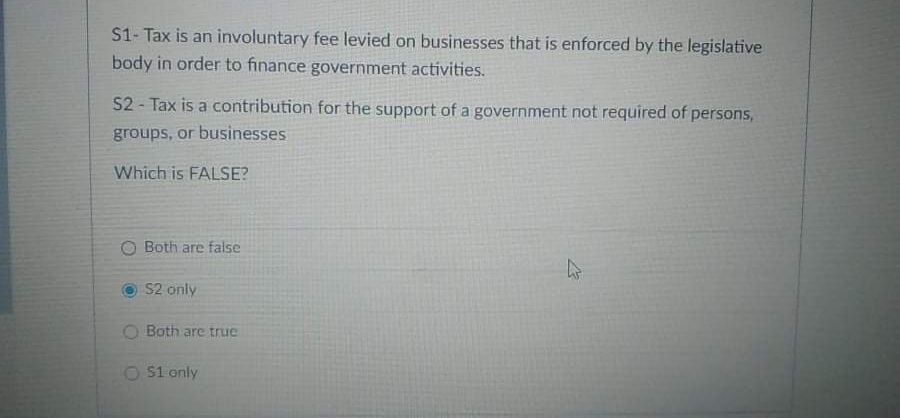

S1- Tax is an involuntary fee levied on businesses that is enforced by the legislative body in order to finance government activities. S2- Tax is a contribution for the support of a government not required of persons, groups, or businesses Which is FALSE?

Q: and you cannot cancel on the due date, so you must cancel with a delay of 25 days, it is requested: ...

A: Interest is the fee paid to a lender for using the funds. It is the compensation paid to an investor...

Q: PART C.) The cost of replacing part of a cell phone video chip production line in 6 years is estimat...

A: The future value of a payment is the value of a single payment or series of payment at some point of...

Q: how to exploit the connection between the business cycle and industry analysis?

A: A business cycle, often known as a "trade cycle" or "economic cycle," is a sequence of stages in the...

Q: If Hulk has taxable income = $94,000, how much will it pay in taxes? Select one: a. $16,750 b. $13...

A: Taxable Income = 94,000 Brackets: Up-to 50,000 = 15% tax rate 50,001 to 75,000 = 25% tax rate 75,0...

Q: fLo0 个bb00 i =6%. $600. $1600 hat is the value of x given the following cash flow?

A: Solution:- We know, Net Present Value= Net Present value of cash inflows and cash outflows discounte...

Q: Find the future value and present value using the ordinary annuity and. No. Principal Rate Mode of P...

A: Given, The payments to calculate the future value and present value of annuity.

Q: 3. Azman purchased a land at a price of RM 280,000. He paid RM W as a down payment and borrowed the ...

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for...

Q: Suppose then that we have three London seats, New York and Madrid In the first, the buyer type is 10...

A: Arbitrage: The foreign exchange rates between the three currencies are said to be in equilibrium if ...

Q: What is the present value of an annuity of P150,000 payable at the end of each 6-month period for 2 ...

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at t...

Q: PART B.) An engineer who is saving for a new house plans on saving $100 per paycheck towards the dow...

A: The future value is the method of finding out the value of the current deposits at a predetermined t...

Q: ACTIVITY # 2: How long will the given principal P take to reach the given maturity value A at the gi...

A: Simple interest is the interest earned on the initial amount invested. It is not added back to the p...

Q: Use the future value formula to find the indicated value FV=5,000; i = 0.03; PMT = $400; n=? n= (Rou...

A: Data given: FV= $ 5000 i= 0.03 PMT = $ 400 Required:: n Formula to be used :: FV= PMT*(1+i)n-1i ...

Q: Ryngard Corp’s sales last year were $43,000 and it’s accounts recivable were $16,000. What was its D...

A: The question is related to Average Collection period. The Average Collection period or Days Sales Ou...

Q: A man borrowed P3 000 to be paid after 18 months with interest at 12% compounded semi-annually and P...

A: Here, First borrowed amount payable in 18 months at 12% interest rate compounded semi annually is P3...

Q: Styles QUESTION 3 Alan, a chartered financial analyst (CFA), is willing to invest two stocks, Bloom ...

A: Expected Return is the return that investor expects from a stock under various conditions based on t...

Q: . Explain what is meant by: a. Cost of debt b. Cost of preferred stock C. Cost of equity

A: Cost of Debt: It refers to the effective rate of return paid by the company on its debt like bonds, ...

Q: If you deposit $100 in an account earning 6%, how much would you have in the account after 1 year?

A: Deposit (PV) = $100 Interest rate (r) = 6% Period (n) = 1 Year

Q: George is loaned $100,000 in Year 0. Approximately (round up to the nearest year) rs will it take hi...

A: Loan Amount = $100,000 Interest Rate = 4% Payment in 1 Year = $10,000

Q: Considering the following two statements concerning share issues: Statement (i): A placing of share...

A:

Q: Future Value - single sums If you deposit $100 in an account earning 6% with monthly compounding, ho...

A: Present value (PV) = $100 Interest rate = 6% Monthly interest rate (r)= 6%/12 = 0.50% Period = 5 Yea...

Q: Mr. Abella owes Mr. Divinagracia the following obligations. (1) P100 due at the end of 10 years.(2) ...

A: First obligation (X1) = P 100 in 10 years Second obligation (X2) = P 200 in 5 years + Interest at 5%...

Q: At the beginning of each quarter, P36,000 is deposited into savings account that pays 6% compounded ...

A: Quarterly deposits (D) = P36,000 Interest rate = 6% Quarterly interest rate (r) = [{1+(0.06/2)}2]1/4...

Q: The price of a new car is s24,000, Assume that an individual makesa down ayment of 25% toard the pur...

A: Calculate the loan amount by deducting the amount of down payment from the price of car. Working: ...

Q: Ar. Rosales deposits P75,000 at the end of each month in a bank which pays 9% compounded month ho wi...

A: Since you have posted a multiple question , therefore we will solve the first question only. However...

Q: Calculating Present Values Imprudential, Inc., has an unfunded pension liability of $645 million tha...

A: The present value is calculated as per the time value of money concept

Q: Calculating Future Values Assume you deposit $1,000 today in an account that pays 8 percent interest...

A: The future value (FV) is the amount of money at some future time given a particular interest rate an...

Q: 4. (Present value of an ordinary annuity) What is the present value of the following annuities? c. $...

A: c) Annual payment (A) = $280 n = 7 years r = 6%

Q: At present, a foundation who has 6 million deposit in bank with interest of 10% compounded annually,...

A: Present value(PV) Present value is resulted when future value is discounted back to present using ...

Q: a company is considering two mutually exclusive projects. Both require an initial cash outlay of Rs....

A: Details under question: Initial Investment = 20,000 each Required Return = 10% Tax Rate = 35% Stra...

Q: Dalagang Pilipina Company needs ₱5,000,000 short-term credit for 90 days. To produce the amount, the...

A: The company wants 5,000,000 in hand after 15% discount on issued amount and after incurring 90,000 (...

Q: ound interest for long-term financial transactions than simple interest. III. In compound interest,...

A: Introduction : There are two methods of computing interest on the principal the simple interest and ...

Q: John Mayer Inc. purchases a house for $500,000. On January 1, He makes a 20 percent down-payment and...

A:

Q: Which of the following statements is / are TRUE about the payback period method of investment apprai...

A:

Q: YIELD CURVES Plots interest rates on different securities of similar default risk for a given day Us...

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one...

Q: do the task with excel and manually if possible.thx A fishing pond entrepreneur has a plan to build ...

A: Loan refers to the amount of money that is lent from one party to another party whenever there is a ...

Q: How did the introduction of mortgage financing help shape American cities after WWII? Group of answe...

A: Mortgage financing boomed in US after second world war, under which potential homebuyers could get l...

Q: How long will it take P 3,000 pesos to accumulate P 3,500 in a bank savings account at 0.25% compoun...

A: Present value (PV) = P3000 Future value (FV) = P3500 Interest rate = 0.25% Monthly interest rate (r)...

Q: Bounty Brands has hired your firm to evaluate its ratios relating to productivity. The CFO, Tyrion L...

A: Asset turnover ratio measures the efficiency of assets in generating revenue of the company.

Q: 2. Suppose you bought a condo for $200,000 financing it with a $40,000 down payment of your own fund...

A: 1. Calculation of Return on Assets (ROA) as follows: Cost of Condo = $200,000 Down payment = $40,000...

Q: Assume you expect a company’s net income to remain stable at $3500 for all future years, and you exp...

A: The Capital asset pricing Model is widely used for estimating the cost of equity. The CAPM formula i...

Q: ash $ 29,000,000 Common stock ($60 par; 1,500,000 shares outstanding) 90,000,000 Additional paid-i...

A: Dividend is the distribution of earning, dividend can be distributed in two ways Cash Dividend Stoc...

Q: 11. A share of stock is expected to pay dividend of £2 in Year 1 and £2.5 in Year 2. The stock will ...

A: The valuation of an equity share depends upon two variables:- Estimating the expected future cash i...

Q: do assignments using excel and manually if possibly A student plans to open a business with the cour...

A: Loan amount (PV) = $1740.11 Interest rate (r) = 6% Period (n) = 5 Years

Q: The one year interest rate over the next ten years will be 6%, 7.5%, 8.5%, 10%, 10.5%, 11%, 12%, 13%...

A: Here, One year interest rate over the next ten years will be as follows: R1 is 6%, E2R1 is 7.5%, E3R...

Q: Belinda invested a sum of money for her two-year-old child education in the amount of fifty thousand...

A: Compounding is a strategy for calculating the future value (FV) of current cashflows using a mention...

Q: 4-1 What is the monthly payment for the conventional mortgage? Do they qualify for the conventional ...

A: Mortgage: A mortgage represents the loan taken by the borrower from the lender to purchase houses an...

Q: nswer the questions based on P/E ratios per company given. Industry: Apparel Industry average P/E: ...

A: The Price Earnings Ratio: The Price-earnings ratio is a well known and widely used ratio to assess h...

Q: Nowadays it is very important to reduce one's carbon "footprint" (how much carbon we produce in our ...

A: IRR is the rate of return at which Net present value of the Investment is zero. If The IRR is great...

Q: Find the i (the rate per period) and n (the number of periods) for the following loan at the given a...

A:

Q: At what annual interest rate must $232,000 be invested so that it will grow to be $417,000 in 12 yea...

A: Present value = $232000 Future value = $417000 Period = 12 Years

Step by step

Solved in 2 steps

- 21. Which is FALSE in withholding tax system? S1 It is one method by which the government collects money from taxpayers S2 - It is a source of third-party information S3 - The withholding tax collected may be used by the company for working capital provided the money is remitted on time 54 - A withholding agent is the agent of the government A. S1 B. S2 C. S3 D. S4 23. Nicanor sold his residential lot located in Iloilo City. The Deed of Absolute Sale is dated January 31, 2021. When is the respective deadline of the payment of the capital gains tax and documentary stamp tax? A. March 1, 2021, February 5, 2021 B. February 28, 2021, February 5, 2021 C. March 1, 2021 and March 5, 2021 D. February 5, 2021 and March 5, 2021 24. It is a certification issued by the Commissioner or his duly authorized representative attesting that the transfer has been reported and the taxes have been fully paid. A. Electronic Certificate of Authority to Register B. Electronic Certificate of Authority for…Which is an incorrect statement regarding taxes? * a. Taxes are necessary for the continued existence of the government. b. The obligation to pay tax does not rest upon the privilege enjoyed by or the protection afforded to the citizen of the government but upon the necessity of money for the support of the state. c. There should be personal benefit enjoyed from the government before one is required to pay tax. d. Taxes should be collected without unnecessary delay but its collection should not be tainted with arbitrariness. e. Answer not given1. The following defines taxation, except: * a. It is an inherent power of the state. b. It is an executive prerogative. c. It is a process of collecting contributions. d.It is a mode of allocating government costs or burden to the people. 2. It is an economic principle that states that the amount of tax an individual pays should be dependent on the level of burden the tax will create relative to the wealth of the individual. * a. Cost allocation b. Ability to pay c. Benefit received d. Lifeblood doctrine

- 1.) Which theory of taxation states that without taxes, a government would be paralyzed for lack of power to activate and operate it, resulting in its destruction? a. Lifeblood theory b. Reciprocity Theory c. Symbiotic theory 2.) Which type of tax is already repealed by the CREATE Act? a. Regular Corporate Income Tax b. Minimum Corporate Income Tax c. Improperly Accumulated Earnings Tax d. Percentage Tax8 Which of the following statements is/are correct?I. The test for exemption from real property tax of private educational institutions is its use and not ownership.II. As a general rule, a tax exemption is an act of liberality which can be revoked by the government.III. Taxes are paid only by those who are directly benefiting from the government.IV. All revenue bills must originate from the Senate.V. All laws granting tax exemption must be approved by a two-thirds (2/3) vote of all the members of the Congress. Group of answer choices Answer not given I, III, IV and V All statements are incorrect All statements are correct I and II II, III, IV and V I, II and IVStatement 1: Government owned and controlled corporations are taxable on their income as such. Statement 2: Social Security System (SSS), a GOCC, is tax-exempt on its income as such. a. Both statements are true b. Both statements are false c. Only statement 1 is true d. Only statement 2 is true

- Which one of the following statements is NOT correct about taxation? (A) Taxes produce revenue for government operations. (B) Itemized deductions provide a larger deduction amount than the standard deduction. (C) Taxation is used to influence the behavior of individuals, businesses, nonprofit entities, and even the government. (D) Tax rates and deductions are impacted by a taxpayer’s filing status.ST. 1 The aspects of taxation are shared by the executive and legislative branches of the government. ST. 2 Taxes should be prospective and shouldn't be given retroactive effect because they are burdens. Which is correct? A. Both B. ST. 1 only C. ST. 2 only D. None23. Which is TRUE? S1: All taxpayers engaged in trade are allowed to use either itemized or optional standard deduction. S2: Exempt corporations are required to report their income. S3: A registered barangay-micro business enterprise who is exempt from paying income tax is also exempt from filing income tax return. S4: A senior citizen who is engaged in trade or business is exempt from taxation. Group of answer choices a. S1 d. S4 b. S2 c. S3

- 4 Which of the following statements is/are correct?I. Tax evasion in one year can be offset by paying excessive taxes in the following year.II. Taxation can be exercised by local government units even without a previous constitutional authorityIII. Tax laws should always be aimed at revenue collection.IV. A tax is a voluntary donation to the government.V. The salary of the President of the Philippines is not subject to income tax. Group of answer choices Answer not given I, IV and V All statements are correct IV and V II, III and V III, IV and V All statements are incorrect19. S1: The salaries of the Chief Justice and associate justices of the Supreme court are tax-exempt. S2: The salary of the Commissioner of Internal Revenue is exempt from income tax. Group of answer choices d. Both are false c. Both are true a. Only S1 is true b. Only S2 is trueWhich of the following statements is (are) correct? (x) Part of the administrative burden of a tax is the cost of implementing and administering government programs that use the tax revenue that is collected (y) A tax loophole occurs when tax laws give preferential treatment to specific types of behavior. (z) A mortgage interest deduction would be considered a tax loophole because it allows home purchasers to reduce their tax liability when they pay mortgage interest. A. (x), (y) and (z) B. (x) and (y) only C. (x) and (z) only D. (y) and (z) only E. (y) only