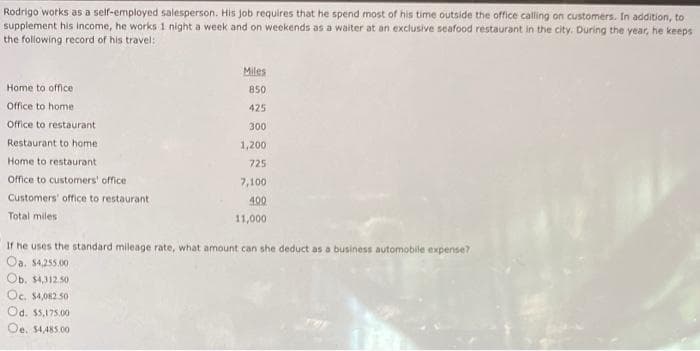

Rodrigo works as a self-employed salesperson. His job requires that he spend most of his time outside the office calling on customers. In addition, to supplement his income, he works 1 night a week and on weekends as a waiter at an exclusive seafood restaurant in the city. During the year, he keeps the following record of his travel: Miles Home to office 850 Office to home 425 Office to restaurant 300 Restaurant to home 1,200 Home to restaurant 725 Office to customers' office 7,100 Customers' office to restaurant 400 Total miles 11,000 If he uses the standard mileage rate, what amount can she deduct as a business automobile expense? Oa, S4255.00 Ob. S431250 Oc. S4,02.50 Od. $5.175.00 Oe. S4AS.00

Rodrigo works as a self-employed salesperson. His job requires that he spend most of his time outside the office calling on customers. In addition, to supplement his income, he works 1 night a week and on weekends as a waiter at an exclusive seafood restaurant in the city. During the year, he keeps the following record of his travel: Miles Home to office 850 Office to home 425 Office to restaurant 300 Restaurant to home 1,200 Home to restaurant 725 Office to customers' office 7,100 Customers' office to restaurant 400 Total miles 11,000 If he uses the standard mileage rate, what amount can she deduct as a business automobile expense? Oa, S4255.00 Ob. S431250 Oc. S4,02.50 Od. $5.175.00 Oe. S4AS.00

Chapter6: Business Expenses

Section: Chapter Questions

Problem 28P

Related questions

Question

100%

Transcribed Image Text:Rodrigo works as a self-employed salesperson. His job requires that he spend most of his time outside the office calling on customers. In addition, to

supplement his income, he works 1 night a week and on weekends as a waiter at an exclusive seafood restaurant in the city. During the year, he keeps

the following record of his travel:

Miles

Home to office

850

Office to home

425

Office to restaurant

300

Restaurant to home

1,200

Home to restaurant

725

Office to custormers' office

7,100

Customers' office to restaurant

400

Total miles

11,000

If he uses the standard mileage rate, what amount can she deduct as a business automobile expense?

Oa. S4255.00

Ob. $431250

Oc. S4,082 50

Od. $5,175.00

Oe, S4,485.00

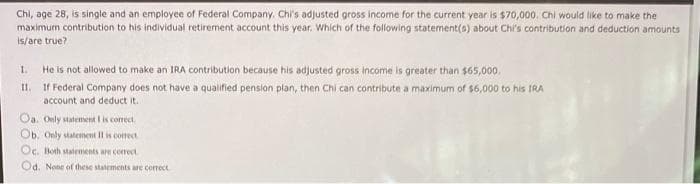

Transcribed Image Text:Chi, age 28, is single and an employee of Federal Company. Chi's adjusted gross income for the current year is $70,000, Chi would like to make the

maximum contribution to his individual retirement account this year. Which of the following statement(s) about Chi's contribution and deduction amounts

is/are true?

1.

He is not allowed to make an IRA contribution because his adjusted gross income is greater than $65,000.

I.

If Federal Company does not have a qualified pension plan, then Chi can contribute a maximum of $6,000 to his TRA

account and deduct it.

Oa, Only statement I is correct.

Ob. Only statemnent Il is corect

Oc. Both statements are correct

Od. None of these statements are correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT