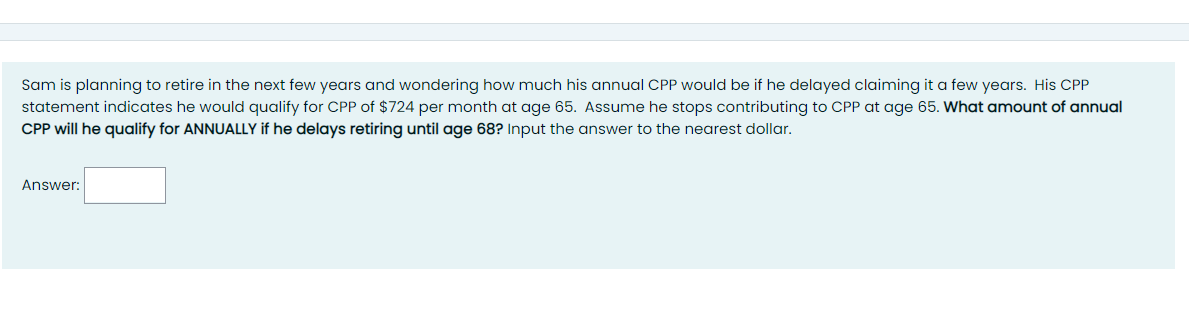

Sam is planning to retire in the next few years and wondering how much his annual CPP would be if he delayed claiming it a few years. His CPP statement indicates he would qualify for CPP of $724 per month at age 65. Assume he stops contributing to CPP at age 65. What amount of annual CPP will he qualify for ANNUALLY if he delays retiring until age 68? Input the answer to the nearest dollar. Answer:

Sam is planning to retire in the next few years and wondering how much his annual CPP would be if he delayed claiming it a few years. His CPP statement indicates he would qualify for CPP of $724 per month at age 65. Assume he stops contributing to CPP at age 65. What amount of annual CPP will he qualify for ANNUALLY if he delays retiring until age 68? Input the answer to the nearest dollar. Answer:

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 50P

Related questions

Question

Transcribed Image Text:Sam is planning to retire in the next few years and wondering how much his annual CPP would be if he delayed claiming it a few years. His CPP

statement indicates he would qualify for CPP of $724 per month at age 65. Assume he stops contributing to CPP at age 65. What amount of annual

CPP will he qualify for ANNUALLY if he delays retiring until age 68? Input the answer to the nearest dollar.

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT