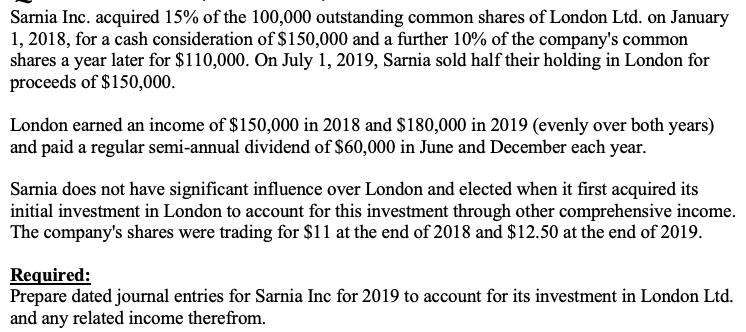

Sarnia Inc. acquired 15% of the 100,000 outstanding common shares of London Ltd. on January 1, 2018, for a cash consideration of $150,000 and a further 10% of the company's common shares a year later for $110,000. On July 1, 2019, Sarnia sold half their holding in London for proceeds of $150,000. London earned an income of $150,000 in 2018 and $180,000 in 2019 (evenly over both years) and paid a regular semi-annual dividend of $60,000 in June and December each year. Sarnia does not have significant influence over London and elected when it first acquired its initial investment in London to account for this investment through other comprehensive income. The company's shares wvere trading for $11 at the end of 2018 and $12 50 at the end of 2019

Sarnia Inc. acquired 15% of the 100,000 outstanding common shares of London Ltd. on January 1, 2018, for a cash consideration of $150,000 and a further 10% of the company's common shares a year later for $110,000. On July 1, 2019, Sarnia sold half their holding in London for proceeds of $150,000. London earned an income of $150,000 in 2018 and $180,000 in 2019 (evenly over both years) and paid a regular semi-annual dividend of $60,000 in June and December each year. Sarnia does not have significant influence over London and elected when it first acquired its initial investment in London to account for this investment through other comprehensive income. The company's shares wvere trading for $11 at the end of 2018 and $12 50 at the end of 2019

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Please include each step of calculation for my reference. Thanks a lot.

Transcribed Image Text:Sarnia Inc. acquired 15% of the 100,000 outstanding common shares of London Ltd. on January

1, 2018, for a cash consideration of $150,000 and a further 10% of the company's common

shares a year later for $110,000. On July 1, 2019, Sarnia sold half their holding in London for

proceeds of $150,000.

London earned an income of $150,000 in 2018 and $180,000 in 2019 (evenly over both years)

and paid a regular semi-annual dividend of $60,000 in June and December each year.

Sarnia does not have significant influence over London and elected when it first acquired its

initial investment in London to account for this investment through other comprehensive income.

The company's shares were trading for $11 at the end of 2018 and $12.50 at the end of 2019.

Required:

Prepare dated journal entries for Sarnia Inc for 2019 to account for its investment in London Ltd.

and any related income therefrom.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning