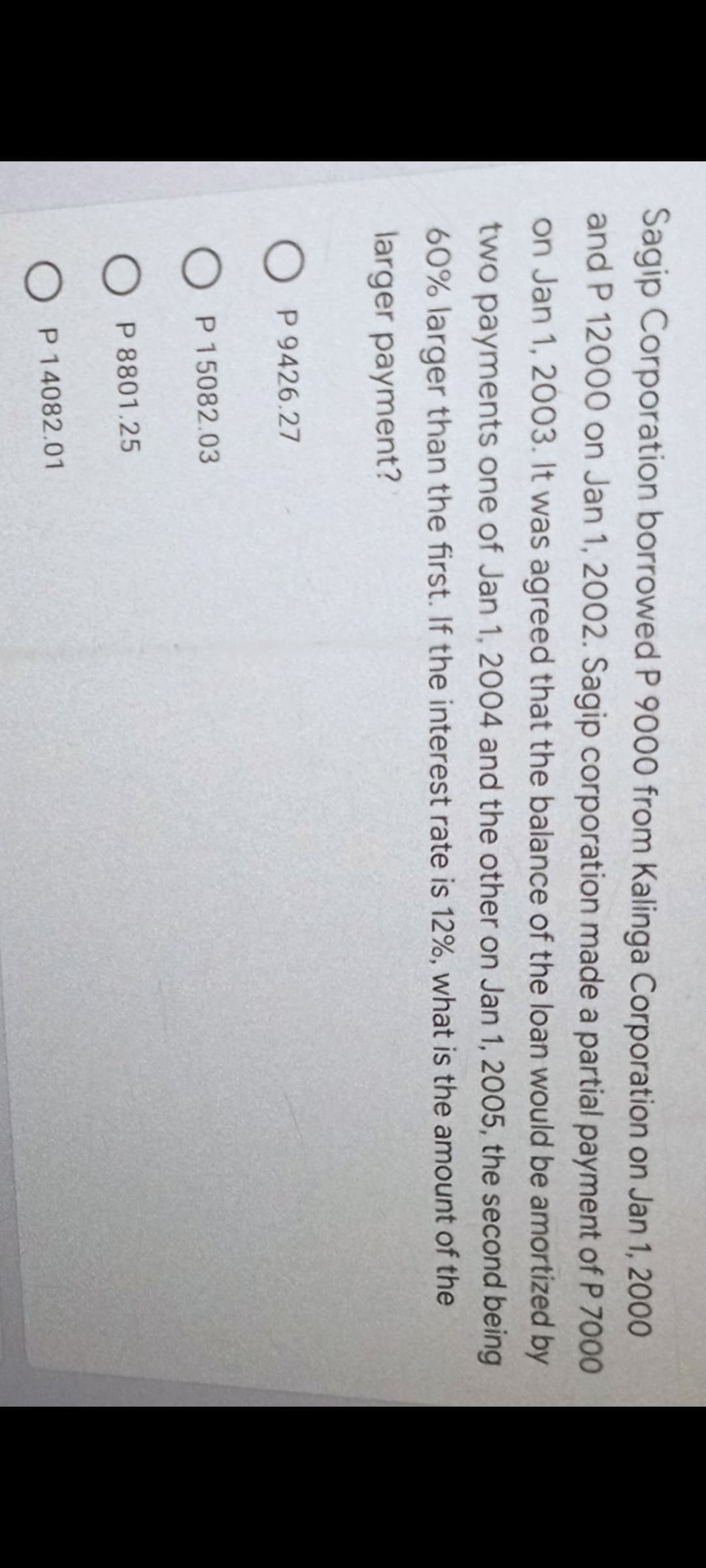

Sagip Corporation borrowed P 9000 from Kalinga Corporation on Jan 1, 2000 and P 12000 on Jan 1, 2002. Sagip corporation made a partial payment of P 7000 on Jan 1, 2003. It was agreed that the balance of the loan would be amortized by two payments one of Jan 1, 2004 and the other on Jan 1, 2005, the second being 60% larger than the first. If the interest rate is 12%, what is the amount of the larger payment? O P 9426.27 O P15082.03 O P 8801.25 O P14082.01

Sagip Corporation borrowed P 9000 from Kalinga Corporation on Jan 1, 2000 and P 12000 on Jan 1, 2002. Sagip corporation made a partial payment of P 7000 on Jan 1, 2003. It was agreed that the balance of the loan would be amortized by two payments one of Jan 1, 2004 and the other on Jan 1, 2005, the second being 60% larger than the first. If the interest rate is 12%, what is the amount of the larger payment? O P 9426.27 O P15082.03 O P 8801.25 O P14082.01

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 10P: The D.J. Masson Corporation needs to raise $500,000 for 1 year to supply working capital to a new...

Related questions

Question

Transcribed Image Text:Sagip Corporation borrowed P 9000 from Kalinga Corporation on Jan 1, 2000

and P 12000 on Jan 1, 2002. Sagip corporation made a partial payment of P 7000

on Jan 1, 2003. It was agreed that the balance of the loan would be amortized by

two payments one of Jan 1, 2004 and the other on Jan 1, 2005, the second being

60% larger than the first. If the interest rate is 12%, what is the amount of the

larger payment?

O P 9426.27

O P 15082.03

O P 8801.25

P 14082.01

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT