se Answer my question 1 Number A, B, C. 3 sub parts .... Because I know this team can answer max 3 sub parts... Please

se Answer my question 1 Number A, B, C. 3 sub parts .... Because I know this team can answer max 3 sub parts... Please

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 29CE: Unearned Sales Revenue Brand Landscaping offers a promotion where a customers lawn will be mowed 20...

Related questions

Question

Please Answer my question 1 Number A, B, C. 3 sub parts .... Because I know this team can answer max 3 sub parts... Please answer my question with the parts... Thank u god bless u... Please no reject

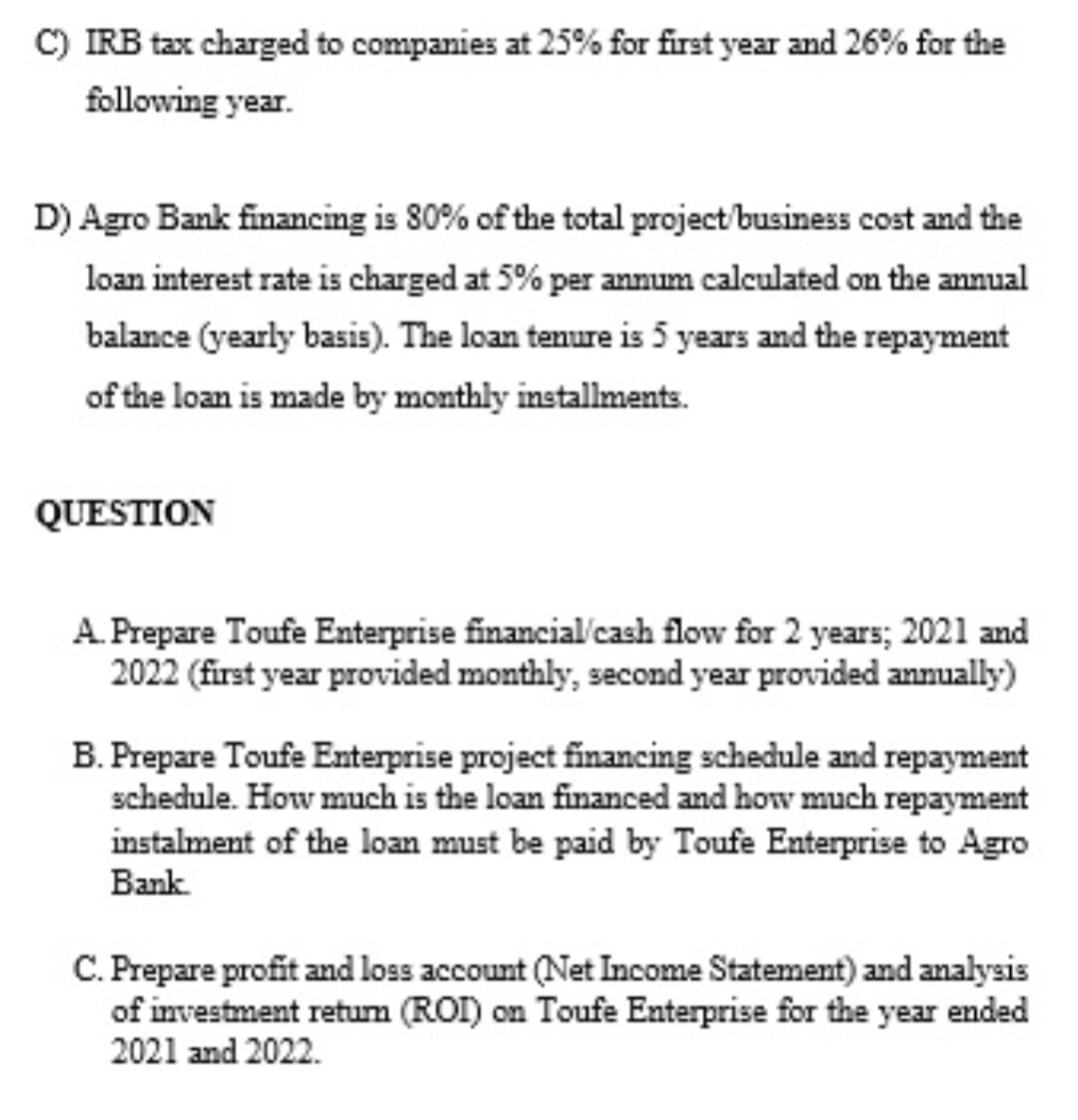

Transcribed Image Text:C) IRB tax charged to companies at 25% for first year and 26% for the

following year.

D) Agro Bank financing is 80% of the total project/business cost and the

loan interest rate is charged at 5% per annum calculated on the annual

balance (yearly basis). The loan tenure is 5 years and the repayment

of the loan is made by monthly installments.

QUESTION

A. Prepare Toufe Enterprise financial'cash flow for 2 years; 2021 and

2022 (first year provided monthly, second year provided annually)

B. Prepare Toufe Enterprise project financing schedule and repayment

schedule. How much is the loan financed and how much repayment

instalment of the loan must be paid by Toufe Enterprise to Agro

Bank.

C. Prepare profit and loss account (Net Income Statement) and analysis

of investment retum (ROI) on Toufe Enterprise for the year ended

2021 and 2022.

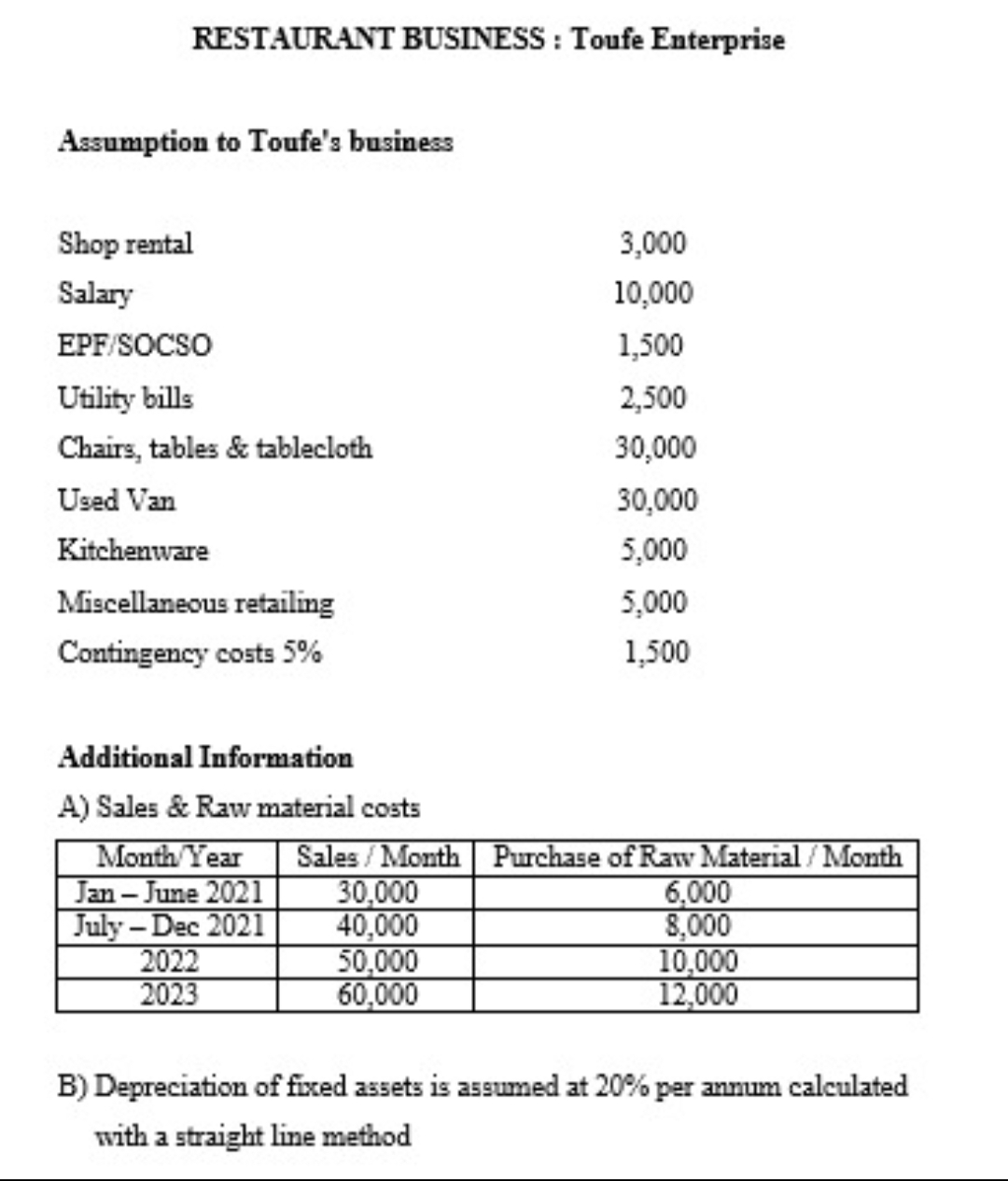

Transcribed Image Text:RESTAURANT BUSINESS : Toufe Enterprise

Assumption to Toufe's business

Shop rental

3,000

Salary

10,000

EPF/SOCSO

1,500

Utility bills

2,500

Chairs, tables & tablecloth

30,000

Used Van

30,000

Kitchenware

5,000

Miscellaneous retailing

5,000

Contingency costs 5%

1,500

Additional Information

A) Sales & Raw material costs

Month Year

Jan-June 2021

July – Dec 2021

2022

2023

Sales / Month Purchase of Raw Material / Month

30,000

40,000

50,000

60,000

6,000

8,000

10,000

12,000

B) Depreciation of fixed assets is assumed at 20% per annum calculated

with a straight line method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning