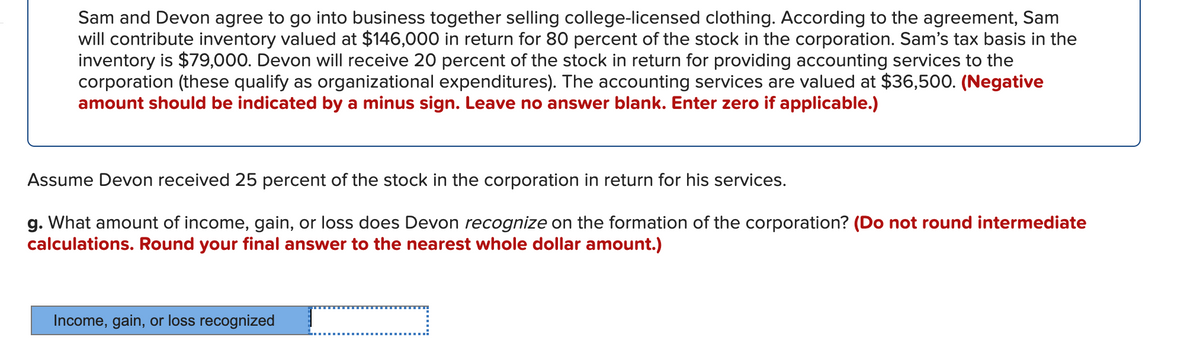

Sam and Devon agree to go into business together selling college-licensed clothing. According to the agreement, Sam will contribute inventory valued at $146,000 in return for 80 percent of the stock in the corporation. Sam's tax basis in the inventory is $79,000. Devon will receive 20 percent of the stock in return for providing accounting services to the corporation (these qualify as organizational expenditures). The accounting services are valued at $36,500. (Negative amount should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.) Assume Devon received 25 percent of the stock in the corporation in return for his services. g. What amount of income, gain, or loss does Devon recognize on the formation of the corporation? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.)

Sam and Devon agree to go into business together selling college-licensed clothing. According to the agreement, Sam will contribute inventory valued at $146,000 in return for 80 percent of the stock in the corporation. Sam's tax basis in the inventory is $79,000. Devon will receive 20 percent of the stock in return for providing accounting services to the corporation (these qualify as organizational expenditures). The accounting services are valued at $36,500. (Negative amount should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.) Assume Devon received 25 percent of the stock in the corporation in return for his services. g. What amount of income, gain, or loss does Devon recognize on the formation of the corporation? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.)

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 30P

Related questions

Question

100%

Transcribed Image Text:Sam and Devon agree to go into business together selling college-licensed clothing. According to the agreement, Sam

will contribute inventory valued at $146,000 in return for 80 percent of the stock in the corporation. Sam's tax basis in the

inventory is $79,000. Devon will receive 20 percent of the stock in return for providing accounting services to the

corporation (these qualify as organizational expenditures). The accounting services are valued at $36,500. (Negative

amount should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.)

Assume Devon received 25 percent of the stock in the corporation in return for his services.

g. What amount of income, gain, or loss does Devon recognize on the formation of the corporation? (Do not round intermediate

calculations. Round your final answer to the nearest whole dollar amount.)

Income, gain, or loss recognized

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you