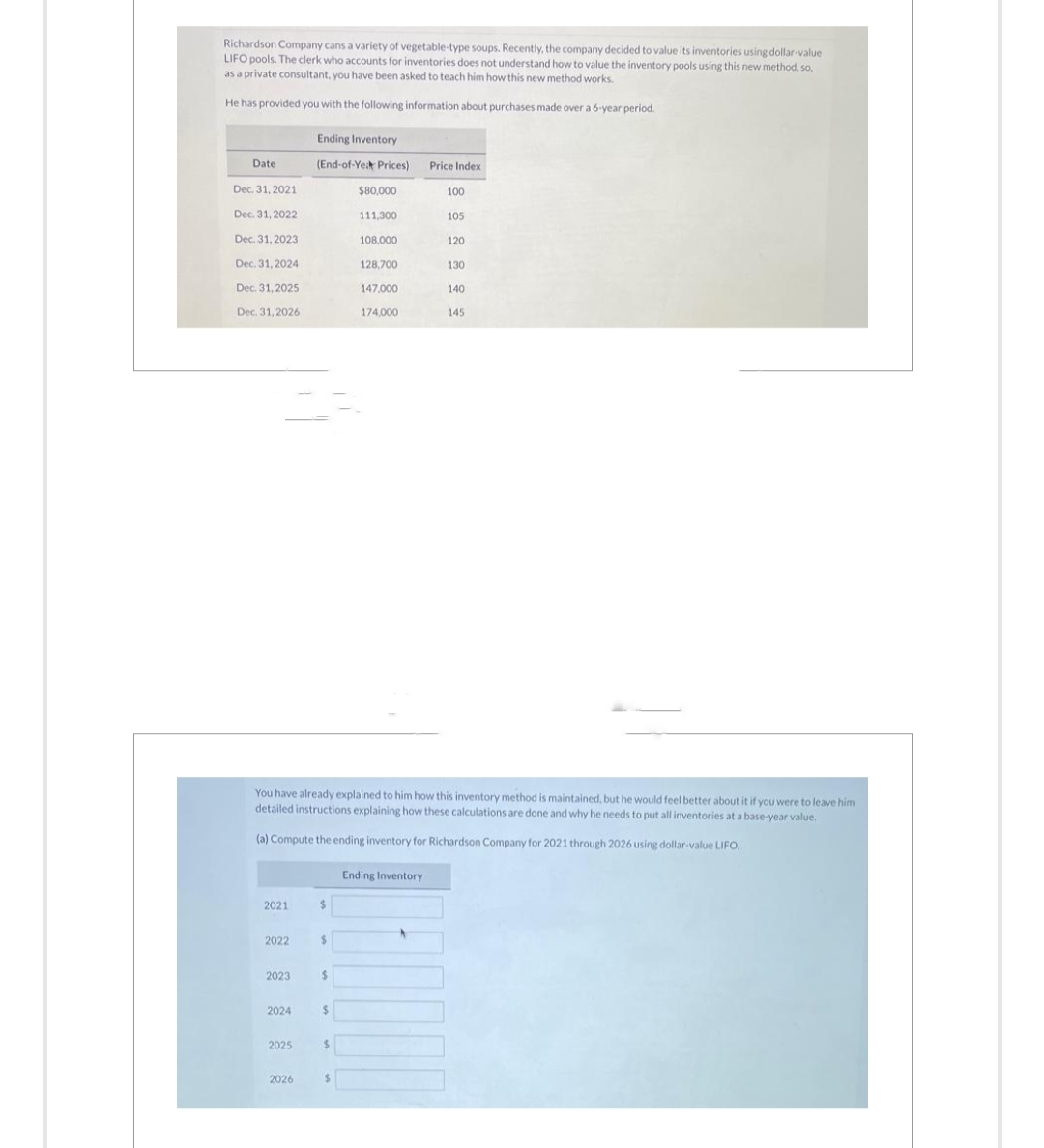

Richardson Company cans a variety of vegetable-type soups. Recently, the company decided to value its inventories using dollar-value LIFO pools. The clerk who accounts for inventories does not understand how to value the inventory pools using this new method, so, as a private consultant, you have been asked to teach him how this new method works. He has provided you with the following information about purchases made over a 6-year period. Date Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2024 Dec. 31, 2025 010034 Ending Inventory (End-of-Yea Prices) $80,000 111,300 108,000 128,700 147,000 174.000 Price Index 100 105 120 130 140

Richardson Company cans a variety of vegetable-type soups. Recently, the company decided to value its inventories using dollar-value LIFO pools. The clerk who accounts for inventories does not understand how to value the inventory pools using this new method, so, as a private consultant, you have been asked to teach him how this new method works. He has provided you with the following information about purchases made over a 6-year period. Date Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2024 Dec. 31, 2025 010034 Ending Inventory (End-of-Yea Prices) $80,000 111,300 108,000 128,700 147,000 174.000 Price Index 100 105 120 130 140

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 5CP: The following is an excerpt from a conversation between Paula Marlo, the warehouse manager for...

Related questions

Question

Transcribed Image Text:Richardson Company cans a variety of vegetable-type soups. Recently, the company decided to value its inventories using dollar-value

LIFO pools. The clerk who accounts for inventories does not understand how to value the inventory pools using this new method, so,

as a private consultant, you have been asked to teach him how this new method works.

He has provided you with the following information about purchases made over a 6-year period.

Date

Dec. 31, 2021

Dec. 31, 2022

Dec. 31, 2023

Dec. 31, 2024

Dec. 31, 2025

Dec. 31, 2026

2021

2022

2023

2024

2025

Ending Inventory

(End-of-Yeat Prices)

2026

$

You have already explained to him how this inventory method is maintained, but he would feel better about it if you were to leave him

detailed instructions explaining how these calculations are done and why he needs to put all inventories at a base-year value.

(a) Compute the ending inventory for Richardson Company for 2021 through 2026 using c

$

$

$

$

$80,000

111,300

108,000

128,700

147,000

174,000

$

Price Index

Ending Inventory

100

105

120

130

140

145

value LIFO.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,