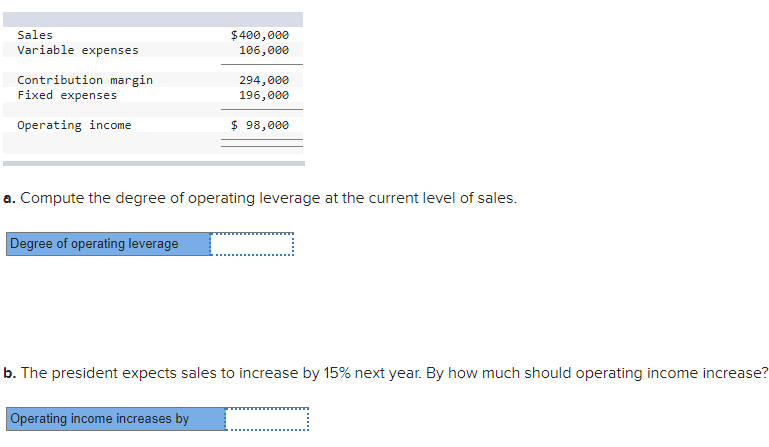

Sales $400,000 106,000 Variable expenses Contribution margin Fixed expenses 294,000 196,000 Operating income $ 98,000 a. Compute the degree of operating leverage at the current level of sales. Degree of operating leverage b. The president expects sales to increase by 15% next year. By how much should operating income increase? Operating income increases by

Sales $400,000 106,000 Variable expenses Contribution margin Fixed expenses 294,000 196,000 Operating income $ 98,000 a. Compute the degree of operating leverage at the current level of sales. Degree of operating leverage b. The president expects sales to increase by 15% next year. By how much should operating income increase? Operating income increases by

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 20MC: Wallace Industries has total contribution margin of $58,560 and net income of $24,400 for the month...

Related questions

Question

Transcribed Image Text:Sales

$400,000

106,000

Variable expenses

Contribution margin

Fixed expenses

294,000

196,000

Operating income

$ 98,000

a. Compute the degree of operating leverage at the current level of sales.

Degree of operating leverage

b. The president expects sales to increase by 15% next year. By how much should operating income increase?

Operating income increases by

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning