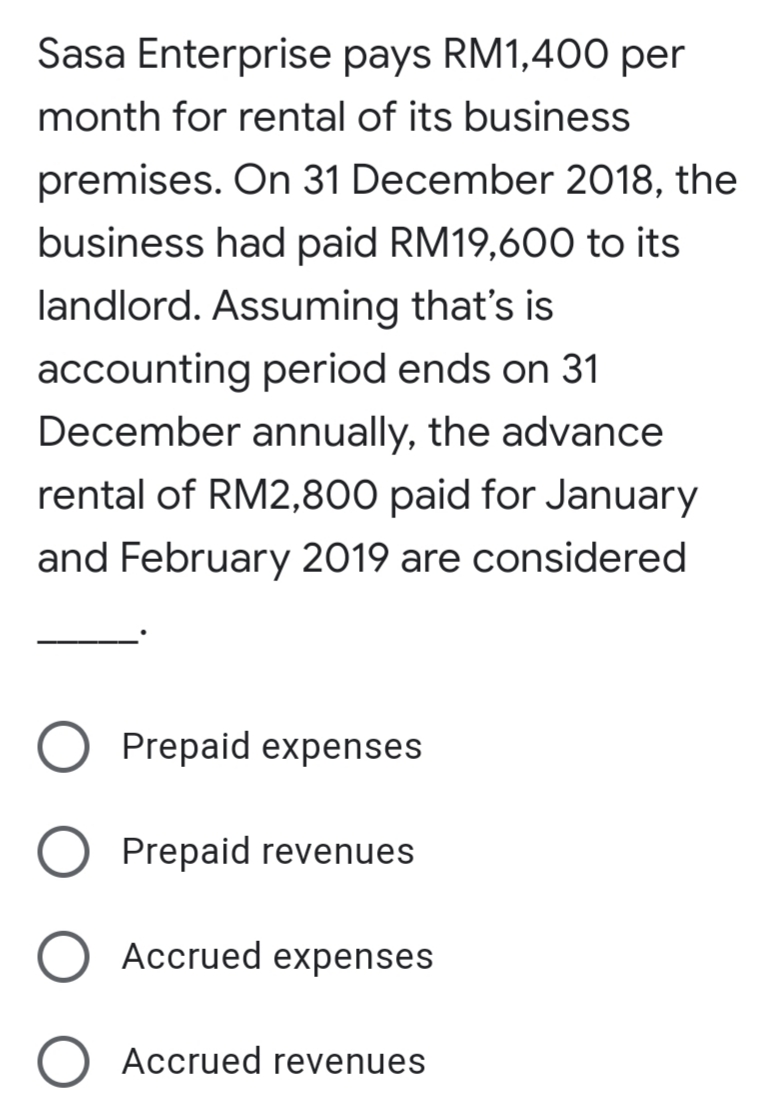

Sasa Enterprise pays RM1,400 per month for rental of its business premises. On 31 December 2018, the business had paid RM19,600 to its landlord. Assuming that's is accounting period ends on 31 December annually, the advance rental of RM2,800 paid for January and February 2019 are considered Prepaid expenses Prepaid revenues Accrued expenses Accrued revenues

Sasa Enterprise pays RM1,400 per month for rental of its business premises. On 31 December 2018, the business had paid RM19,600 to its landlord. Assuming that's is accounting period ends on 31 December annually, the advance rental of RM2,800 paid for January and February 2019 are considered Prepaid expenses Prepaid revenues Accrued expenses Accrued revenues

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 2MCQ: In December 2019, Swanstrom Inc. receives a cash payment of $3,500 for services performed in...

Related questions

Question

Transcribed Image Text:Sasa Enterprise pays RM1,400 per

month for rental of its business

premises. On 31 December 2018, the

business had paid RM19,600 to its

landlord. Assuming that's is

accounting period ends on 31

December annually, the advance

rental of RM2,800 paid for January

and February 2019 are considered

Prepaid expenses

Prepaid revenues

Accrued expenses

Accrued revenues

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning