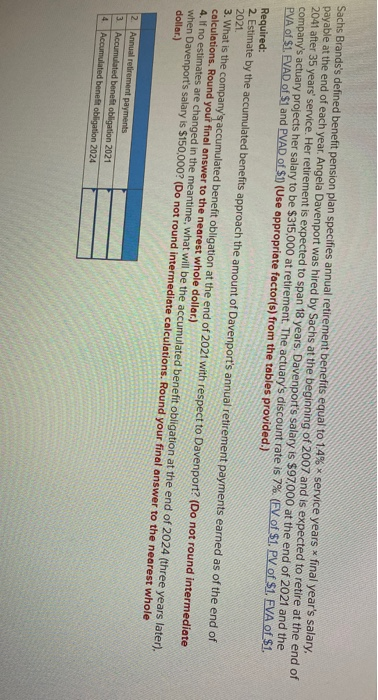

Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1,4% * service years x final year's salary. payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $97,000 at the end of 2021 and the company's actuary projects her salary to be $315,000 at retirement. The actuary's discount rate is 7%. (EV of $1. PV of $1, EVA of S1. PVA of $1. EVAD of $1 and PVAD of S1) (Use appropriate factor(s) from the tables provided.) Required: 2. Estimate by the accumulated benefits approach the amount of Davenport's annual retirement payments earned as of the end of 2021. 3. What is the company'yaccumulated benefit obligation at the end of 2021 with respect to Davenport? (Do not round intermediate calculations. Round yout final answer to the nearest whole dollar.) 4. f no estimates are changed in the meantime, what will be the accumulated benefit obligation at the end of 2024 (three years later), when Davenport's salary is $150,000? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) 2. Annual retirement payments Accumulated beneft obligation 2021 4 Accumulated beneft obligation 2024

Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1,4% * service years x final year's salary. payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $97,000 at the end of 2021 and the company's actuary projects her salary to be $315,000 at retirement. The actuary's discount rate is 7%. (EV of $1. PV of $1, EVA of S1. PVA of $1. EVAD of $1 and PVAD of S1) (Use appropriate factor(s) from the tables provided.) Required: 2. Estimate by the accumulated benefits approach the amount of Davenport's annual retirement payments earned as of the end of 2021. 3. What is the company'yaccumulated benefit obligation at the end of 2021 with respect to Davenport? (Do not round intermediate calculations. Round yout final answer to the nearest whole dollar.) 4. f no estimates are changed in the meantime, what will be the accumulated benefit obligation at the end of 2024 (three years later), when Davenport's salary is $150,000? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) 2. Annual retirement payments Accumulated beneft obligation 2021 4 Accumulated beneft obligation 2024

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 1E

Related questions

Question

Transcribed Image Text:Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1,4% x service years x final year's salary,

payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of

2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $97,000 at the end of 2021 and the

company's actuary projects her salary to be $315,000 at retirement. The actuary's discount rate is 7%. (EV of $1. PV of $1. FVA of $1.

PVA of $1. EVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.)

Required:

2 Estimate by the accumulated benefits approach the amount of Davenport's annual retirement payments earned as of the end of

2021.

3. What is the company's accumulated benefit obligation at the end of 2021 with respect to Davenport? (Do not round intermediate

calculations. Round yout final answer to the nearest whole dollar.)

4. If no estimates are changed in the meantime, what will be the accumulated benefit obligation at the end of 2024 (three years later).

when Davenport's salary is $150,000? (Do not round intermediate calculations. Round your final answer to the nearest whole

dollar.)

2. Annual refirement payments

3. Accumulated benefit obligation 2021

4. Accumulated benefit obligation 2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT