Scenario You will be recording 2 months of income and expenses, April and May for both a checking account and a savings account. This will show your knowledge of unit rates, sales tax, tips, discounts markups, compound interest, percent of change, and maintaining your bank balance. For the purpose of this project, you will be going to college and your parents will be paying your rent, utilities, food, car insurance, and other big bills. You do have a part-time job and will be expected to cover some of your expenses as given in the instructions Each section gives you the date(s) that income and expenses happen (note: they are not in chronological order). Use these dates for filling out your bank account register. The register must include the date, transaction description, credit/debit, and current balance. You can use a standard written register or an Excel spreadsheet. Beginning Information: You begin the month with $54.27 in your checking account and $1200.00 in your savings account. Your job pays you $12.25/hr You work 15 hours/week Between income taxes and other deductions, your company takes 4.99% for income tax, 6.2% for Social Security and 1.45% for Medicare, out of your paycheck before they deposit net pay into your bank account every Friday beginning April 1". How much is your net pay?_ Monthly Expenses: Savings: It is important to pay yourself first in the form of putting money into your savings account. Each paycheck, deposit 10% of your net pay into your savings account. Amount deposited every week into savings: Reduct savings amount from take home pay before recording pay deposit into your checking account! Amount of take home pay to be recorded into checking account after deducting savings:

Scenario You will be recording 2 months of income and expenses, April and May for both a checking account and a savings account. This will show your knowledge of unit rates, sales tax, tips, discounts markups, compound interest, percent of change, and maintaining your bank balance. For the purpose of this project, you will be going to college and your parents will be paying your rent, utilities, food, car insurance, and other big bills. You do have a part-time job and will be expected to cover some of your expenses as given in the instructions Each section gives you the date(s) that income and expenses happen (note: they are not in chronological order). Use these dates for filling out your bank account register. The register must include the date, transaction description, credit/debit, and current balance. You can use a standard written register or an Excel spreadsheet. Beginning Information: You begin the month with $54.27 in your checking account and $1200.00 in your savings account. Your job pays you $12.25/hr You work 15 hours/week Between income taxes and other deductions, your company takes 4.99% for income tax, 6.2% for Social Security and 1.45% for Medicare, out of your paycheck before they deposit net pay into your bank account every Friday beginning April 1". How much is your net pay?_ Monthly Expenses: Savings: It is important to pay yourself first in the form of putting money into your savings account. Each paycheck, deposit 10% of your net pay into your savings account. Amount deposited every week into savings: Reduct savings amount from take home pay before recording pay deposit into your checking account! Amount of take home pay to be recorded into checking account after deducting savings:

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter1: Variables, Expressions, And Integers

Section1.5: Adding Integers

Problem 45E

Related questions

Question

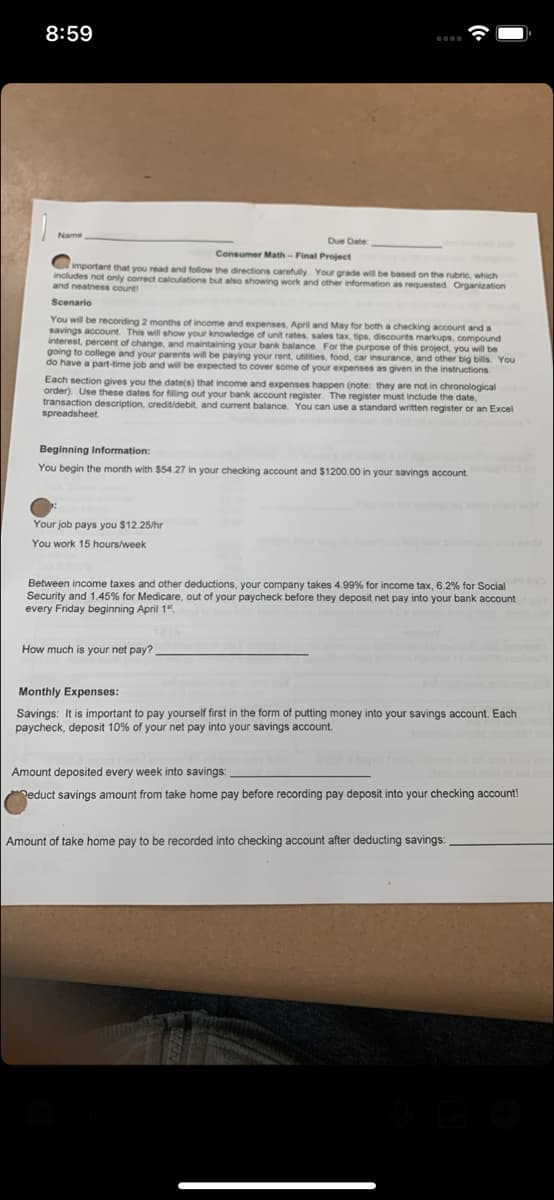

Transcribed Image Text:8:59

Name

Due Date:

Consumer Math-Final

Project

important that you read and follow the directions carefully. Your grade will be based on the rubric, which

includes not only correct calculations but also showing work and other information as requested. Organization

and neatness count!

Scenario

You will be recording 2 months of income and expenses, April and May for both a checking account and a

savings account. This will show your knowledge of unit rates, sales tax, tips, discounts markups, compound

interest, percent of change, and maintaining your bank balance. For the purpose of this project, you will be

going to college and your parents will be paying your rent, utilities, food, car insurance, and other big bills. You

do have a part-time job and will be expected to cover some of your expenses as given in the instructions.

Each section gives you the date(s) that income and expenses happen (note: they are not in chronological

order). Use these dates for filling out your bank account register. The register must include the date,

transaction description, credit/debit, and current balance. You can use a standard written register or an Excel

spreadsheet.

Beginning Information:

You begin the month with $54.27 in your checking account and $1200.00 in your savings account.

Your job pays you $12.25/hr

You work 15 hours/week

Between income taxes and other deductions, your company takes 4.99% for income tax, 6.2% for Social

Security and 1.45% for Medicare, out of your paycheck before they deposit net pay into your bank account

every Friday beginning April 1st

How much is your net pay?.

Monthly Expenses:

Savings: It is important to pay yourself first in the form of putting money into your savings account. Each

paycheck, deposit 10% of your net pay into your savings account.

Amount deposited every week into savings:

educt savings amount from take home pay before recording pay deposit into your checking account!

Amount of take home pay to be recorded into checking account after deducting savings:

OMO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Elementary Geometry For College Students, 7e

Geometry

ISBN:

9781337614085

Author:

Alexander, Daniel C.; Koeberlein, Geralyn M.

Publisher:

Cengage,

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Elementary Geometry For College Students, 7e

Geometry

ISBN:

9781337614085

Author:

Alexander, Daniel C.; Koeberlein, Geralyn M.

Publisher:

Cengage,

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage