ri's dive shop had the following 2019 results: • • Sales - $7,200 Costs - $6,100 Assets - $18,000 Debt-$8,000 Equity - $10,000 orecasted sales for 2020 are $8,500. There are no taxes. Assets and costs are proportional sales. Debt and Equity are not. The retention rate is 100%. What is the AFN (additional unds needed) in 2020 to support forecasted sales of $8,500? (Hint: Construct the 2020 alance sheet and find the AFN required to make the balance sheet balance. Also, assume pontaneous liabilities are unchanged from 2019 to 2020.)

ri's dive shop had the following 2019 results: • • Sales - $7,200 Costs - $6,100 Assets - $18,000 Debt-$8,000 Equity - $10,000 orecasted sales for 2020 are $8,500. There are no taxes. Assets and costs are proportional sales. Debt and Equity are not. The retention rate is 100%. What is the AFN (additional unds needed) in 2020 to support forecasted sales of $8,500? (Hint: Construct the 2020 alance sheet and find the AFN required to make the balance sheet balance. Also, assume pontaneous liabilities are unchanged from 2019 to 2020.)

Chapter18: The Management Of Accounts Receivable And Inventories

Section: Chapter Questions

Problem 10P

Related questions

Question

Hi please calculate additional funds needed

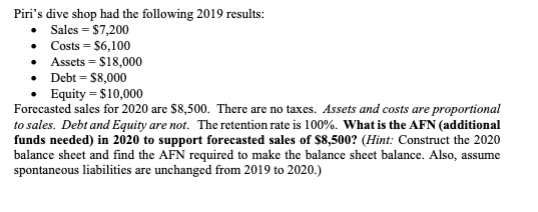

Transcribed Image Text:Piri's dive shop had the following 2019 results:

• Sales = $7,200

• Costs = $6,100

Assets $18,000

•

• Debt = $8,000

Equity = $10,000

Forecasted sales for 2020 are $8,500. There are no taxes. Assets and costs are proportional

to sales. Debt and Equity are not. The retention rate is 100%. What is the AFN (additional

funds needed) in 2020 to support forecasted sales of $8,500? (Hint: Construct the 2020

balance sheet and find the AFN required to make the balance sheet balance. Also, assume

spontaneous liabilities are unchanged from 2019 to 2020.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning