Rhiner Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: Raw materials Work in process Finished goods $42,000 $20,000 $36,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For th current year, the company's predetermined overhead rate of $16.50 per direct labor- nour was based on a cost formula that estimated $660,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following ransactions were recorded for the year. Raw materials were purchased on account, $520,000. Raw materials used in production, $465,000. All of the raw materials were us as direct materials. The following costs were accrued for employee services: direct labor, $605,0 indirect labor, $150,000, selling and administrative salaries, $240,000. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), $357,000. Incurred various manufacturing overhead costs (e g., depreciation, insuranc and utilities), $505,000. • Manufacturing overhead cost was applied to production. The company actu worked 42,000 direct labor-hours on all jobs during the year.

Rhiner Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: Raw materials Work in process Finished goods $42,000 $20,000 $36,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For th current year, the company's predetermined overhead rate of $16.50 per direct labor- nour was based on a cost formula that estimated $660,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following ransactions were recorded for the year. Raw materials were purchased on account, $520,000. Raw materials used in production, $465,000. All of the raw materials were us as direct materials. The following costs were accrued for employee services: direct labor, $605,0 indirect labor, $150,000, selling and administrative salaries, $240,000. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), $357,000. Incurred various manufacturing overhead costs (e g., depreciation, insuranc and utilities), $505,000. • Manufacturing overhead cost was applied to production. The company actu worked 42,000 direct labor-hours on all jobs during the year.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

Post the transactions in the T accounts using the chart accounts given

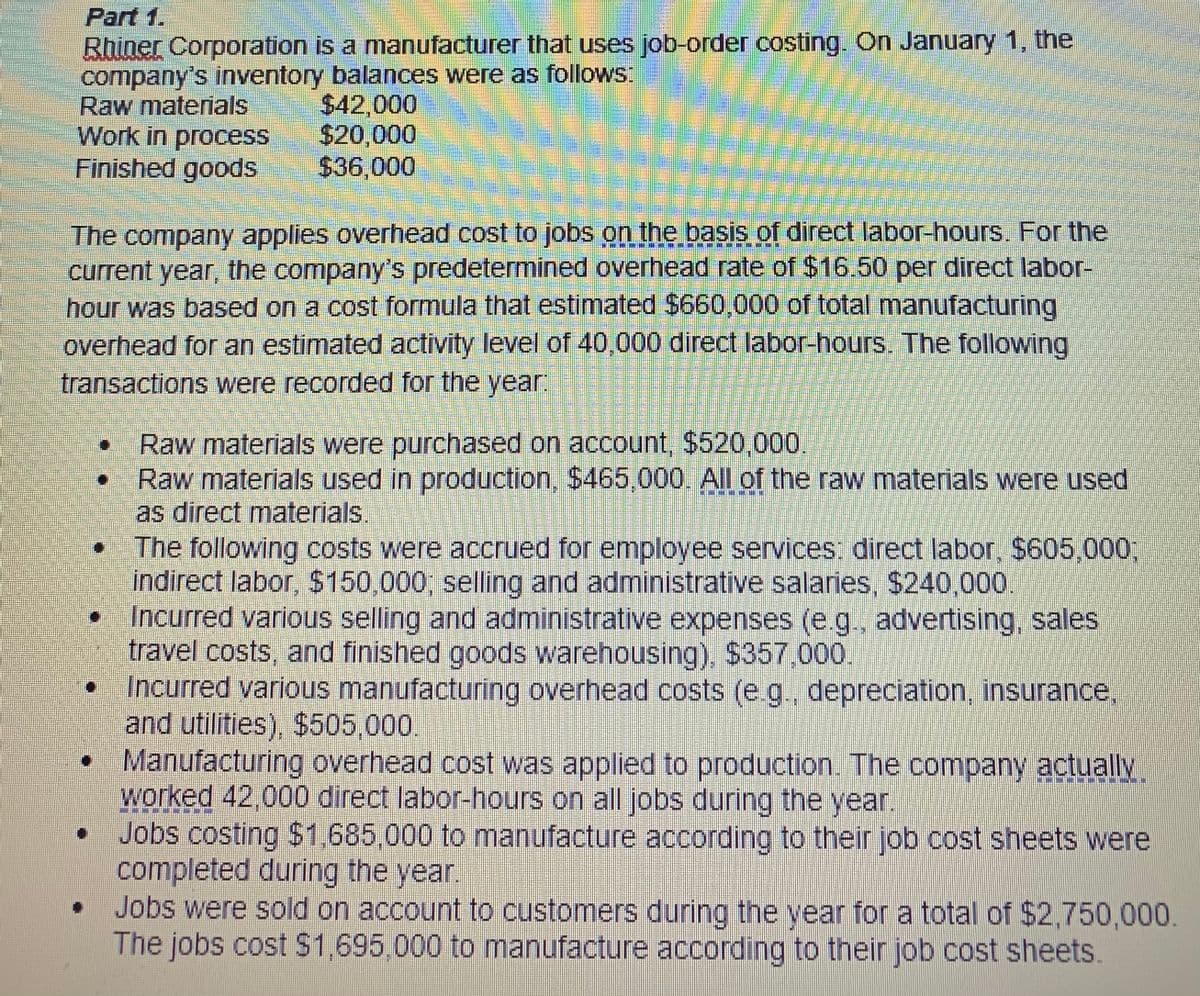

Transcribed Image Text:Part 1.

Rhiner Corporation is a manufacturer that uses job-order costing. On January 1, the

company's inventory balances were as follows:

Raw materials

Work in process

Finished goods

$42,000

$20,000

$36,000

The company applies overhead cost to jobs on the basis of direct labor-hours. For the

current year, the company's predetermined overhead rate of $16.50 per direct labor-

hour was based on a cost formula that estimated $660,000 of total manufacturing

overhead for an estimated activity level of 40,000 direct labor-hours. The following

transactions were recorded for the year:

Raw materials were purchased on account, $520,000.

Raw materials used in production, $465,000. All of the raw materials were used

as direct materials.

The following costs were accrued for employee services: direct labor, $605,000,

indirect labor, $150,000, selling and administrative salaries, $240,000.

Incurred various selling and administrative expenses (e.g., advertising, sales

travel costs, and finished goods warehousing), $357.000.

• Incurred various manufacturing overhead costs (e g., depreciation, insurance,

and utilities), $505,000.

• Manufacturing overhead cost was applied to production. The company actuallV.

worked 42,000 direct labor-hours on all jobs during the year.

Jobs costing $1,685,000 to manufacture according to their job cost sheets were

completed during the year.

Jobs were sold on account to customers during the year for a total of $2,750,000.

The jobs cost $1,695,000 to manufacture according to their job cost sheets.

Expert Solution

Step 1

Solution:

a.) Journal Entry:

| No. | General Journal | Debit ($) | Credit ($) |

| 1. | Work in process | 480,000 | |

| Raw materials | 480,000 | ||

| (To record the raw materials used in production) | |||

b.) The ending balance in Raw Materials:

| Raw materials: | |

| Begging balance | $40,000 |

| Add: | $510,000 |

| Less: Raw materials used in production | - $480,000 |

| Ending balance | $70,000 |

c. ) The journal entry to record the labor costs during the year:

| No. | General Journal | Debit ($) | Credit ($) |

| 1 | Salaries and administrative salaries | 240,000 | |

| Manufacturing overhead | 150,000 | ||

| Work in process | 600,000 | ||

| Wages payable | 990,000 | ||

| (To record the labor cost incurred) | |||

d.) The total amount of manufacturing overhead applied to production during the year:-

Manufacturing overhead applied = $16.25 × 41,000 hours

= $666,250

e.) The total manufacturing costs added to work in process during the year:-

| Raw materials | $480,000 |

| Direct labor | $600,000 |

| Manufacturing overhead | $666,250 |

| Cost added to work in process | $1,746,250 |

f.) Journal Entry:

| No. | General Journal | Debit ($) | Credit ($) |

| 1. | Finished goods | 1,680,000 | |

| Work in process | 1,680,000 | ||

| (To record the transfer of completed jobs) | |||

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.