Royal Gift Shop sells cards, supplies, and various holiday greeting cards. Sales to retail customers are subject to an 8 percent sales The firm sells its merchandise for cash; to customers using bank credit cards, such as MasterCard and Visa; and to customers using American Express. The bank credit cards charge a 2 percent fee. American Express charges a 3 percent fee. Royal Gift Shop also grants trade discounts to certain wholesale customers who place large orders. These orders are not subject to sales tax. During February 20X1, Royal Gift Shop engaged in the following transactions: DATE TRANSACTIONS 20X1 "eb. 1 Sold crystal goods to Lovely Kitchens, a wholesale customer. The list price is $3,800, with a 25 percent trade discount. This sale is not subject to sales tax. Issued Invoice 5950 with terms of n/15. 15 Recorded cash sales for the period from February 1 to February 15 of $8,300 pl s sales tax of $664. 15 Recorded sales for the period from February 1 to February 15 to customers using bank credit cards of $11,800 p sales tax of $944. (Record the 2 percent credit card expense at this time.) 16 Received a check from Lovely Kitchens in payment of Invoice 5950 dated February 1. 16 Sold merchandise to customers using American Express for $7,800 plus sales tax of $624. 17 Sold a set of Roman statues to Beautiful Bedrooms, a wholesale customer. The list price is $7,800, with a 30 percent trade discount. This sale is not subject to sales tax. Issued Invoice 5951 with terms of n/15. 20 Received payment from American Express for the amount billed on February 16, less a 3 percent credit card expense. 27 Received a check from Beautiful Bedrooms in payment of Invoice 5951 dated February 17. 28 Recorded cash sales for the period from February 16 to February 28 of $7,150 plus sales tax of $572. 28 Recorded sales for the period from February 16 to February 28 to customers using bank credit cards of $10,000 plus sales'tax of $800. (Record the 2 percent credit card expense at this time.) 28 Sold merchandise to customers using American Express for $9,000 plus sales tax of $720. Required: 2. Record the transactions in a general journal. 3. Post the entries from the general journal to the appropriate accounts in the general ledger. < Prev 2 of 2 Next >

Royal Gift Shop sells cards, supplies, and various holiday greeting cards. Sales to retail customers are subject to an 8 percent sales The firm sells its merchandise for cash; to customers using bank credit cards, such as MasterCard and Visa; and to customers using American Express. The bank credit cards charge a 2 percent fee. American Express charges a 3 percent fee. Royal Gift Shop also grants trade discounts to certain wholesale customers who place large orders. These orders are not subject to sales tax. During February 20X1, Royal Gift Shop engaged in the following transactions: DATE TRANSACTIONS 20X1 "eb. 1 Sold crystal goods to Lovely Kitchens, a wholesale customer. The list price is $3,800, with a 25 percent trade discount. This sale is not subject to sales tax. Issued Invoice 5950 with terms of n/15. 15 Recorded cash sales for the period from February 1 to February 15 of $8,300 pl s sales tax of $664. 15 Recorded sales for the period from February 1 to February 15 to customers using bank credit cards of $11,800 p sales tax of $944. (Record the 2 percent credit card expense at this time.) 16 Received a check from Lovely Kitchens in payment of Invoice 5950 dated February 1. 16 Sold merchandise to customers using American Express for $7,800 plus sales tax of $624. 17 Sold a set of Roman statues to Beautiful Bedrooms, a wholesale customer. The list price is $7,800, with a 30 percent trade discount. This sale is not subject to sales tax. Issued Invoice 5951 with terms of n/15. 20 Received payment from American Express for the amount billed on February 16, less a 3 percent credit card expense. 27 Received a check from Beautiful Bedrooms in payment of Invoice 5951 dated February 17. 28 Recorded cash sales for the period from February 16 to February 28 of $7,150 plus sales tax of $572. 28 Recorded sales for the period from February 16 to February 28 to customers using bank credit cards of $10,000 plus sales'tax of $800. (Record the 2 percent credit card expense at this time.) 28 Sold merchandise to customers using American Express for $9,000 plus sales tax of $720. Required: 2. Record the transactions in a general journal. 3. Post the entries from the general journal to the appropriate accounts in the general ledger. < Prev 2 of 2 Next >

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter9: Receivables

Section: Chapter Questions

Problem 9.6APR: Sales and notes receivable transactions The following were selected from among the transactions...

Related questions

Question

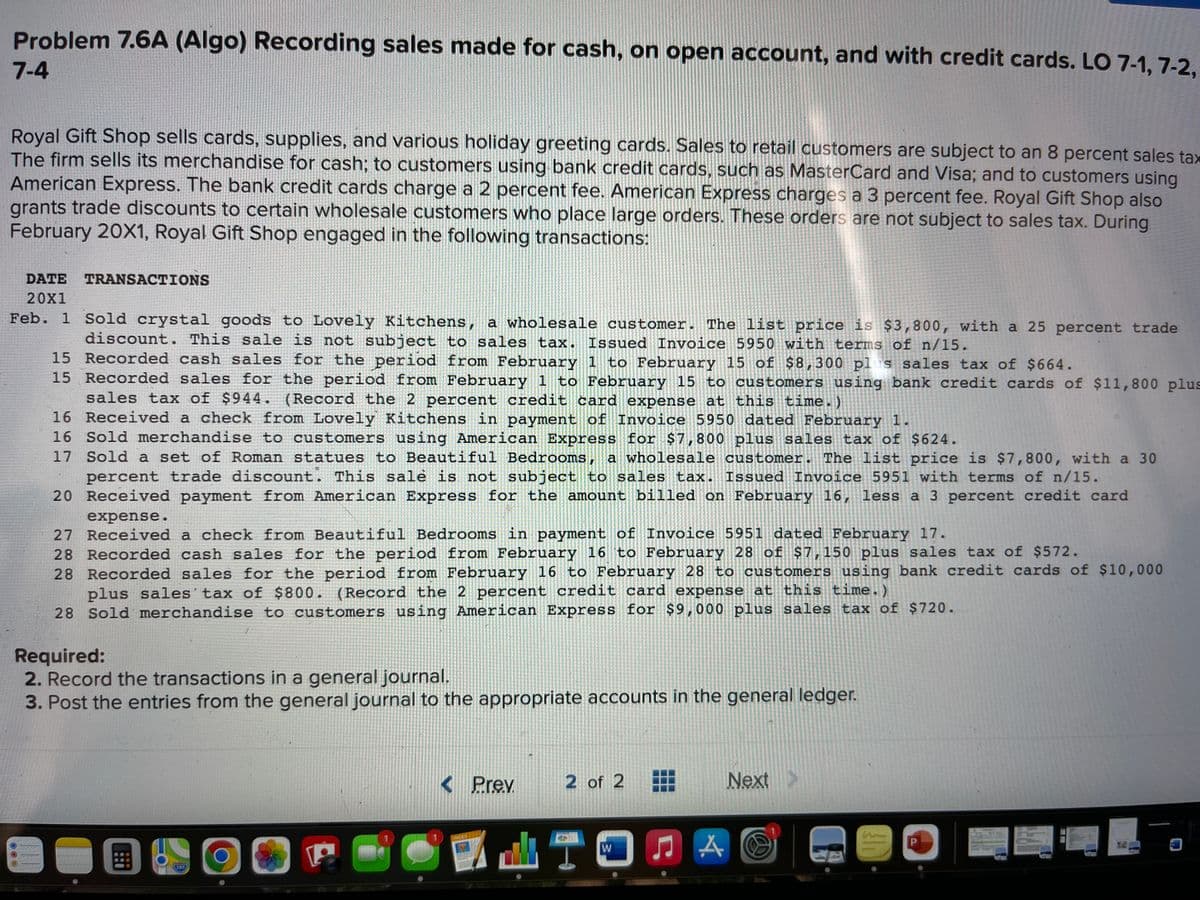

Transcribed Image Text:Problem 7.6A (Algo) Recording sales made for cash, on open account, and with credit cards. LO 7-1, 7-2.

7-4

Royal Gift Shop sells cards, supplies, and various holiday greeting cards. Sales to retail customers are subject to an 8 percent sales tax

The firm sells its merchandise for cash; to customers using bank credit cards, such as MasterCard and Visa; and to customers using

American Express. The bank credit cards charge a 2 percent fee. American Express charges a 3 percent fee. Royal Gift Shop also

grants trade discounts to certain wholesale customers who place large orders. These orders are not subject to sales tax. During

February 20X1, Royal Gift Shop engaged in the following transactions:

DATE

TRANSACTIONS

20X1

Feb. 1 Sold crystal goods to Lovely Kitchens, a wholesale customer. The list price is $3,800, with a 25 percent trade

discount. This sale is not subject to sales tax. Issued Invoice 5950 with terms of n/15.

15 Recorded cash sales for the period from February 1 to February 15 of $8,300 pl s sales tax of $664.

15 Recorded sales for the period from February 1 to February 15 to customers using bank credit cards of $11,800 plus

sales tax of $944. (Record the 2 percent credit card expense at this time.)

16 Received a check from Lovely Kitchens in payment of Invoice 5950 dated February 1.

16 Sold merchandise to customers using American Express for $7,800 plus sales tax of $624.

17 Sold a set of Roman statues to Beautiful Bedrooms, a wholesale customer. The list price is $7,800, with a 30

percent trade discount. This salė is not subject to sales tax. Issued Invoice 5951 with terms of n/15.

20 Received payment from American Express for the amount billed on February 16, less a 3 percent credit card

expense.

27 Received a check from Beautiful Bedrooms in payment of Invoice 5951 dated February 17.

28 Recorded cash sales for the period from February 16 to February 28 of $7,150 plus sales tax of $572.

28 Recorded sales for the period from February 16 to February 28 to customers using bank credit cards of $10,000

plus sales'tax of $800. (Record the 2 percent credit card expense at this time.)

28 Sold merchandise to customers using American Express for $9, 000 plus sales tax of $720.

Required:

2. Record the transactions in a general journal.

3. Post the entries from the general journal to the appropriate accounts in the general ledger.

< Prev

2 of 2

Next>

P

W

F80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning