

respectively. Also suppose that inventory had

a balance of $34,740 at the end of year 1,

$35,168 at the end of year 2, and $36,356 at

the end of year 3. If the annual growth in total

revenues is 8.42% for the foreseeable future,

calculate the forecasted inventory balance at

the end of year 5. Assume the same inventory

turnover in all future years as that in year 3

calculated using the average asset balances.

Also assume the same gross margin % in all

future years as that in year 3. Note that year 3

is the latest year with reported results, while

years 4 onwards are all forecasted years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning