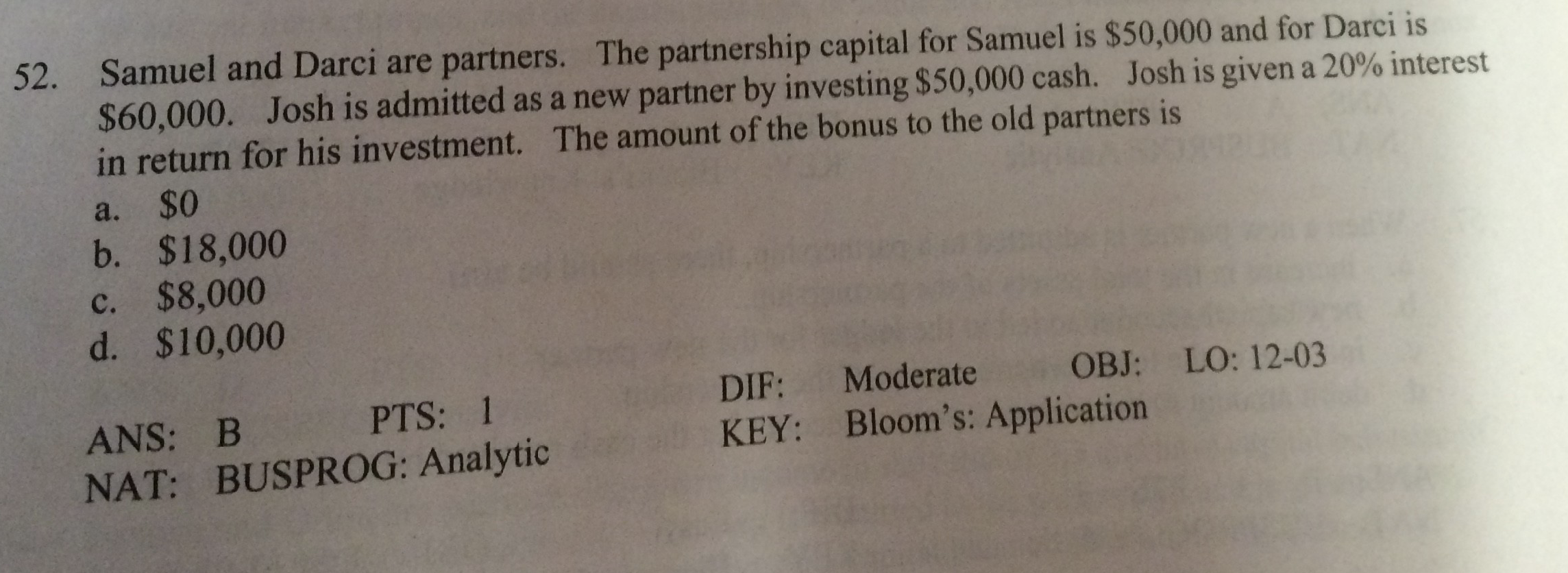

Samuel and Darci are partners. The partnership capital for Samuel is $50,000 and for Darci is $60,000. Josh is admitted as a new partner by investing $50,000 cash. Josh is given a 20% interest in return for his investment. The amount of the bonus to the old partners is 52. $0 b. $18,000 c. $8,000 d. $10,000 a. OBJ: LO: 12-03 DIF: Moderate PTS: 1 ANS: B KEY: Bloom's: Application NAT: BUSPROG: Analytic

Samuel and Darci are partners. The partnership capital for Samuel is $50,000 and for Darci is $60,000. Josh is admitted as a new partner by investing $50,000 cash. Josh is given a 20% interest in return for his investment. The amount of the bonus to the old partners is 52. $0 b. $18,000 c. $8,000 d. $10,000 a. OBJ: LO: 12-03 DIF: Moderate PTS: 1 ANS: B KEY: Bloom's: Application NAT: BUSPROG: Analytic

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 11MC: Thandie and Marco are partners with capital balances of $60,000. They share profits and losses at...

Related questions

Question

Transcribed Image Text:Samuel and Darci are partners. The partnership capital for Samuel is $50,000 and for Darci is

$60,000. Josh is admitted as a new partner by investing $50,000 cash. Josh is given a 20% interest

in return for his investment. The amount of the bonus to the old partners is

52.

$0

b. $18,000

c. $8,000

d. $10,000

a.

OBJ: LO: 12-03

DIF: Moderate

PTS: 1

ANS: B

KEY: Bloom's: Application

NAT: BUSPROG: Analytic

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College