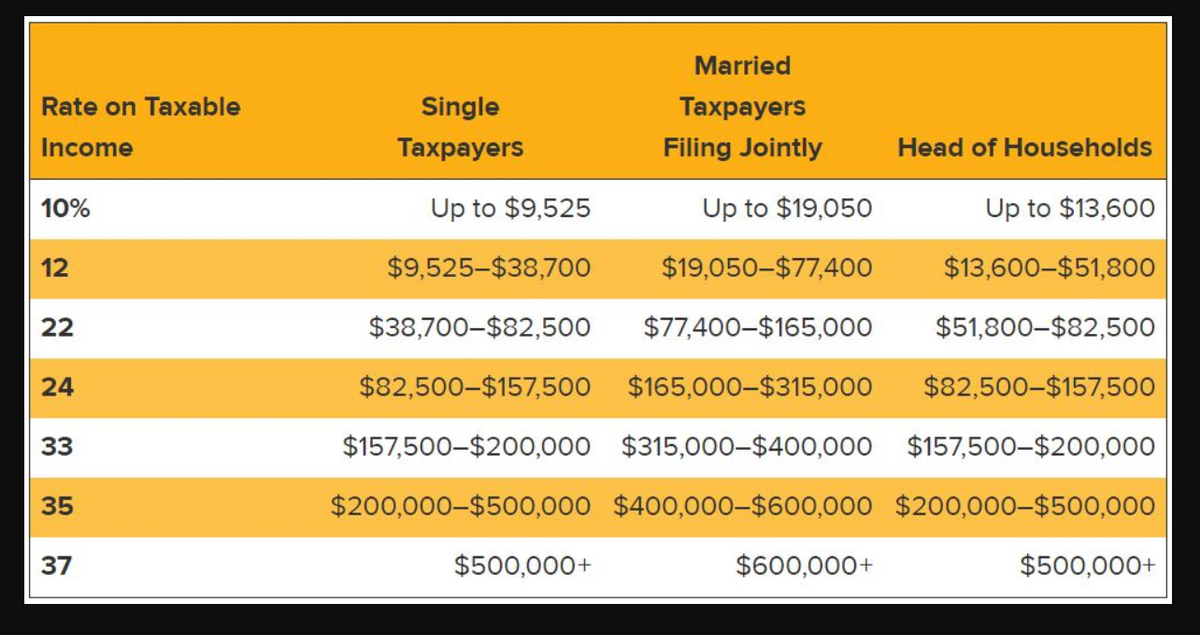

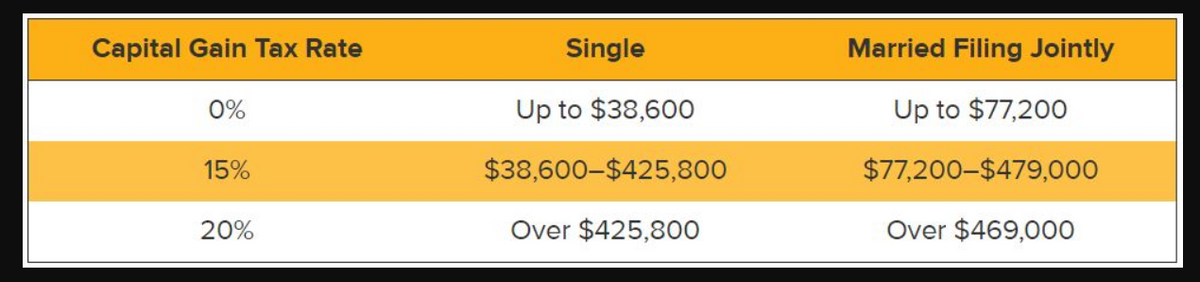

Samuel Jenkins made two investments; the first was 13 months ago and the second was two months ago. He just sold both investments and has a capital gain of $10,000 on each. If Samuel is single and has taxable income of $40,000, what will be the amount of capital gains tax on each investment? See Capital Gains table and Taxable income rate table. Investment 1: held 13 months: whats the capital gains tax? Investment 2: held 2 months: Whats the capital gains tax?

Samuel Jenkins made two investments; the first was 13 months ago and the second was two months ago. He just sold both investments and has a capital gain of $10,000 on each. If Samuel is single and has taxable income of $40,000, what will be the amount of capital gains tax on each investment? See Capital Gains table and Taxable income rate table. Investment 1: held 13 months: whats the capital gains tax? Investment 2: held 2 months: Whats the capital gains tax?

Chapter28: Income Taxati On Of Trusts And Estates

Section: Chapter Questions

Problem 5BCRQ

Related questions

Question

Samuel Jenkins made two investments; the first was 13 months ago and the second was two months ago. He just sold both investments and has a

Investment 1: held 13 months: whats the capital gains tax?

Investment 2: held 2 months: Whats the capital gains tax?

Transcribed Image Text:Married

Rate on Taxable

Single

Taxpayers

Income

Тахраyers

Filing Jointly

Head of Households

10%

Up to $9,525

Up to $19,050

Up to $13,600

12

$9,525-$38,700

$19,050-$77,400

$13,600-$51,800

22

$38,700-$82,500

$77,400-$165,000

$51,800-$82,500

24

$82,500-$157,500 $165,000-$315,000

$82,500-$157,500

33

$157,500-$200,000 $315,000-$400,000 $157,500-$200,000

35

$200,000-$500,000 $400,000-$600,000 $200,000-$500,000

37

$500,000+

$600,000+

$500,000+

Transcribed Image Text:Capital Gain Tax Rate

Single

Married Filing Jointly

0%

Up to $38,60O

Up to $77,200

15%

$38,600-$425,800

$77,200-$479,000

20%

Over $425,800

Over $469,000

Expert Solution

Step 1

Investment 1 - made 13 months ago -

The tax rate for long-term capital gains for taxable income of $40,000 is 15%, so capital gain tax amount is : $10,000 x 15% = $1500

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you