REVIEW PROBLEM: SALE OF PROPERTY. PLANT AND EQUIPMENT The 1. M. Stoned Company acquired a machine from the Mickey Lobe Corporation on January 1, 20A0. The purchase price of the machine was $100,000, which did not include the 6% sales tax. Installation and delivery charges amounted to $4,000. One of the employees, Bad Wiser, damaged some parts whne installing the machine. It cost $500 to repair the damage. The machine has a projected useful life of 10 years. The estimated salvage for the machine is $5,000. REQUIRED: 1. Compute the initial cost of the machine on January 1, 20X6: 100000 +1,000 +6% 6000 110,000 2. Compute the yearly depreciation expense under the straight-line method: 110,000 9,000 10,500 10 3. Show what this machine would look like on the Balance Sheet at the end of 20X9. 4. Assume the machine is sold on December 31, 20X9 for $60,000. Compute the gain or loss on the sale. Show all work clearly!!! (110,000 - 60,060) x 50,000 5. Record the sale.

REVIEW PROBLEM: SALE OF PROPERTY. PLANT AND EQUIPMENT The 1. M. Stoned Company acquired a machine from the Mickey Lobe Corporation on January 1, 20A0. The purchase price of the machine was $100,000, which did not include the 6% sales tax. Installation and delivery charges amounted to $4,000. One of the employees, Bad Wiser, damaged some parts whne installing the machine. It cost $500 to repair the damage. The machine has a projected useful life of 10 years. The estimated salvage for the machine is $5,000. REQUIRED: 1. Compute the initial cost of the machine on January 1, 20X6: 100000 +1,000 +6% 6000 110,000 2. Compute the yearly depreciation expense under the straight-line method: 110,000 9,000 10,500 10 3. Show what this machine would look like on the Balance Sheet at the end of 20X9. 4. Assume the machine is sold on December 31, 20X9 for $60,000. Compute the gain or loss on the sale. Show all work clearly!!! (110,000 - 60,060) x 50,000 5. Record the sale.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter7: Fixed Assets, Natural Resources, And Intangible Assets

Section: Chapter Questions

Problem 7.3.1C

Related questions

Question

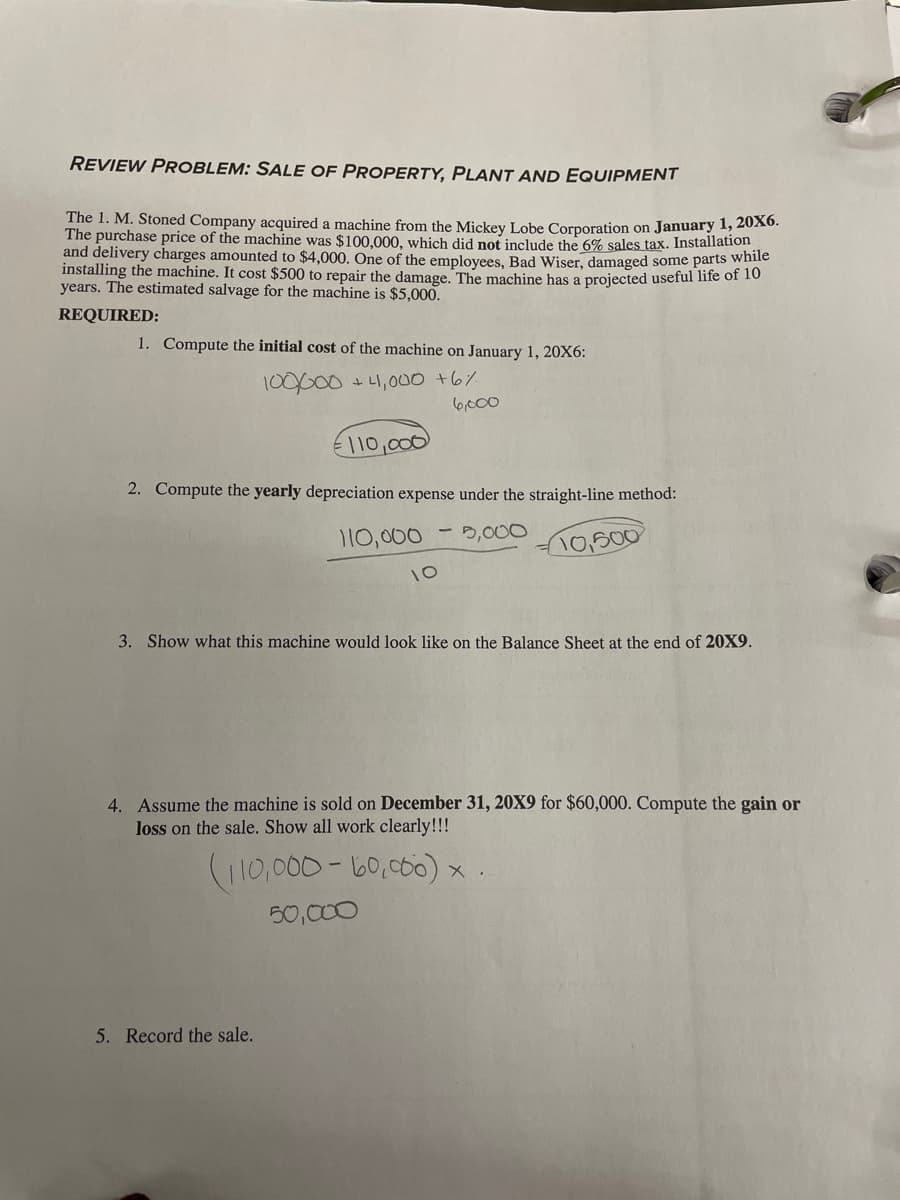

Transcribed Image Text:REVIEW PROBLEM: SALE OF PROPERTY, PLANT AND EQUIPMENT

The 1. M. Stoned Company acquired a machine from the Mickey Lobe Corporation on January 1, 20A0.

The purchase price of the machine was $100,000, which did not include the 6% sales tax. Installation

and delivery charges amounted to $4,000. One of the employees, Bad Wiser, damaged some parts while

installing the machine. It cost $500 to repair the damage. The machine has a projected useful life or 10

years. The estimated salvage for the machine is $5,000.

REQUIRED:

1. Compute the initial cost of the machine on January 1, 20X6:

100000 +1,000 +6%

6000

110,000

2. Compute the yearly depreciation expense under the straight-line method:

110,000

5,000

10,500

10

3. Show what this machine would look like on the Balance Sheet at the end of 20X9.

4. Assume the machine is sold on December 31, 20X9 for $60,000. Compute the gain or

loss on the sale. Show all work clearly!!!

(110,000- 60,000)x.

50,000

5. Record the sale.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning