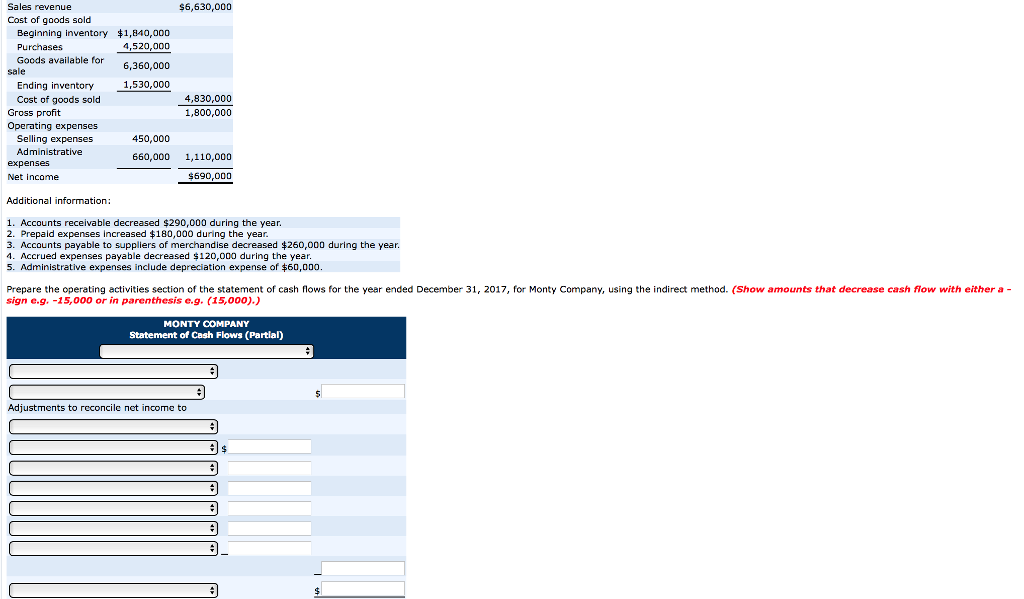

Sales revenue Cost of goods sold Beginning inventory $1,840,000 Purchases Goods available for sale Ending inventory $6,630,000 4,520,000 6,360,000 1,530,000 Cost of goods sold 4,830,000 Gross profit 1,800,000 Operating expenses Selling expenses 450,000 Administrative 660,000 1,110,000 expenses $690,000 Net income Additional information: 1. Accounts receivable decreased $290,000 during the year. 2. Prepaid expenses Increased $180,000 during the year. 3. Accounts payable to suppliers of merchandise decreased $260,000 during the year. 4. Accrued expenses payable decreased $120,000 during the year. 5. Administrative expenses include depreciation expense of $60,000. Prepare the operating activities section of the statement of cash flows for the year ended December 31, 2017, for Monty Company, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) MONTY COMPANY Statement of Cash Flows (Partial) Adjustments to reconcile net income to $

Sales revenue Cost of goods sold Beginning inventory $1,840,000 Purchases Goods available for sale Ending inventory $6,630,000 4,520,000 6,360,000 1,530,000 Cost of goods sold 4,830,000 Gross profit 1,800,000 Operating expenses Selling expenses 450,000 Administrative 660,000 1,110,000 expenses $690,000 Net income Additional information: 1. Accounts receivable decreased $290,000 during the year. 2. Prepaid expenses Increased $180,000 during the year. 3. Accounts payable to suppliers of merchandise decreased $260,000 during the year. 4. Accrued expenses payable decreased $120,000 during the year. 5. Administrative expenses include depreciation expense of $60,000. Prepare the operating activities section of the statement of cash flows for the year ended December 31, 2017, for Monty Company, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) MONTY COMPANY Statement of Cash Flows (Partial) Adjustments to reconcile net income to $

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 58E: Analyzing Inventory The recent financial statements of McLelland Clothing Inc. include the following...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Sales revenue

Cost of goods sold

Beginning inventory $1,840,000

Purchases

Goods available for

sale

Ending inventory

$6,630,000

4,520,000

6,360,000

1,530,000

Cost of goods sold

4,830,000

Gross profit

1,800,000

Operating expenses

Selling expenses

450,000

Administrative

660,000

1,110,000

expenses

$690,000

Net income

Additional information:

1. Accounts receivable decreased $290,000 during the year.

2. Prepaid expenses Increased $180,000 during the year.

3. Accounts payable to suppliers of merchandise decreased $260,000 during the year.

4. Accrued expenses payable decreased $120,000 during the year.

5. Administrative expenses include depreciation expense of $60,000.

Prepare the operating activities section of the statement of cash flows for the year ended December 31, 2017, for Monty Company, using the indirect method. (Show amounts that decrease cash flow with either a -

sign e.g. -15,000 or in parenthesis e.g. (15,000).)

MONTY COMPANY

Statement of Cash Flows (Partial)

Adjustments to reconcile net income to

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,