RM sells the investments in (a) for $174,000 in cash. RM used that money plus the previously recorded interest income (along with $25,000 in cash given last year to RM with the donor stipulation that the money be used for equipment) to buy new equipment. RM receives pledges near the end of the year totaling $200,000. Of that amount, $38,000 is judged to be conditional. The remaining $162,000 has a donor-stipulated purpose restriction. The present value of the $162,000 is calculated as $131,000. a. Record each of these transactions in appropriate journal entry form. b. Prepare a schedule calculating the change in net assets without donor restrictions and net assets with donor restrictions.

RM sells the investments in (a) for $174,000 in cash. RM used that money plus the previously recorded interest income (along with $25,000 in cash given last year to RM with the donor stipulation that the money be used for equipment) to buy new equipment. RM receives pledges near the end of the year totaling $200,000. Of that amount, $38,000 is judged to be conditional. The remaining $162,000 has a donor-stipulated purpose restriction. The present value of the $162,000 is calculated as $131,000. a. Record each of these transactions in appropriate journal entry form. b. Prepare a schedule calculating the change in net assets without donor restrictions and net assets with donor restrictions.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

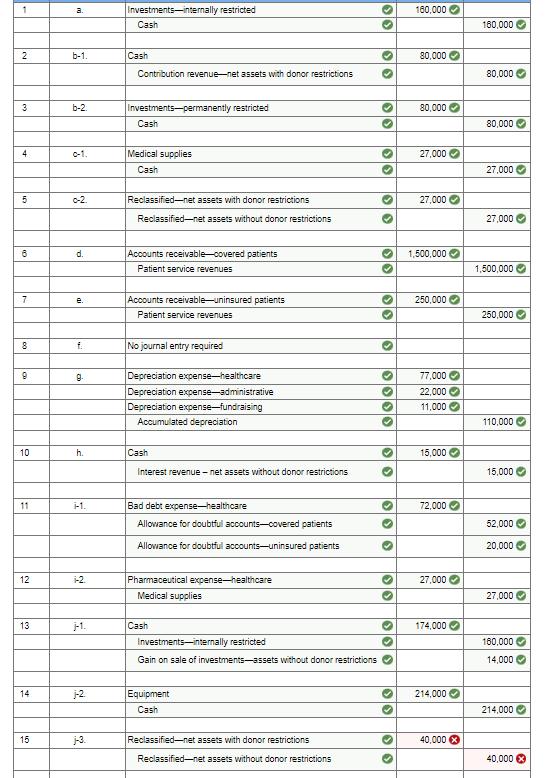

A local private not-for-profit health care entity (Rochester Medical) incurred the following transactions during the current year. The entity has one program service (health care) and two supporting services (fundraising and administrative).

- The board of governors for Rochester Medical (RM) announces that $160,000 in previously unrestricted cash will be used in the near future to acquire equipment. These funds are invested until the purchase eventually occurs.

- RM receives a donation of $80,000 in cash with the stipulation that the money be invested in U.S. government bonds. All subsequent income derived from this investment must be paid to supplement nursing salaries.

- RM spends $27,000 in cash to acquire medicines. RM had received this money during the previous year. The donor had specified that it had to be used for medicines.

- RM charges patients $2 million. These amounts are the responsibility of government programs and insurance companies. These third-party payors will receive explicit price concessions because of long standing contracts. Officials believe RM has an 80 percent chance of receiving $1.5 million and a 20 percent chance of receiving $1.0 million. RM has a policy of reporting the most likely outcome.

- RM charges patients $1 million. These patients are not insured. RM sets implicit price concessions because of the high cost of health care. Officials believe RM has a 70 percent chance of collecting $250,000 and a 30 percent chance of receiving $100,000. As stated before, RM has a policy of reporting the most likely outcome.

- RM charges patients $600,000. These patients have little or no income. The hospital administration chooses to view this work as charity care and make no attempt at collection.

Depreciation expense for the year is $110,000. Of that amount, 70 percent relates to health care, 20 percent to administrative, and 10 percent to fundraising.- RM receives interest income of $15,000 on the investments acquired in (a).

- Based on past history, officials estimate that $52,000 of the reported receivable amount from third-party payors will never be collected. Of the amount reported by uninsured patients who are expected to pay a portion of their debt, officials estimate that $20,000 of the reported receivable amount will not be collected. The medicines in (c) are consumed through daily patient care.

- RM sells the investments in (a) for $174,000 in cash. RM used that money plus the previously recorded interest income (along with $25,000 in cash given last year to RM with the donor stipulation that the money be used for equipment) to buy new equipment.

- RM receives pledges near the end of the year totaling $200,000. Of that amount, $38,000 is judged to be conditional. The remaining $162,000 has a donor-stipulated purpose restriction. The present value of the $162,000 is calculated as $131,000.

a. Record each of these transactions in appropriate

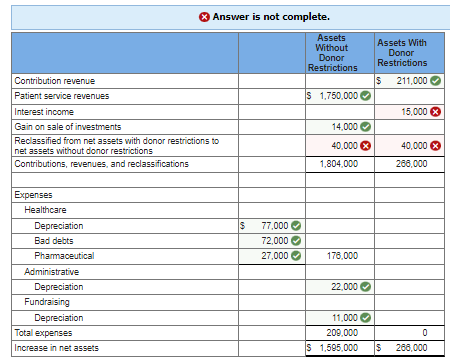

b. Prepare a schedule calculating the change in net assets without donor restrictions and net assets with donor restrictions.

PLEASE ONLY ASSIST WITH THE INCORRECT PORTIONS

Transcribed Image Text:1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

a.

b-1.

b-2.

0-1.

c-2.

d.

e.

f.

9.

h.

i-1.

i-2.

j-1.

j-2.

j-3.

Investments-internally restricted

Cash

Cash

Contribution revenue-net assets with donor restrictions

Investments-permanently restricted

Cash

Medical supplies

Cash

Reclassified-net assets with donor restrictions

Reclassified-net assets without donor restrictions

Accounts receivable-covered patients

Patient service revenues

Accounts receivable-uninsured patients

Patient service revenues

No journal entry required

Depreciation expense-healthcare

Depreciation expense-administrative

Depreciation expense-fundraising

Accumulated depreciation

Cash

Interest revenue - net assets without donor restrictions

Bad debt expense-healthcare

Allowance for doubtful accounts-covered patients

Allowance for doubtful accounts-uninsured patients

Pharmaceutical expense-healthcare

Medical supplies

Cash

Investments internally restricted

Gain on sale of investments-assets without donor restrictions

Equipment

Cash

Reclassified-net assets with donor restrictions

Reclassified-net assets without donor restrictions

33

33

>>

33

33

33

33

3

3333

33

3

>

33

333

33

3

>

180,000

80,000

80,000

3

3

27,000 →

27,000 →

1,500,000✔

250,000 ✓

77,000 →

22,000 →

11,000✔

15,000 ✓

72,000 ✓

27,000 →

214,000

174,000 →

40,000 x

160,000✔

80,000

80,000

27,000✔

27,000

1,500,000

250,000

110,000

15,000

52,000

20,000

27,000

160,000

14,000

214,000

40,000 X

Transcribed Image Text:Contribution revenue

Patient service revenues

Interest income

Gain on sale of investments

Reclassified from net assets with donor restrictions to

net assets without donor restrictions

Contributions, revenues, and reclassifications

Expenses

Healthcare

Depreciation

Bad debts

Pharmaceutical

Administrative

Depreciation

Fundraising

Answer is not complete.

Depreciation

Total expenses

Increase in net assets

19

77,000

72,000✔

27,000✔✔

Assets

Without

Donor

Restrictions

$ 1,750,000✔

14,000✔

40,000 X

1,804,000

176,000

22,000✔

11,000

209,000

$ 1,595,000

Assets With

Donor

Restrictions

$

211,000✔

15,000 X

40,000 X

268,000

0

$ 288,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education