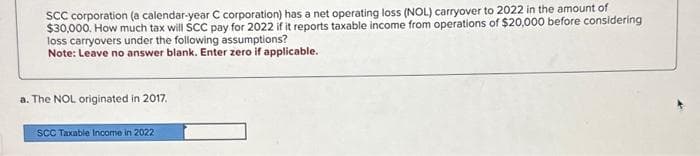

SCC corporation (a calendar-year C corporation) has a net operating loss (NOL) carryover to 2022 in the amount of $30,000. How much tax will SCC pay for 2022 if it reports taxable income from operations of $20,000 before considering loss carryovers under the following assumptions? Note: Leave no answer blank. Enter zero if applicable. a. The NOL originated in 2017. SCC Taxable Income in 2022

SCC corporation (a calendar-year C corporation) has a net operating loss (NOL) carryover to 2022 in the amount of $30,000. How much tax will SCC pay for 2022 if it reports taxable income from operations of $20,000 before considering loss carryovers under the following assumptions? Note: Leave no answer blank. Enter zero if applicable. a. The NOL originated in 2017. SCC Taxable Income in 2022

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 15P

Related questions

Question

f2.

Subject:- Accounting

Transcribed Image Text:SCC corporation (a calendar-year C corporation) has a net operating loss (NOL) carryover to 2022 in the amount of

$30,000. How much tax will SCC pay for 2022 if it reports taxable income from operations of $20,000 before considering

loss carryovers under the following assumptions?

Note: Leave no answer blank. Enter zero if applicable.

a. The NOL originated in 2017.

SCC Taxable Income in 2022

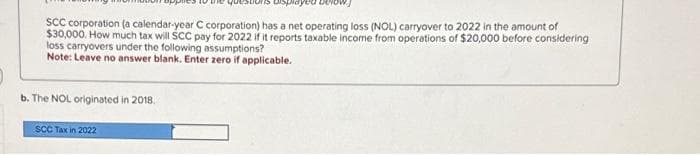

Transcribed Image Text:SCC corporation (a calendar-year C corporation) has a net operating loss (NOL) carryover to 2022 in the amount of

$30,000. How much tax will SCC pay for 2022 if it reports taxable income from operations of $20,000 before considering

loss carryovers under the following assumptions?

Note: Leave no answer blank. Enter zero if applicable.

b. The NOL originated in 2018.

SCC Tax in 2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you