rovide a short narrative of your analysis of the problem. Explain what theories/ concepts apply, how, and why. Then present the solution/computation. Write a short narrative explaining the meaning of the final answer - its implication to the firm. Write a short recommendation/conclusion based on the analysis and solutions. You solved a current problem only. How can you provide for the future? What about contingencies that may arise? What proactive measures can you t

rovide a short narrative of your analysis of the problem. Explain what theories/ concepts apply, how, and why. Then present the solution/computation. Write a short narrative explaining the meaning of the final answer - its implication to the firm. Write a short recommendation/conclusion based on the analysis and solutions. You solved a current problem only. How can you provide for the future? What about contingencies that may arise? What proactive measures can you t

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter19: Cost-Volume-Profit Analysis

Section: Chapter Questions

Problem 19.17EX

Related questions

Question

Provide a short narrative of your analysis of the problem. Explain what theories/ concepts apply, how, and why. Then present the solution/computation. Write a short narrative explaining the meaning of the final answer - its implication to the firm. Write a short recommendation/conclusion based on the analysis and solutions. You solved a current problem only. How can you provide for the future? What about contingencies that may arise? What proactive measures can you take?

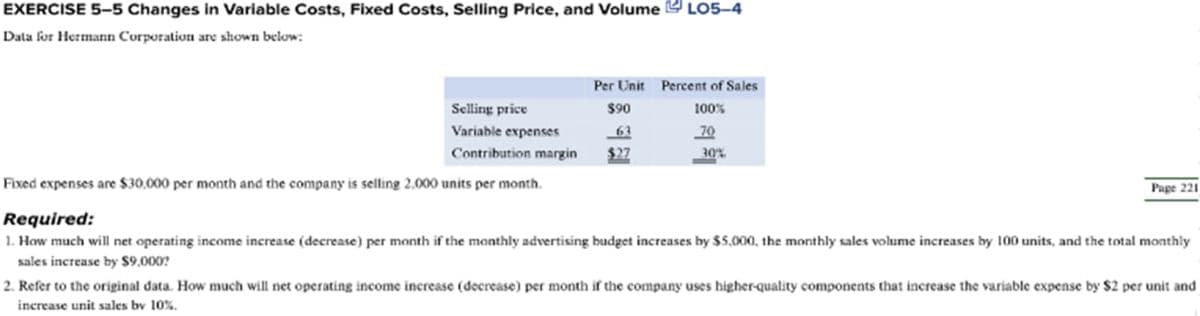

Transcribed Image Text:EXERCISE 5-5 Changes in Variable Costs, Fixed Costs, Selling Price, and Volume LO5-4

Data for Hermann Corporation are shown below:

Per Unit Percent of Sales

$90

100%

63

70

Contribution margin $27

Selling price

Variable expenses

Fixed expenses are $30,000 per month and the company is selling 2,000 units per month.

30%

Page 221

Required:

1. How much will net operating income increase (decrease) per month if the monthly advertising budget increases by $5,000, the monthly sales volume increases by 100 units, and the total monthly

sales increase by $9,000?

2. Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher-quality components that increase the variable expense by $2 per unit and

increase unit sales by 10%.

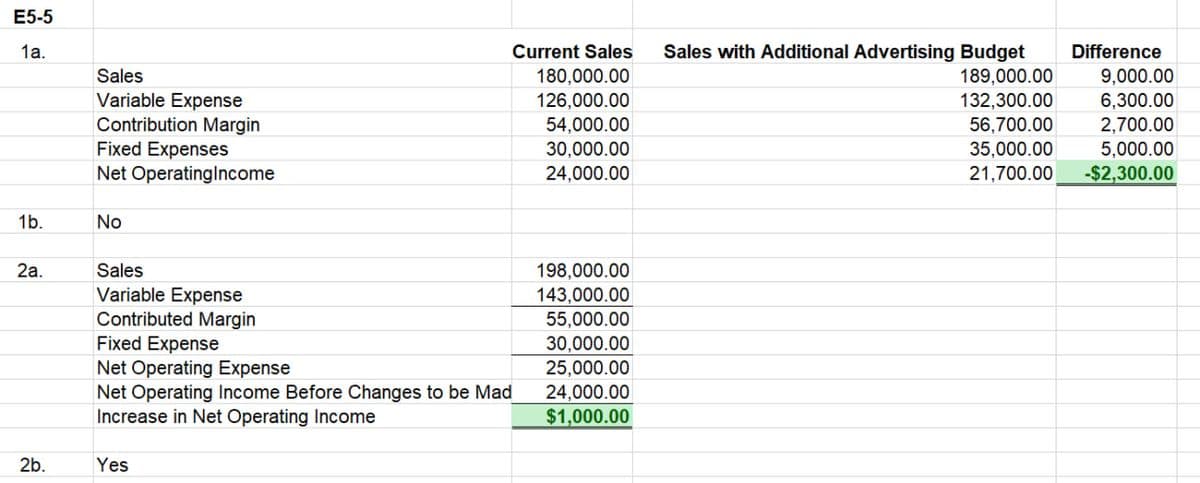

Transcribed Image Text:E5-5

1a.

1b.

2a.

2b.

Sales

Variable Expense

Contribution Margin

Fixed Expenses

Net Operating Income

No

Sales

Variable Expense

Contributed Margin

Current Sales

180,000.00

126,000.00

54,000.00

30,000.00

24,000.00

Fixed Expense

Net Operating Expense

Net Operating Income Before Changes to be Mad

Increase in Net Operating Income

Yes

198,000.00

143,000.00

55,000.00

30,000.00

25,000.00

24,000.00

$1,000.00

Sales with Additional Advertising Budget

189,000.00

132,300.00

56,700.00

Difference

9,000.00

6,300.00

2,700.00

35,000.00

5,000.00

21,700.00 -$2,300.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning