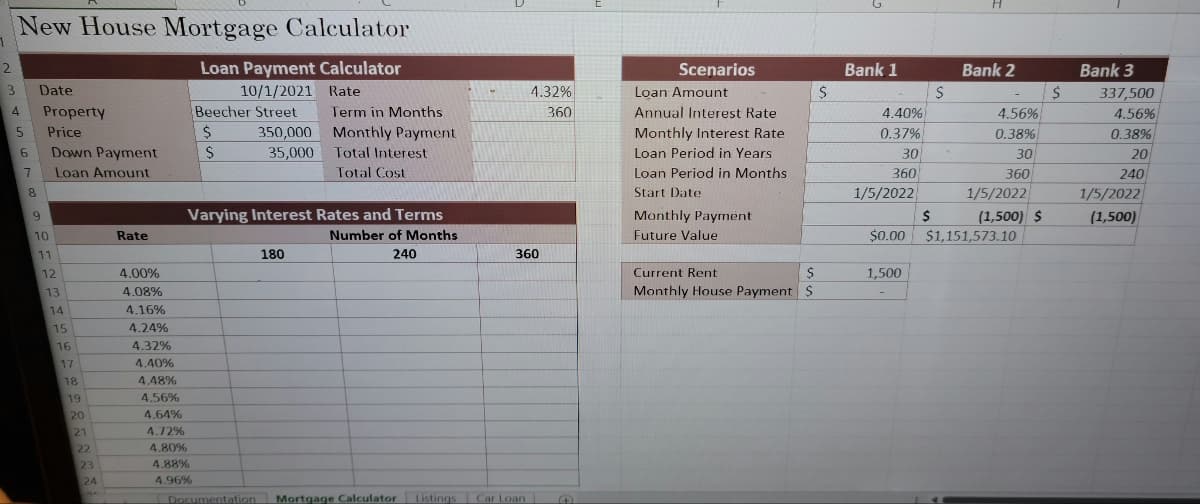

Ricardo and Miranda Ramos are considering whether to buy their first home, and have spoken to three lenders about taking out a mortgage for the house purchase. They now pay $1,500 per month in rent and can pay up to $1,600 per month for a mortgage. Miranda has created an Excel spreadsheet to compare the terms of the mortgage. She asks you to help her complete the analysis of their loan options. Go to the Mortgage Calculator worksheet. The cells in the range B5:B7 have defined names, but one is incomplete and could be confusing. Cell A2 also has a defined name, which is unnecessary for a cell that will not be used in a formula. Update the defined names in the worksheet as follows: Delete the Loan_Payment_Calculator defined name. For cell B7, edit the defined name to use Loan_Amt as the name. [Mac Hint: Delete the existing defined name "Loan_Am" and add the new defined name.] a. b. In cell B7, calculate the loan amount by entering a formula without using a function that subtracts the Down Payment from the Price. Miranda also wants to use defined names in other calculations to help her interpret the formulas. In the range D3:D7, create defined names based on the values in the range C3:C7.

Ricardo and Miranda Ramos are considering whether to buy their first home, and have spoken to three lenders about taking out a mortgage for the house purchase. They now pay $1,500 per month in rent and can pay up to $1,600 per month for a mortgage. Miranda has created an Excel spreadsheet to compare the terms of the mortgage. She asks you to help her complete the analysis of their loan options. Go to the Mortgage Calculator worksheet. The cells in the range B5:B7 have defined names, but one is incomplete and could be confusing. Cell A2 also has a defined name, which is unnecessary for a cell that will not be used in a formula. Update the defined names in the worksheet as follows: Delete the Loan_Payment_Calculator defined name. For cell B7, edit the defined name to use Loan_Amt as the name. [Mac Hint: Delete the existing defined name "Loan_Am" and add the new defined name.] a. b. In cell B7, calculate the loan amount by entering a formula without using a function that subtracts the Down Payment from the Price. Miranda also wants to use defined names in other calculations to help her interpret the formulas. In the range D3:D7, create defined names based on the values in the range C3:C7.

Chapter9: Obtaining Affordable Housing

Section: Chapter Questions

Problem 3FPC

Related questions

Question

I need help with the questions, provide the steps and find the right work in the Excel spreadsheet.

![PROJECT STEPS

Ricardo and Miranda Ramos are considering whether to buy their first home, and have

spoken to three lenders about taking out a mortgage for the house purchase. They now

pay $1,500 per month in rent and can pay up to $1,600 per month for a mortgage.

Miranda has created an Excel spreadsheet to compare the terms of the mortgage. She

asks you to help her complete the analysis of their loan options.

1.

2.

3.

Go to the Mortgage Calculator worksheet. The cells in the range B5:B7 have defined

names, but one is incomplete and could be confusing. Cell A2 also has a defined name,

which is unnecessary for a cell that will not be used in a formula.

Update the defined names in the worksheet as follows:

Delete the Loan_Payment_Calculator defined name.

For cell B7, edit the defined name to use Loan_Amt as the name. [Mac Hint:

Delete the existing defined name "Loan_Am" and add the new defined name.]

a.

b.

In cell B7, calculate the loan amount by entering a formula without using a function that

subtracts the Down Payment from the Price.

Miranda also wants to use defined names in other calculations to help her interpret the

formulas.

In the range D3:D7, create defined names based on the values in the range C3:C7.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fb7b9bc12-9bec-475d-bc99-e13d2a9b76e2%2F7a708bb8-3201-46ae-9d09-812265187259%2F42v3v7d_processed.jpeg&w=3840&q=75)

Transcribed Image Text:PROJECT STEPS

Ricardo and Miranda Ramos are considering whether to buy their first home, and have

spoken to three lenders about taking out a mortgage for the house purchase. They now

pay $1,500 per month in rent and can pay up to $1,600 per month for a mortgage.

Miranda has created an Excel spreadsheet to compare the terms of the mortgage. She

asks you to help her complete the analysis of their loan options.

1.

2.

3.

Go to the Mortgage Calculator worksheet. The cells in the range B5:B7 have defined

names, but one is incomplete and could be confusing. Cell A2 also has a defined name,

which is unnecessary for a cell that will not be used in a formula.

Update the defined names in the worksheet as follows:

Delete the Loan_Payment_Calculator defined name.

For cell B7, edit the defined name to use Loan_Amt as the name. [Mac Hint:

Delete the existing defined name "Loan_Am" and add the new defined name.]

a.

b.

In cell B7, calculate the loan amount by entering a formula without using a function that

subtracts the Down Payment from the Price.

Miranda also wants to use defined names in other calculations to help her interpret the

formulas.

In the range D3:D7, create defined names based on the values in the range C3:C7.

Transcribed Image Text:New House Mortgage Calculator

Loan Payment Calculator

10/1/2021

2

3 Date

4

5 Price

6 Down Payment

7

Loan Amount

8

9

Property

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

Rate

Beecher Street

4.00%

4.08%

4.16%

4.24%

4.32%

4.40%

4.48%

4.56%

4.64%

4.72%

4.80%

4.88%

4.96%

Ś

$

350,000

35,000

Rate

Term in Months

Varying Interest Rates and Terms

Number of Months

240

180

Monthly Payment

Total Interest

Total Cost

4.32%

360

360

Documentation Mortgage Calculator Listings Car Loan

4

E

Scenarios

Loan Amount

Annual Interest Rate

Monthly Interest Rate

Loan Period in Years

Loan Period in Months

Start Date

Monthly Payment

Future Value

Current Rent

$

Monthly House Payment S

$

Bank 1

4.40%

0.37%

30

360

1/5/2022

$

1,500

S

H

Bank 2

4.56%

0.38%

30

360

1/5/2022)

(1,500) $

$0.00 $1,151,573.10

$

Bank 3

337,500

4.56%

0.38%

20

240

1/5/2022)

(1,500)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning