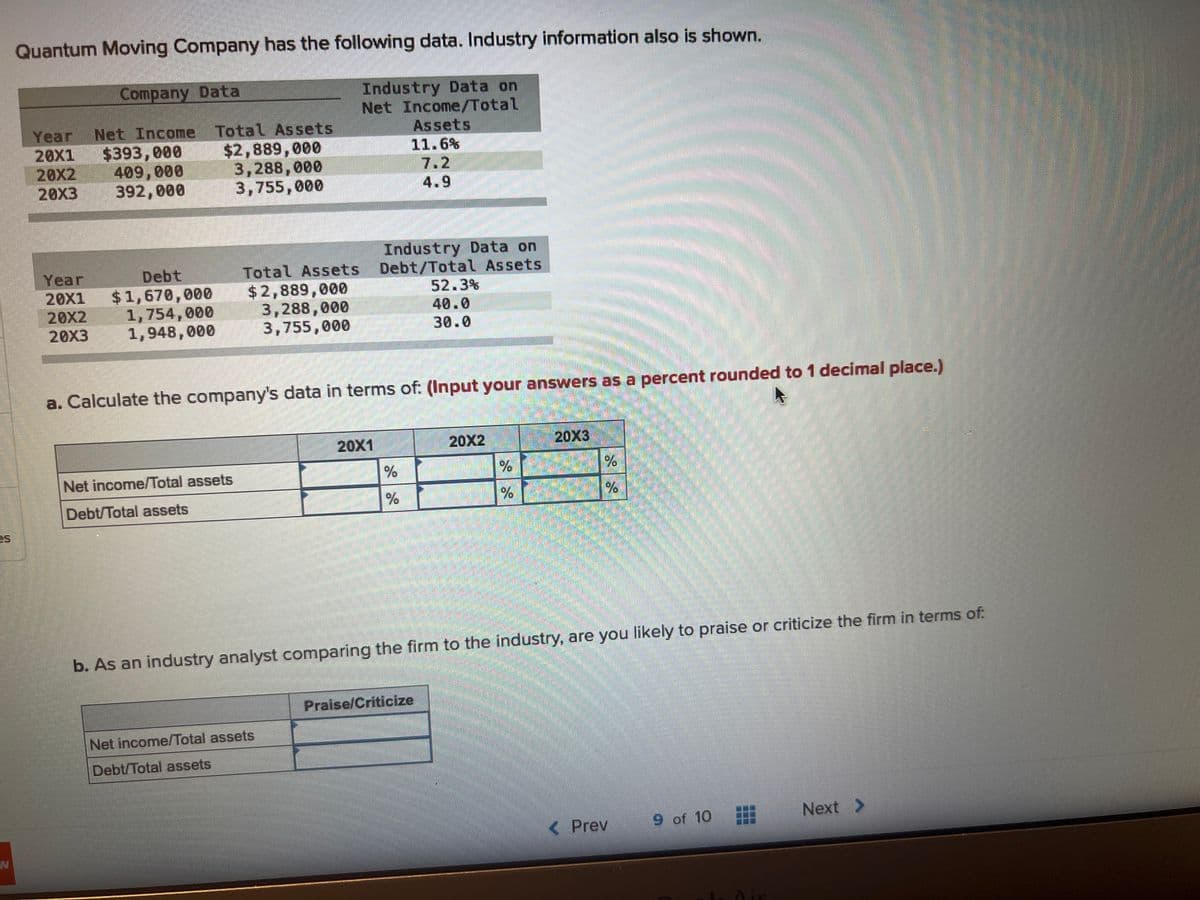

S Quantum Moving Company has the following data. Industry information also is shown. Company Data Year Net Income 20X1 $393,000 20X2 409,000 20X3 392,000 Year Debt $1,670,000 20X1 20X2 1,754,000 20x3 1,948,000 Total Assets $2,889,000 3,288,000 3,755,000 Total Assets $2,889,000 3,288,000 3,755,000 Net income/Total assets Debt/Total assets Industry Data on Net Income/Total Assets 11.6% 7.2 4.9 a. Calculate the company's data in terms of: (Input your answers as a percent rounded to 1 decimal place.) Net income/Total assets Debt/Total assets Industry Data on Debt/Total Assets 20X1 % % 52.3% 40.0 30.0 Praise/Criticize 20X2 % % 20X3 b. As an industry analyst comparing the firm to the industry, are you likely to praise or criticize the firm in terms of: % %

S Quantum Moving Company has the following data. Industry information also is shown. Company Data Year Net Income 20X1 $393,000 20X2 409,000 20X3 392,000 Year Debt $1,670,000 20X1 20X2 1,754,000 20x3 1,948,000 Total Assets $2,889,000 3,288,000 3,755,000 Total Assets $2,889,000 3,288,000 3,755,000 Net income/Total assets Debt/Total assets Industry Data on Net Income/Total Assets 11.6% 7.2 4.9 a. Calculate the company's data in terms of: (Input your answers as a percent rounded to 1 decimal place.) Net income/Total assets Debt/Total assets Industry Data on Debt/Total Assets 20X1 % % 52.3% 40.0 30.0 Praise/Criticize 20X2 % % 20X3 b. As an industry analyst comparing the firm to the industry, are you likely to praise or criticize the firm in terms of: % %

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Complete parts a and b please and thank you

Transcribed Image Text:Quantum Moving Company has the following data. Industry information also is shown.

Company Data

Year Net Income Total Assets

20X1 $393,000

20x2 409,000

20X3

392,000

Year

Debt

20X1

$1,670,000

20X2

1,754,000

20X3 1,948,000

$2,889,000

3,288,000

3,755,000

Net income/Total assets

Debt/Total assets

Total Assets

$2,889,000

3,288,000

3,755,000

Debt/Total assets

Industry Data on

Net Income/Total

a. Calculate the company's data in terms of: (Input your answers as a percent rounded to 1 decimal place.)

Net income/Total assets

Assets

11.6%

20X1

Industry Data on

Debt/Total Assets

52.3%

30.0

Praise/Criticize

20X2

b. As an industry analyst comparing the firm to the industry, are you likely to praise or criticize the firm in terms of:

%

%

< Prev

9 of 10

Air

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,