RomZar Sdn Bhd takes a simple interest, 180-day note from a SoonWay Supplier with a face value RM 17,500, at a rate 9.5%. Due to emergency, SoonWay Supplier need an urgent cash to settle their debt and sell the promissory notes 100 days late at the discount rate of 11%. Find the bank profit and proceeds. Rossa invested RM 3,600 in a mutual fund containing bonds. Find the interest rate if she earned RM 237.50 in interest in 250 days.

RomZar Sdn Bhd takes a simple interest, 180-day note from a SoonWay Supplier with a face value RM 17,500, at a rate 9.5%. Due to emergency, SoonWay Supplier need an urgent cash to settle their debt and sell the promissory notes 100 days late at the discount rate of 11%. Find the bank profit and proceeds. Rossa invested RM 3,600 in a mutual fund containing bonds. Find the interest rate if she earned RM 237.50 in interest in 250 days.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 4P: Gifts Galore Inc. borrowed 1.5 million from National City Bank. The loan was made at a simple annual...

Related questions

Question

Transcribed Image Text:QUESTION 5

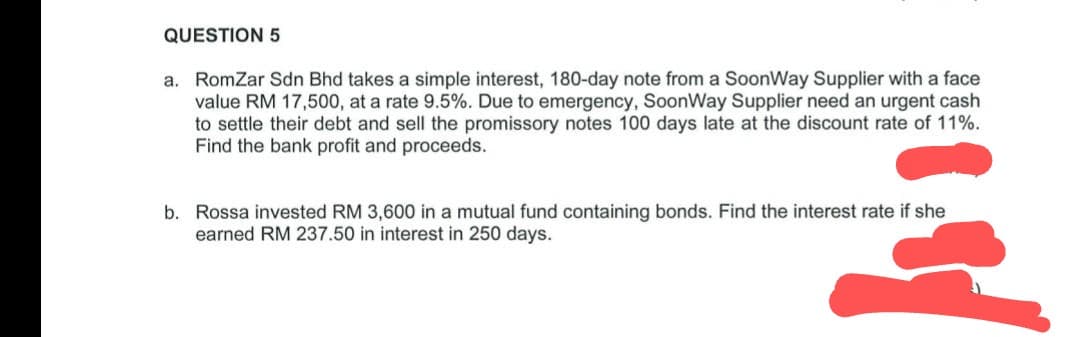

a. RomZar Sdn Bhd takes a simple interest, 180-day note from a SoonWay Supplier with a face

value RM 17,500, at a rate 9.5%. Due to emergency, SoonWay Supplier need an urgent cash

to settle their debt and sell the promissory notes 100 days late at the discount rate of 11%.

Find the bank profit and proceeds.

b. Rossa invested RM 3,600 in a mutual fund containing bonds. Find the interest rate if she

earned RM 237.50 in interest in 250 days.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning