Sale of an capital assets

Chapter4: Additional Income And The Qualified Business Income Deduction

Section: Chapter Questions

Problem 19MCQ

Related questions

Question

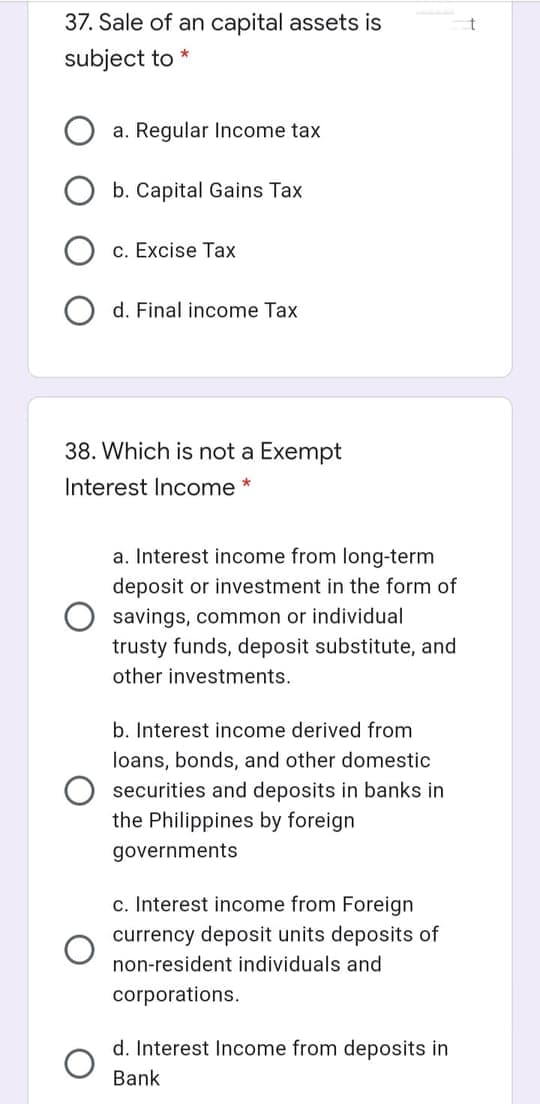

Transcribed Image Text:37. Sale of an capital assets is

subject to *

a. Regular Income tax

b. Capital Gains Tax

c. Excise Tax

d. Final income Tax

38. Which is not a Exempt

Interest Income *

a. Interest income from long-term

deposit or investment in the form of

savings, common or individual

trusty funds, deposit substitute, and

other investments.

b. Interest income derived from

loans, bonds, and other domestic

securities and deposits in banks in

the Philippines by foreign

governments

c. Interest income from Foreign

currency deposit units deposits of

non-resident individuals and

corporations.

d. Interest Income from deposits in

Bank

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT