Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: $ 0 $ 20,550 $ 83,550 $ 178,150 $ 340,100 $ 431,900 $ 647,850 $ 20,550 $ 83,550 $ 178,150 $340,100 $431,900 $647,850 The tax is: 10% of taxable income $2,055 plus 12% of the excess over $20,550 $9,615 plus 22% of the excess over $83,550 $30,427 plus 24% of the excess over $178,150 $69,295 plus 32% of the excess over $340,100 $98,671 plus 35% of the excess over $431,900 $174,253.50 plus 37% of the excess over $647,850

Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: $ 0 $ 20,550 $ 83,550 $ 178,150 $ 340,100 $ 431,900 $ 647,850 $ 20,550 $ 83,550 $ 178,150 $340,100 $431,900 $647,850 The tax is: 10% of taxable income $2,055 plus 12% of the excess over $20,550 $9,615 plus 22% of the excess over $83,550 $30,427 plus 24% of the excess over $178,150 $69,295 plus 32% of the excess over $340,100 $98,671 plus 35% of the excess over $431,900 $174,253.50 plus 37% of the excess over $647,850

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 26P

Related questions

Question

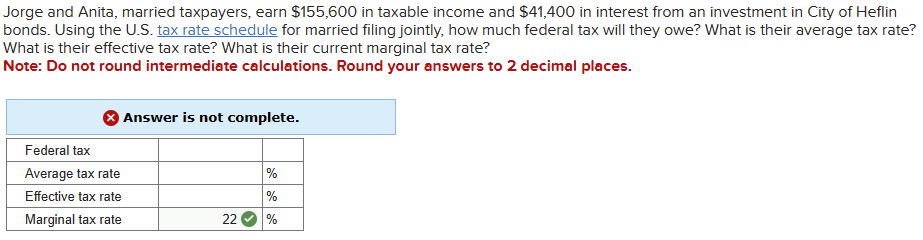

Jorge and Anita, married taxpayers, earn $155,600 in taxable income and $41,400 in interest from an investment in City of Heflin bonds. Using the U.S. tax rate schedule for married filing jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate?

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Transcribed Image Text:Jorge and Anita, married taxpayers, earn $155,600 in taxable income and $41,400 in interest from an investment in City of Heflin

bonds. Using the U.S. tax rate schedule for married filing jointly, how much federal tax will they owe? What is their average tax rate?

What is their effective tax rate? What is their current marginal tax rate?

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Federal tax

Average tax rate

Effective tax rate

Marginal tax rate

Answer is not complete.

22

%

%

%

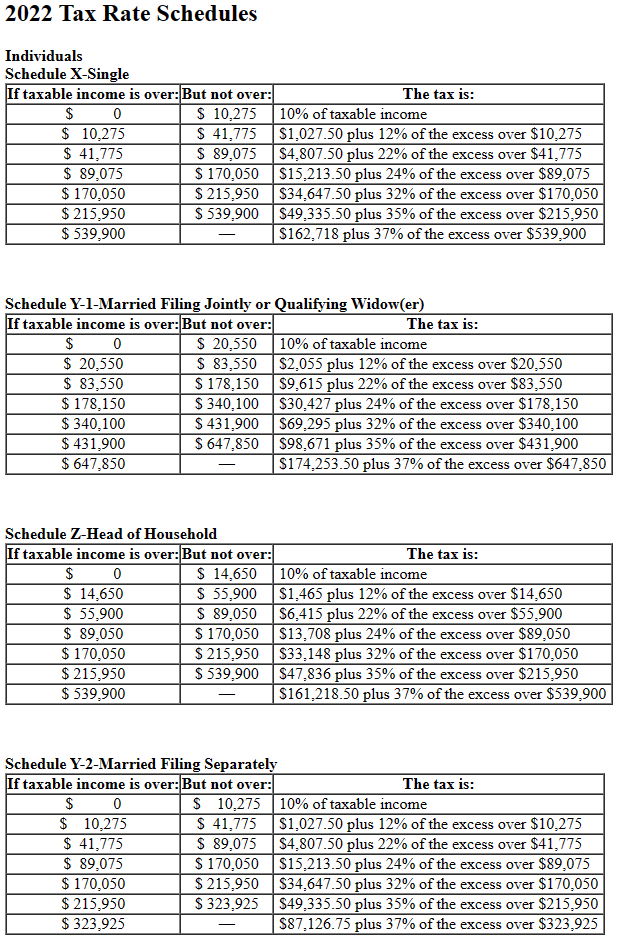

Transcribed Image Text:2022 Tax Rate Schedules

Individuals

Schedule X-Single

If taxable income is over: But not over:

$ 0

$ 10,275

$ 41,775

$ 89,075

$ 170,050

$ 215,950

$ 539,900

$ 0

$ 20,550

$ 83,550

$ 178,150

$ 340,100

$ 431,900

$ 647,850

$ 10,275

$ 41,775

$ 89,075

$ 170,050

$215,950

$539,900

Schedule Y-1-Married Filing Jointly or Qualifying Widow(er)

If taxable income is over: But not over:

$ 20,550

$ 83,550

$ 178,150

$340,100

$431,900

$ 647,850

Schedule Z-Head of Household

If taxable income is over: But not over:

$ 0

$ 14,650

$ 55,900

$ 89,050

$ 170,050

$ 215,950

$ 539,900

$ 14,650

$ 55,900

$ 89,050

$ 170,050

$215,950

$539,900

The tax is:

10% of taxable income

$1,027.50 plus 12% of the excess over $10,275

$4,807.50 plus 22% of the excess over $41,775

$15,213.50 plus 24% of the excess over $89,075

$34,647.50 plus 32% of the excess over $170,050

$49,335.50 plus 35% of the excess over $215,950

$162,718 plus 37% of the excess over $539,900

The tax is:

10% of taxable income

$2,055 plus 12% of the excess over $20,550

$9,615 plus 22% of the excess over $83,550

$30,427 plus 24% of the excess over $178,150

$69,295 plus 32% of the excess over $340,100

$98,671 plus 35% of the excess over $431,900

$174.253.50 plus 37% of the excess over $647,850

Schedule Y-2-Married Filing Separately

If taxable income is over: But not over:

$ 10,275

$ 0

$10,275

$ 41,775

$ 41,775

$ 89,075

$ 89,075

$ 170,050

$ 170,050

$215,950

$323,925

$ 215,950

$ 323,925

The tax is:

10% of taxable income

$1,465 plus 12% of the excess over $14,650

$6,415 plus 22% of the excess over $55,900

$13,708 plus 24% of the excess over $89,050

$33,148 plus 32% of the excess over $170,050

$47,836 plus 35% of the excess over $215,950

$161.218.50 plus 37% of the excess over $539,900

The tax is:

10% of taxable income

$1,027.50 plus 12% of the excess over $10,275

$4,807.50 plus 22% of the excess over $41,775

$15,213.50 plus 24% of the excess over $89,075

$34,647.50 plus 32% of the excess over $170,050

$49,335.50 plus 35% of the excess over $215,950

$87,126.75 plus 37% of the excess over $323,925

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you