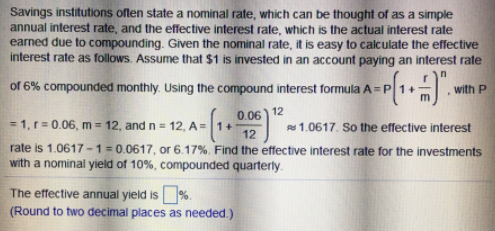

Savings institutions often state a nominal rate, which can be thought of as a simple annual interest rate, and the effective interest rate, which is the actual interest rate earned due to compounding. Given the nominal rate, it is easy to calculate the effective interest rate as follows. Assume that $1 is invested in an account paying an interest rate of 6% compounded monthly. Using the compound interest formula A = P 1+ with P 0.06) 12 = 1, r = 0.06, m = 12, and n = 12, A = |1+ rate is 1.0617 -1= 0.0617, or 6.17%. Find the effective interest rate for the investments with a nominal yield of 10%, compounded quarterly. s 1.0617. So the effective interest 12 The effective annual yield is%. (Round to two decimal places as needed.)

Savings institutions often state a nominal rate, which can be thought of as a simple annual interest rate, and the effective interest rate, which is the actual interest rate earned due to compounding. Given the nominal rate, it is easy to calculate the effective interest rate as follows. Assume that $1 is invested in an account paying an interest rate of 6% compounded monthly. Using the compound interest formula A = P 1+ with P 0.06) 12 = 1, r = 0.06, m = 12, and n = 12, A = |1+ rate is 1.0617 -1= 0.0617, or 6.17%. Find the effective interest rate for the investments with a nominal yield of 10%, compounded quarterly. s 1.0617. So the effective interest 12 The effective annual yield is%. (Round to two decimal places as needed.)

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:Savings institutions often state a nominal rate, which can be thought of as a simple

annual interest rate, and the effective interest rate, which is the actual interest rate

earned due to compounding. Given the nominal rate, it is easy to calculate the effective

interest rate as follows. Assume that $1 is invested in an account paying an interest rate

of 6% compounded monthly. Using the compound interest formula A = P 1+

with P

0.06) 12

= 1, r = 0.06, m = 12, and n = 12, A = |1+

rate is 1.0617 -1= 0.0617, or 6.17%. Find the effective interest rate for the investments

with a nominal yield of 10%, compounded quarterly.

s 1.0617. So the effective interest

12

The effective annual yield is%.

(Round to two decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT