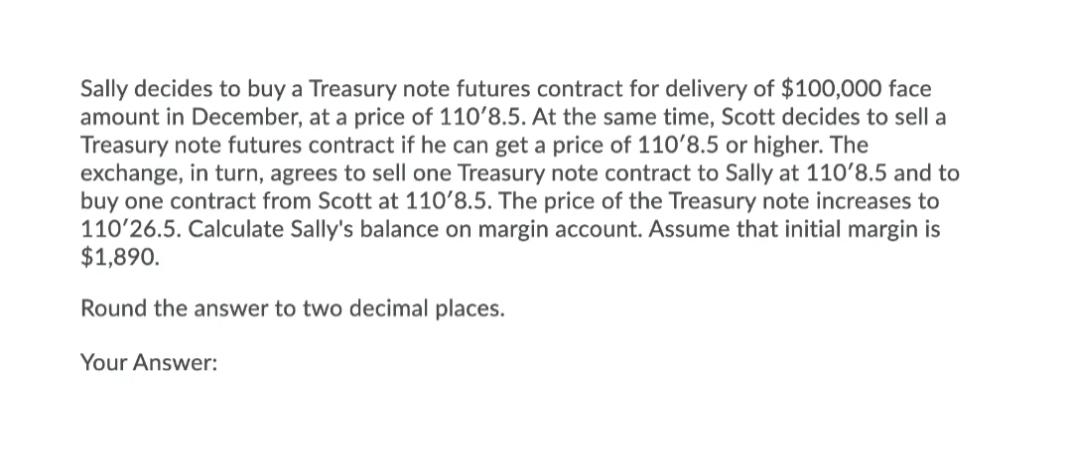

Sally decides to buy a Treasury note futures contract for delivery of $100,000 face amount in December, at a price of 110'8.5. At the same time, Scott decides to sell a Treasury note futures contract if he can get a price of 110'8.5 or higher. The exchange, in turn, agrees to sell one Treasury note contract to Sally at 110'8.5 and to buy one contract from Scott at 110'8.5. The price of the Treasury note increases to 110'26.5. Calculate Sally's balance on margin account. Assume that initial margin is $1,890. Round the answer to two decimal places. Your Answer:

Sally decides to buy a Treasury note futures contract for delivery of $100,000 face amount in December, at a price of 110'8.5. At the same time, Scott decides to sell a Treasury note futures contract if he can get a price of 110'8.5 or higher. The exchange, in turn, agrees to sell one Treasury note contract to Sally at 110'8.5 and to buy one contract from Scott at 110'8.5. The price of the Treasury note increases to 110'26.5. Calculate Sally's balance on margin account. Assume that initial margin is $1,890. Round the answer to two decimal places. Your Answer:

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 3SBD

Related questions

Question

Transcribed Image Text:Sally decides to buy a Treasury note futures contract for delivery of $100,000 face

amount in December, at a price of 110'8.5. At the same time, Scott decides to sell a

Treasury note futures contract if he can get a price of 110'8.5 or higher. The

exchange, in turn, agrees to sell one Treasury note contract to Sally at 110ʻ8.5 and to

buy one contract from Scott at 110ʻ8.5. The price of the Treasury note increases to

110'26.5. Calculate Sally's balance on margin account. Assume that initial margin is

$1,890.

Round the answer to two decimal places.

Your Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you