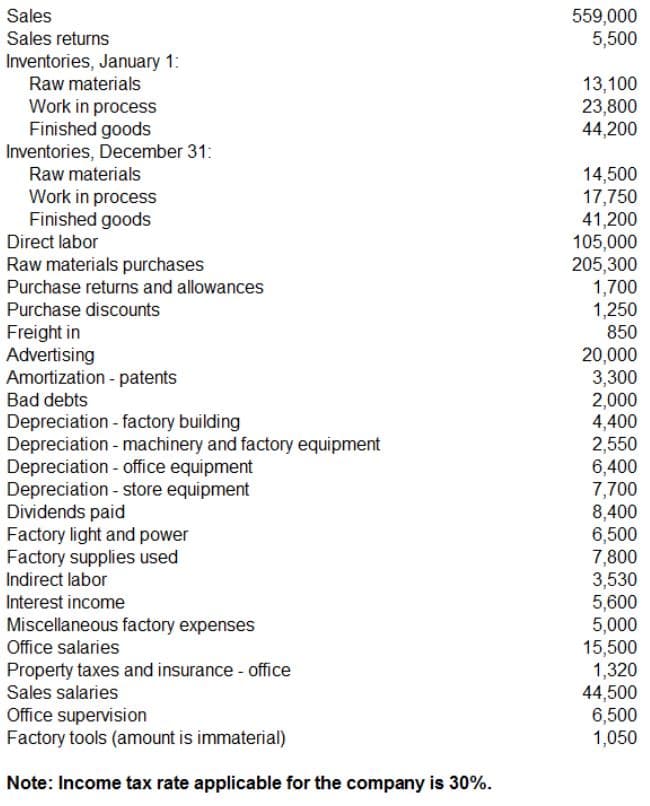

Sales 559,000 5,500 Sales returns Inventories, January 1: Raw materials Work in process Finished goods Inventories, December 31: 13,100 23,800 44,200 Raw materials 14,500 17,750 41,200 105,000 205,300 1,700 1,250 Work in process Finished goods Direct labor Raw materials purchases Purchase returns and allowances Purchase discounts Freight in Advertising Amortization - patents 850 20,000 3,300 2,000 4,400 2,550 6,400 7,700 8,400 6,500 7,800 3,530 5,600 5,000 15,500 1,320 44,500 6,500 1,050 Bad debts Depreciation - factory building Depreciation - machinery and factory equipment Depreciation - office equipment Depreciation - store equipment Dividends paid Factory light and power Factory supplies used Indirect labor Interest income Miscellaneous factory expenses Office salaries Property taxes and insurance - office Sales salaries Office supervision Factory tools (amount is immaterial) Note: Income tax rate applicable for the company is 30%.

Sales 559,000 5,500 Sales returns Inventories, January 1: Raw materials Work in process Finished goods Inventories, December 31: 13,100 23,800 44,200 Raw materials 14,500 17,750 41,200 105,000 205,300 1,700 1,250 Work in process Finished goods Direct labor Raw materials purchases Purchase returns and allowances Purchase discounts Freight in Advertising Amortization - patents 850 20,000 3,300 2,000 4,400 2,550 6,400 7,700 8,400 6,500 7,800 3,530 5,600 5,000 15,500 1,320 44,500 6,500 1,050 Bad debts Depreciation - factory building Depreciation - machinery and factory equipment Depreciation - office equipment Depreciation - store equipment Dividends paid Factory light and power Factory supplies used Indirect labor Interest income Miscellaneous factory expenses Office salaries Property taxes and insurance - office Sales salaries Office supervision Factory tools (amount is immaterial) Note: Income tax rate applicable for the company is 30%.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.16E: Product cost concept of product pricing Based on the data presented in Exercise 12-15, assume that...

Related questions

Question

WHAT IS THE TOTAL NET INCOME AFTER TAX 2021?

Transcribed Image Text:Sales

559,000

5,500

Sales returns

Inventories, January 1:

Raw materials

Work in process

Finished goods

Inventories, December 31:

13,100

23,800

44,200

14,500

17,750

41,200

105,000

205,300

1,700

1,250

Raw materials

Work in process

Finished goods

Direct labor

Raw materials purchases

Purchase returns and allowances

Purchase discounts

Freight in

Advertising

Amortization - patents

850

20,000

3,300

2,000

4,400

2,550

6,400

7,700

8,400

6,500

7,800

3,530

5,600

5,000

15,500

1,320

44,500

6,500

1,050

Bad debts

Depreciation - factory building

Depreciation - machinery and factory equipment

Depreciation - office equipment

Depreciation - store equipment

Dividends paid

Factory light and power

Factory supplies used

Indirect labor

Interest income

Miscellaneous factory expenses

Office salaries

Property taxes and insurance - office

Sales salaries

Office supervision

Factory tools (amount is immaterial)

Note: Income tax rate applicable for the company is 30%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning