rge. The stickers mu omers. Bridgeport egnough to uentlyer

Chapter6: Business Expenses

Section: Chapter Questions

Problem 37P

Related questions

Question

SOLVE THIS

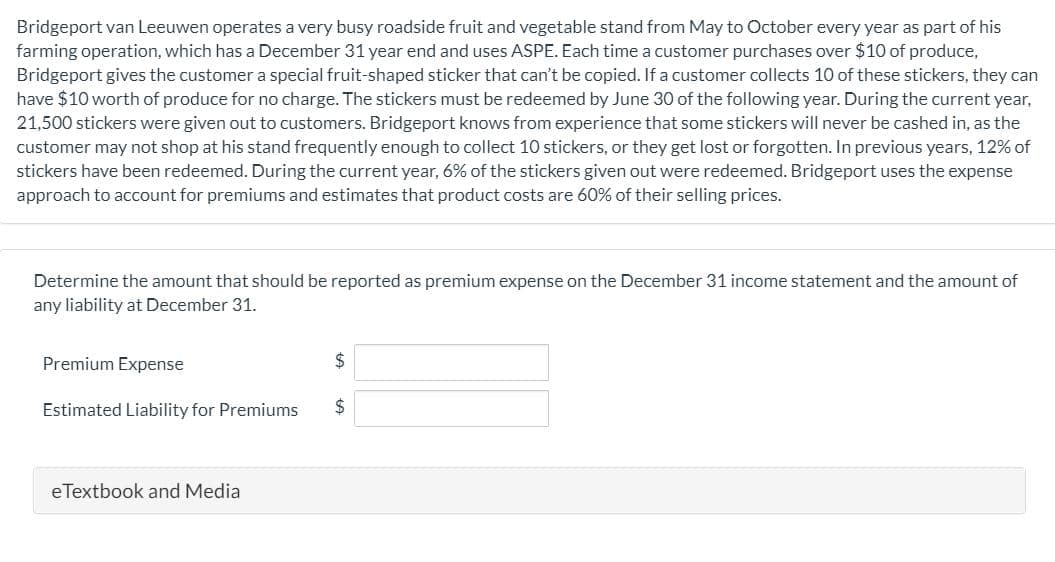

Transcribed Image Text:Bridgeport van Leeuwen operates a very busy roadside fruit and vegetable stand from May to October every year as part of his

farming operation, which has a December 31 year end and uses ASPE. Each time a customer purchases over $10 of produce,

Bridgeport gives the customer a special fruit-shaped sticker that can't be copied. If a customer collects 10 of these stickers, they can

have $10 worth of produce for no charge. The stickers must be redeemed by June 30 of the following year. During the current year,

21,500 stickers were given out to customers. Bridgeport knows from experience that some stickers will never be cashed in, as the

customer may not shop at his stand frequently enough to collect 10 stickers, or they get lost or forgotten. In previous years, 12% of

stickers have been redeemed. During the current year, 6% of the stickers given out were redeemed. Bridgeport uses the expense

approach to account for premiums and estimates that product costs are 60% of their selling prices.

Determine the amount that should be reported as premium expense on the December 31 income statement and the amount of

any liability at December 31.

Premium Expense

Estimated Liability for Premiums

2$

eTextbook and Media

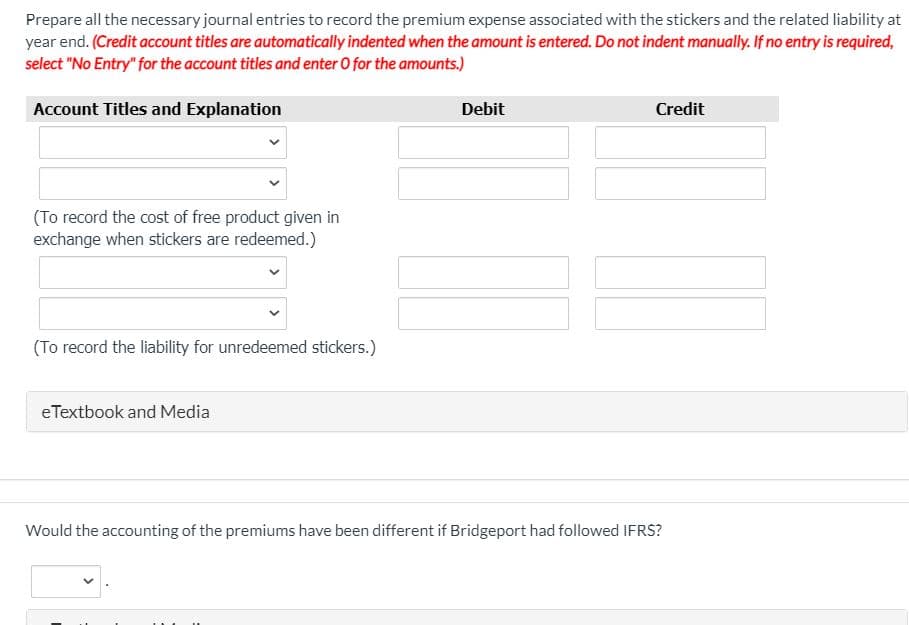

Transcribed Image Text:Prepare all the necessary journal entries to record the premium expense associated with the stickers and the related liability at

year end. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required,

select "No Entry" for the account titles and enter 0 for the amounts.)

Account Titles and Explanation

Debit

Credit

(To record the cost of free product given in

exchange when stickers are redeemed.)

(To record the liability for unredeemed stickers.)

eTextbook and Media

Would the accounting of the premiums have been different if Bridgeport had followed IFRS?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning