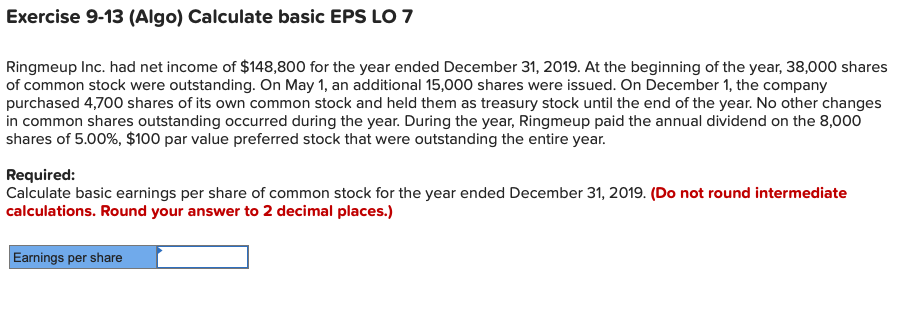

Ringmeup Inc. had net income of $148,800 for the year ended December 31, 2019. At the beginning of the year, 38,000 shares of common stock were outstanding. On May 1, an additional 15,000 shares were issued. On December 1, the company purchased 4,700 shares of its own common stock and held them as treasury stock until the end of the year. No other changes in common shares outstanding occurred during the year. During the year, Ringmeup paid the annual dividend on the 8,000 shares of 5.00%, $100 par value preferred stock that were outstanding the entire year. Required: Calculate basic earnings per share of common stock for the year ended December 31, 2019. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Earnings per share

Ringmeup Inc. had net income of $148,800 for the year ended December 31, 2019. At the beginning of the year, 38,000 shares of common stock were outstanding. On May 1, an additional 15,000 shares were issued. On December 1, the company purchased 4,700 shares of its own common stock and held them as treasury stock until the end of the year. No other changes in common shares outstanding occurred during the year. During the year, Ringmeup paid the annual dividend on the 8,000 shares of 5.00%, $100 par value preferred stock that were outstanding the entire year. Required: Calculate basic earnings per share of common stock for the year ended December 31, 2019. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Earnings per share

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 41E: Exercise 1-41 Stockholders Equity OBJECTIVE o On January 11 2019, Mulcahy Manufacturing Inc., a...

Related questions

Question

Transcribed Image Text:Exercise 9-13 (Algo) Calculate basic EPS LO 7

Ringmeup Inc. had net income of $148,800 for the year ended December 31, 2019. At the beginning of the year, 38,000 shares

of common stock were outstanding. On May 1, an additional 15,000 shares were issued. On December 1, the company

purchased 4,700 shares of its own common stock and held them as treasury stock until the end of the year. No other changes

in common shares outstanding occurred during the year. During the year, Ringmeup paid the annual dividend on the 8,000

shares of 5.00%, $100 par value preferred stock that were outstanding the entire year.

Required:

Calculate basic earnings per share of common stock for the year ended December 31, 2019. (Do not round intermediate

calculations. Round your answer to 2 decimal places.)

Earnings per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning