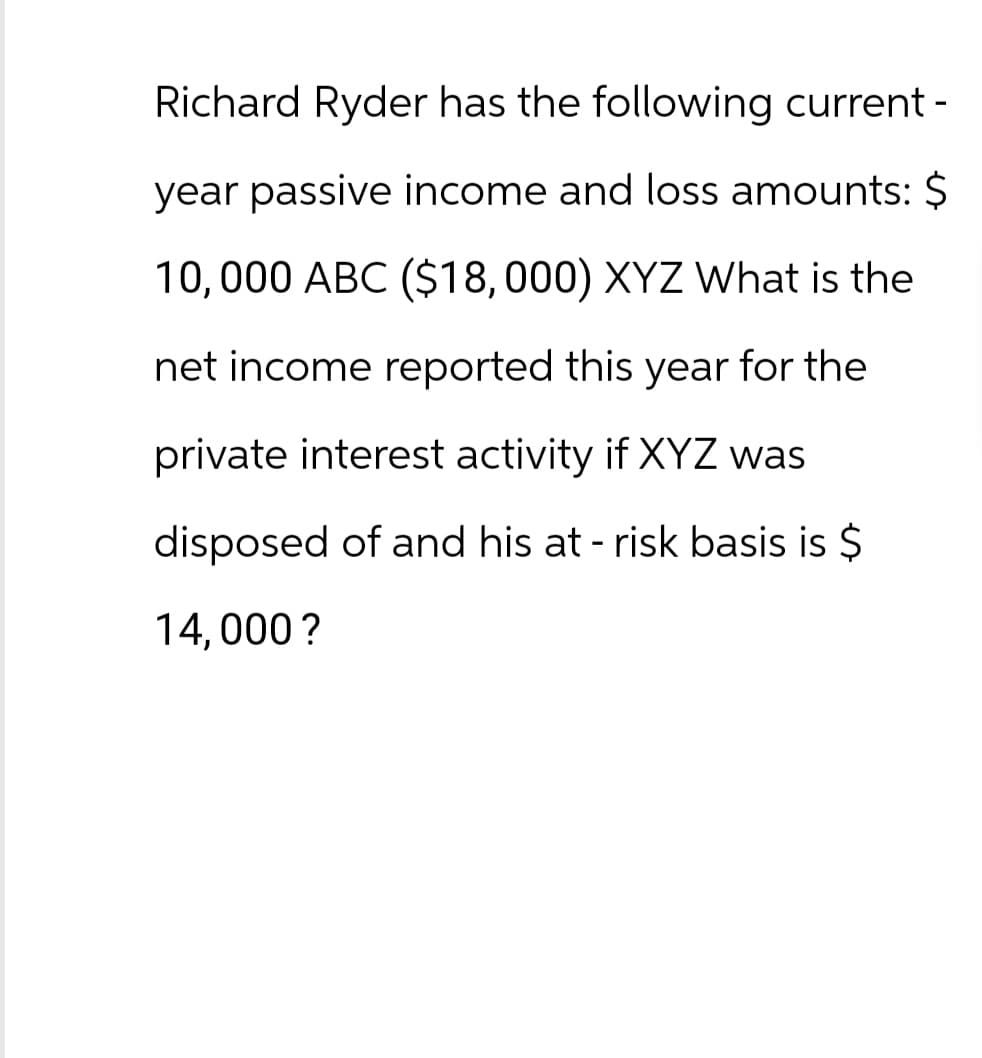

Richard Ryder has the following current - year passive income and loss amounts: $ 10,000 ABC ($18,000) XYZ What is the net income reported this year for the private interest activity if XYZ was disposed of and his at-risk basis is $ 14,000?

Q: The following materials standards have been established for a particular product: Standard quantity…

A: Variance refers to a change between the expected value and the actual result. This term is usually…

Q: c. What is spending variance for wages and salaries? Note: Indicate the effect of each variance by…

A: Variances are the differences between the actual values and budgeted values. If the budgeted values…

Q: Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two…

A: Cost allocation is the process of assigning or distributing costs among various cost objects, such…

Q: On January 1, current year, Kaiser Permanente issued $2,000,000 of 8% bonds at par. These bonds are…

A: Since the bonds are issued at par, the market rate of interest and stated rate of interest will be…

Q: Dawson Toys, Limited, produces a toy called the Maze with the following standards: Direct materials:…

A: Analyzing material and labor variances helps businesses understand the reasons behind cost…

Q: How did you calculate the proposed $2.50 dividend?

A: The amount of earnings distributed by the company to its shareholders is called dividend. It is…

Q: Davidson Manufacturing produces cabinet doors for farmhouse kitchens. Below is information related…

A: Manufacturing costs are subject to constant fluctuation due to a multitude of determining factors.…

Q: The following information relates to production activities of Mercer Manufacturing for the year.…

A: Direct Materials Price Variance = (AP - SP) * AQDirect Materials quantity Variance = (AQ - SQ) *…

Q: Required information [The following information applies to the questions displayed below.] Trio…

A: ABSORPTION COSTINGAbsorption Costing is a Cost Management Accounting method in which all costs…

Q: What is the correct entry to record postretirement benefit expense for the current year? Note: Do…

A: A journal entry of a transaction is a basic accounting entry to record that is used to…

Q: The following data is given for the Walker Company: Budgeted…

A: Analyzing the labor hour efficiency variance helps management identify areas for improvement in…

Q: In fiscal 2023, Swifty Realty Corporation purchased unimproved land for $57,000. The land was…

A: According to the question, we need to compute the year-end inventory and net income.Sales…

Q: Janco Industries has a relevant range extending to 30,200 units each month. The following…

A: The flexible budget performance report is prepared by comparing the actual revenue and costs with…

Q: 2006 Units produced Per unit sales volue at split-off Added processing costs per unit Per unit sales…

A: A product can be sold either at the time of split or can be processed further after incurring…

Q: Units-of-activity Depreciation A truck acquired at a cost of $150,000 has an estimated residual…

A: Deprecation is the account system used to allocate the cost of a palpable asset over its useful…

Q: Sales Variable cost of goods sold Fixed manufacturing costs Variable selling and administrative…

A: Lets understand the basicsManufacturing margin is calculated as difference between sales and…

Q: E January 1, 2025 (beginning inventory) Purchases: January 5, 2025 January 25, 2025 February 16,…

A: In FIFO (First-In-First-Out) method for calculating ending inventory involves valuing the inventory…

Q: Required information Skip to question [The following information applies to the questions…

A: The objective of this question is to prepare the journal entries for the sale of a grandfather clock…

Q: Required information [The following information applies to the questions displayed below.] Praveen…

A: Break even point :— It is the point of production where total cost is equal to total revenue. At…

Q: At May 31, 2019, FOR Deliveries reported the following amounts (in millions) in its financial…

A: Debt-to-asset ratio is calculated by dividing the total debt by the total assets. It states the…

Q: Coronado Co. sells product P-14 at a price of $47 a unit. The per-unit cost data are direct…

A: According to the question given, we need to compute the incremental income or loss.A special order…

Q: Required information [The following information applies to the questions displayed below.] Grandpa…

A: Journal Entry :— It is an act of recording transactions in books of account when transaction…

Q: The Oriole Co. knows that students want new backpack and jacket styles before school begins each…

A: In this question, we need to recognize the revenue for both Backpack and Jackets separately using…

Q: At the beginning of the current period, Carla Vista Co. had a balance of $102,000 in Accounts…

A: Accounts receivable refers to the sales or accounts that are yet to be received. However, it is not…

Q: Question 1 The following trial balance has been extracted from the ledger of Azwin, a sole trader as…

A: Income Statement: It is a part of financial statement of a company in which revenue and expenses…

Q: Determine the missing amounts. Total Manufacturing Costs $248.800 $ $260,400 Work in Process (Jan 1)…

A: Lets understand the basics.Total manufacturing costs are the total of all the direct material,…

Q: Sheffield Sports sells volleyball kits that it purchases from a sports equipment distributor. The…

A: The flexible budget is prepared for actual level of production. The budget is prepared using the…

Q: Patrick's Retail Company is planning a cash budget for the next three months. Estimated sales…

A: Cash budget is the statement which is prepared by the entity to report the estimated cash receipts…

Q: Determine the price of a $1.7 million bond issue under each of the following independent…

A: Coupon Payment (C):The annual interest payment made by the bond issuer to the bondholder. It's…

Q: Royal Mount Games would like to invest in a division to develop software for video games. To…

A: Working capital refers to the funds that a company has available for its daily operations. It…

Q: Hillsborough Architecture and Engineering, Inc. has purchased a blueprint printing machine for…

A: Determine the MACRS Class Life and Depreciation PercentageIn this step, we need to find out the…

Q: On January 1, 2023, Bona Vista Co purchased land, a building, equipment, and tools for a total price…

A: As per real account rule we should debit what comes in and credit what goes out. Amount borrowed…

Q: The annual report for Sneer Corporation disclosed that the company declared and paid preferred…

A: Dividends is distribution of profits to shareholders. Preference shareholders get preference for…

Q: A company purchased $3,500 of merchandise on July 5 with terms 1/10, n/30. On July 7, it returned…

A: The account payable represents the amount due for payment. The cash discount is allowed to this…

Q: Superlor Developers sells lots for residential development. When lots are sold, Superior recognizes…

A: Deferred tax liability is the amount of tax liability imposed on difference between accounting…

Q: Inc. repurchased 15,000 shares of stock when the market price was $1 per share. Dec 5: ABC Inc.…

A: A journal entry is a basic accounting record that is used to chronologically track financial…

Q: Required information [The following information applies to the questions displayed below.] The…

A: The stock dividend less than 30% is declared on the basis of the market share of dividend. The…

Q: Required information The Foundational 15 (Algo) [LO6-1, LO6-3, LO6-4, LO6-5, LO6-6, LO6-7, LO6-8]…

A: The break-even point in units sales is a critical concept in business and finance. It represents the…

Q: pls pls in the given table without date for a ,d SophCO Inc. is a distributor of linseed oil which…

A: There are two inventory systems i.e., a periodic inventory system and a perpetual inventory system.…

Q: Your father invested $50,000 for your education in the year 2000 in ABC bank. The bank paid 8.00%…

A: The future value formula is used when the future value of the current amount needs to be determined.…

Q: Required: Prepare Shadee's budgeted Income statement for the months of May and June. Note: Do not…

A: Contribution means the difference between the sale and variable cost. Net operating income means the…

Q: The transactions relating to the formation of Blue Company Stores Incorporated, and its first month…

A: Income statement is a financial statement that records all the income and expenses of the business…

Q: Hayden’s Recreation Center purchased an asset for $240,000 that has $30,000 residual value and a…

A: The objective of the question is to calculate the annual tax savings from the depreciation tax…

Q: At December 31, Folgeys Coffee Company reports the following results for its calendar year. Cash…

A: Bad debt expenseAt the end of the accounting period, a financial statement is prepared by every…

Q: Waterway Company has the following two notes receivable at May 31, 2024, its fiscal year end: 1.…

A: Interest on notes receivable is the amount of money earned by an entity as a return on the note…

Q: Thomas travels from his home in Massachusetts and flies to Paris to attend meetings related to his…

A: According to the IRS (Internal Revenue Service) rules, if a trip to another country is primarily for…

Q: Calculate the amount of gross profit that should be recognized each year under the percentage of…

A: One of the methods of revenue recognition, under construction contracts, is percentage of completion…

Q: Prepare the adjusting entry at Dec. 31 , 2023

A: Year 2022:Amortization of Premium: $25,274 * 6% = $1,516Interest Expense: $25,274 * 8% = $80Ending…

Q: During September, Clendennen Corporation budgeted for 38,000 customers, but actually served 36,000…

A: FLEXIBLE BUDGETA flexible budget is a budget that is prepared for different levels of activity or…

Q: Swifty Company uses a periodic inventory system, For April, when the company sold 420 units, the…

A: In a periodic inventory system, the weighted average cost per unit is calculated by considering the…

Step by step

Solved in 3 steps with 1 images

- Tammy had the following aggregate results from her 2019 investing activity: STCG $300,000 LTCG $450,000 STCL -$260,000 LTCL -$390,000 After the capital gain and loss netting procedure listed below 1.Classify as short-term or long-term based on holding period: •Short-termheld less than 12 months •Long-term held longer than 12 months 2. Net short-term and long-term gains and losses to obtain a net short-term and a net long-term position for the year. Collectibles gains and losses, gains on qualified small businessstock, and unrecaptured Section 1250 gains are treated as long-term gains and losses inthe netting procedure. Short-term capital gain $ XX Short-term capital loss (XX) Net short-term gain (loss) Short-term capital gain or loss Long-term capital gain $ XX Long-term capital loss (XX) Net long-term gain (loss) Long-term capital gain or loss 3.If long-term…Coline has the following capital gain and loss transactions for 2020. a. Short-term capital gain $5,000 b. Short-term capital loss ($2,100) c. Long-term capital gain (28%) $6,000 d. Long-term capital gain (15%) $2,000 e. Long-term capital loss (28%) ($10,500) After the netting process, Coline has an overall of $fill in the blank 2.In the current year, Eva has net short-term capital losses of $3,000, a net long-term capital loss of $42,000, and taxable income from wages of $36,000. a. Calculate the amount of Estes' deduction for capital losses for the current year. b. Calculate the amount and nature (short-term or long-term) of his capital loss carryforward. c. For how many years may Eva carry the unused loss forward?

- Uri has the following income and capital gains and losses in 2020. He has no other income or loss during the year. Which is Uri's income or loss after the netting process? Ordinary income 30,000 LTCG 28% Gain 15,000 LTCG 15% Gain 4000 STCL (23,000) Select one or more: a. URI has a $1000 LTCL carryover to 2021. b. URI has a $1000 STCL carryover to 2021 c. Uri can deduct only $22,000 out of the total STCL of $23,000 in 2020 d. URI has Ordinary income $27,000 e. Uri can deduct only $3000 of the STCL in 2020 f. URI has Ordinary income $30,000 g. URI has Ordinary income $7000; $15,000 28% Gain;KNB sold real property to Firm P for $15,000 cash and Firm P’s assumption of the$85,000 mortgage on the property.Required: What is KNB’s amount realized on the sale?b. Compute KNB’s after-tax cash flow from the sale if its adjusted basis in the realproperty is $40,000 and its marginal tax rate is 35 percent.On October 31 , 20x4 , Mr . Cruz bought property from D'Vision Heights which had earlier cost the latter P250,000 . The company received a down payment of P100.000 and a P400,000 mortgage note payable in twenty equal semiannual installments plus 16 % interest per annum on unpaid principal . Assuming the gross profit is recognized in the period of sole of gross profit to be recognized by D'Vision Heights in 20x6 would be :

- For the current tax year, Morgan had $25,000 of ordinary income. In addition, he had an $1,900 long-term capital loss and a $1,600 short-term capital loss. What will be the amount of Morgan's capital loss carryforward to the next year? a.$300 b.$500 c.$3,500 d.$0 e.$3,000An individual has an RSP that they are drawing money out of during 2020. TheRRSP has earned dividends of $10,000. The individual withdraws $32,000 from theRRSP. To obtain that much cash, the RSP sells investments worth $32,000 thathave a cost basis of $20,000. What is the individual's 2020 taxable income as aresult of the RRSP? A) 42000 B) 16000 C)19800 D)32000In 2019, Jenny had a $12,000 net short-term capital loss and deducted $3,000 as a capital loss deduction. In 2020, Jenny has a $18,000 0%/15%/20% long-term capital gain and no other capital gain or loss transactions. Which of the statements below is correct for 2020? a.) has a $9,000 net capital loss. b.) has a $3,000 capital loss deduction. c.) has a $9,000 net capital gain. d.) has a $18,000 net capital gain

- KNB sold real property to Firm P for $15,000 cash and Firm P’s assumption of the $85,000 mortgage on the property. Required: What is KNB’s amount realized on sale? Compute KNB’s after-tax cash flow from the sale if its adjusted basis in the real property is $40,000 and its marginal tax rate is 35 percent.Mr. Dela Cruz bought a piece of property forPhp100,000 downpayment and 10 deferred semiannualpayments of Php8,000 starting 3 years from now. Ifthe interest rate is 12% compounded semiannually,what is the present worth of the property?On May 7, 2021, Jimin Corporation sold a tract of land for P70,000 that resulted in a P30,000 gain on the sale. PTD agreed to accept one payment of P35,000 on August 15 and a second payment of P35,000 on December 15. PTD had a calendar year-end. What amount of gain was reported during the second, third, and fourth quarters of the year from this sale?